Personal auto

-

Sources said Jefferies and RBC have been retained to advise on the sale process.

-

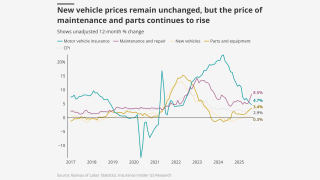

Casualty and auto loss costs continue to rise due to inflation as we head into 2026.

-

Insurance has been an increasingly salient issue among politicians in the state.

-

The medical care index increased 3.5% over the past 12 months.

-

The company announced several moves Monday, including the promotion of Nancy Pierce to Geico CEO.

-

The ratings agency said that it continues to assess State Farm’s balance sheet among the strongest.

-

The executive said inflation isn’t completely gone but is now “more understood”.

-

The reserve strengthening stemmed from bodily injury and defense costs for accident years 2023 and prior.

-

The LA fires were a microcosm of “everything we do well when things go bad”.

-

The executive’s exit follows CEO Joseph Lacher’s resignation last week.

-

September’s medical care index increase follows a 0.2% drop in August.

-

By line of business, $35mn of the charge relates to commercial auto and $5mn to personal auto.

-

The insurer booked a $950mn policyholder credit expense in September.

-

Joseph Lacher will step down as president and CEO and resign from the board.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

The governor has yet to sign a pending bill to create a public cat model.

-

The charges allege “egregious delays” and “unreasonable denials” in claims.

-

The proposed changes aim to establish clear guidelines for intervenors.

-

While the Fed is more concerned with jobs, other macroeconomic concerns trouble the industry.

-

A report by the ratings agency challenges current industry wisdom.

-

The bipartisan legislation would make Fema a cabinet-level agency.

-

The data modeling firm said losses previously averaged $132bn annually.

-

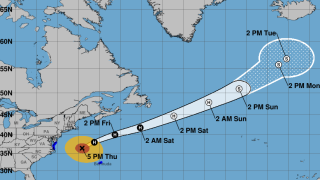

Storm surge of two to four feet could affect the North Carolina coast.

-

Life-threatening surf and rip currents are expected on the east coast of the US.