Progressive

-

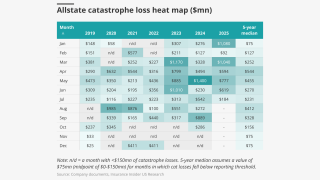

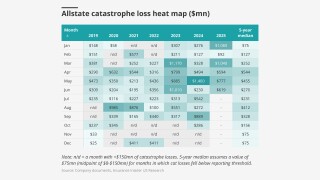

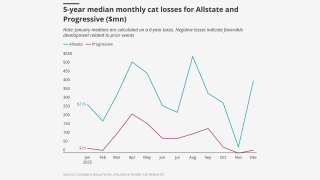

Light cat losses at year-end portend capital deployment and return decisions in 2026.

-

Selective’s CEO earlier attributed Q3 adverse development to the NJ market.

-

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

Early Q3 earnings reports point to worsening market conditions.

-

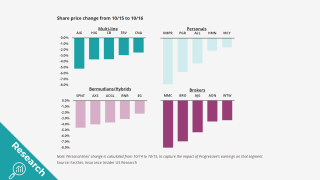

The selloff may hint at headwinds for equity investors.

-

The insurer booked a $950mn policyholder credit expense in September.

-

Cat losses in August were below historical trends, but we are not in the clear just yet.

-

Cat losses in July were below historical trends, but all eyes are on peak hurricane season.

-

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

The company also purchased $15mn of SCS parametric coverage.

-

The research team presents the June cat heatmap.

-

Allstate attributed the bulk of its losses to three major wind and hail events.

-

January cat losses continue to run higher than prior years, with no help from latest wildfires.

-

Net property losses from Hurricane Milton in October reached $153.6mn.

-

The company incurred $563mn of total cat losses related to the storm.

-

It had planned to non-renew 47,000 DP-3 and 53,000 high-risk homeowners’ policies this year.

-

The industry could weather a recession, unless loss costs and reserving pressures worsen.

-

-

Investor skepticism visible in stock prices and short interest data over first half of 2024.

-

The losses added 12.3 points to the firm's 100.4% CoR.

-

Changes in investment strategy and strong results show carriers can weather financial storms.

-

The CoR for homeowners’ insurance rose to 95.4% from 75.8% in February.

-

The homeowners' CoR fell over 32 points sequentially to 75.8%.

-

The carrier also plans to ramp up media spend.

-

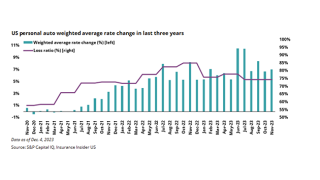

Personal auto rates increased 19% during the year.

-

The homeowners’ CoR worsened 39 points sequentially to 107.9%.

-

The commercial auto CoR decreased to 93.7% in December, while the homeowners’ CoR improved 13.2 points to 68.9%.

-

The commercial auto CoR worsened 7.8 points to 108.6% for the month, while the homeowners’ CoR deteriorated 15.1 points to 82.1%.

-

Personal auto carriers risk falling behind in the battle between loss costs and approved rate declines, while homeowners carriers’ double-digit filings might not be enough to keep up.

-

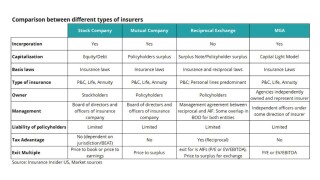

Reciprocals have been cropping up more recently, with a shift toward cat-exposed lines, giving investors a quick way to tap into the hard market with an expectation of a rich multiple at exit.

-

The net cat loss ratio dropped to 0.4% from 1.8% in September, but the consolidated loss ratio deteriorated 2.4 points to 75.5% during the same period.

-

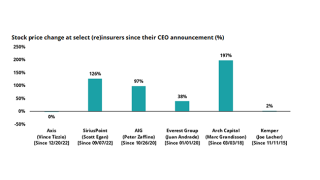

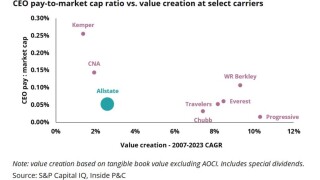

Kemper’s current results and historical trends suggest continued difficulty and remains a TBD story.

-

The company also plans to ramp up its media spend in 2024 after having significantly slashed advertising budgets earlier this year.

-

Loss costs trends continue to increase in both physical damage and bodily injury coverages for nearly all of Progressive’s commercial auto products, CEO Tricia Griffith wrote in a quarterly update.

-

Allstate’s underperformance in results and value creation may be an opportunity for activist investor Trian, but history suggests it will have its work cut out.

-

These figures mark an improvement from August, which was impacted by losses from Hurricane Idalia.