Top Stories / Ad / Most Recent

Top Stories / Ad / Most Recent

-

The mayor-elect has promised to build 200,000 new units in New York City.

-

By line of business, $35mn of the charge relates to commercial auto and $5mn to personal auto.

-

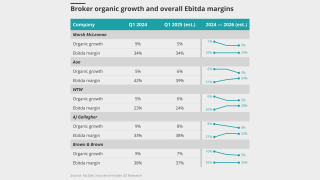

Lighter cat losses a plus, while top-line, organic growth and reserving concerns persist.

-

The request cites use of Verisk’s forward-looking wildfire model.

-

Sources said that the carrier’s listing is expected to raise around ~$100mn.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

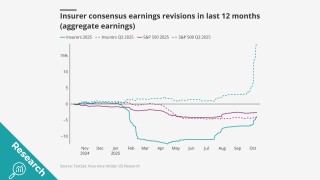

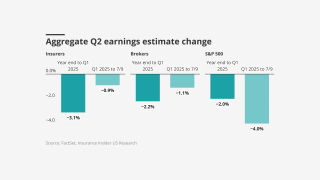

Social inflation, reserving, and organic growth are the topics to watch this earnings season.

-

Under the new law, vehicles will only be required to carry $100,000 in PIP per person.

-

Rates need to be fair but also should not be “destructive of competition”.

-

Economic unease will join cat losses, renewals, and organic growth as Q1’s key topics.

-

Universal submitted allegedly ineligible claims to the Florida fund.

-

RBC reports can help regulators identify weakly capitalized companies.

-

The insurer has lined up Piper Sandler and KBW to run the process.

-

The bill also creates a governing board comprising insurance and consumer reps.

-

Inflation, tariffs and climate change are all making for an uncertain 2025.

-

The losses do not change the near-term assessment of CinFin’s balance sheet strength.

-

By contrast, capacity remains tight at the lead level.

-

No named storms exceeded AFG’s $70mn cat retention.

-

The “Golden Age of Specialty” continues in the Q3 releases of these specialty companies.

-

Increased antitrust activity and the NFIP’s dissolution would present new challenges for the industry.

-

The executive joins Selective after 19 years at Progressive.

-

Potential for rate cuts at the upcoming Fed meeting should be an addressable event for P&C insurers.

-

The deal helps boost Davies’ growth across North America and Canada.

-

The industry could weather a recession, unless loss costs and reserving pressures worsen.

-

Reserving trends, pricing declines and hurricane forecasts are causes for concern.

-

It is understood that the goal is to use a capital injection to form a reciprocal.

-

Light cat losses, reserve development, and pricing trends are key topics in Q1.

-

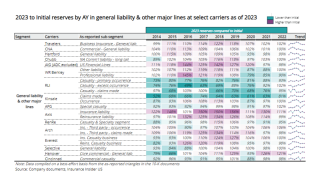

Some carriers may be pressing too hard on reserve releases from recent years.

-

2024 is likely to be another challenging year for the industry, and commercial in particular, though improvement in personal lines may soften the blow.

-

The outlooks on IMT Insurance Company and its affiliate, Wadena Insurance Company – both domiciled in West Des Moines, Iowa, and collectively referred to as IMT Insurance Companies – were downgraded to negative.

-

The bill removes a previous Farm Bill requirement mandating that carriers purchase unlimited catastrophic reinsurance. Instead, companies can purchase “adequate” catastrophic reinsurance.

-

There’s a “willingness of respect” from reinsurers regarding how the shock of dramatic price increases can put regional and mutual carriers under a lot of pressure, said Greg Moore.

-

HDI Global has agreed to acquire Indiana Lumbermens, a subsidiary of Pennsylvania Lumbermens Mutual.

-

Pricing, reserves and uneven catastrophe losses will be the theme this quarter.

-

Shifting economic winds make growth plays more attractive, causing insurer stock performance to lag though short interest remains flat.

-

Inside P&C’s news team runs you through the key highlights of the week.