Re/insurers

-

Ackman will need leaders like Ajit Jain behind him and make the right bets at the right price at the right time.

-

The executive’s 30-year career includes stints at Neon, Chubb and Arch.

-

The Japanese P&C carrier agreed a deal to buy 15% of WR Berkley shares in March.

-

Admitted carriers on the other hand are still exercising caution as regulatory reforms take hold.

-

Light cat losses at year-end portend capital deployment and return decisions in 2026.

-

The peril has been historically difficult to model compared to others.

-

Sizable reserve releases offsetting casualty reserve charges cannot last forever.

-

Insurers with SCS exposure reaped fewer benefits but still improved over Q3 2024.

-

The deal to reopen the government also extended the NFIP.

-

Aspen's GWP increased 0.9% to $1.13bn, as it focuses on “robust cycle management”.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

The executive noted that an influx of new entrants in the E&S market is increasing competition.

-

Fears of the oncoming soft market are causing a sector rotation away from P&C.

-

The global insurer is buying access to distribution and underwriting at a carrier with a 27% GWP CAGR.

-

Both the primary and reinsurance segments benefitted from a light cat year.

-

While attritional losses were up for the quarter, those in the carrier’s core business declined.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

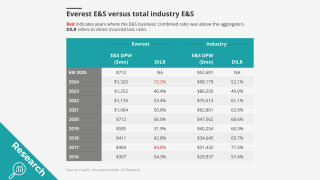

A re-focus on reinsurance nearly brings Everest back where it started.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

Sources said that the businesses in Canada and LatAm were part of Everest’s original plans to sell its retail book.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The global insurer will need to convince investors on the quality of the book.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.