Top Stories / Ad / Most Recent

Top Stories / Ad / Most Recent

-

T&Cs, as well as exclusions, remain largely unchanged, the executive said.

-

The carrier is continuing to reposition its portfolio to drive more consistent returns.

-

Casualty rates in Q3 rose 6.1% driven by increases in commercial auto, energy and excess liability.

-

Interim CUO Nick Pritchard turned in his notice in August of this year.

-

YTD disclosed run-off deals total 26, with $1.36bn of gross liabilities transferred.

-

The global insurer is buying access to distribution and underwriting at a carrier with a 27% GWP CAGR.

-

The Bermuda carrier brought a winding-up petition earlier in October.

-

A re-focus on reinsurance nearly brings Everest back where it started.

-

Onex’s own balance sheet will become a 63% owner and AIG takes a 35% stake.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

Despite the pricing pressure, margins for the line of business remain attractive, he added.

-

The global insurer will need to convince investors on the quality of the book.

-

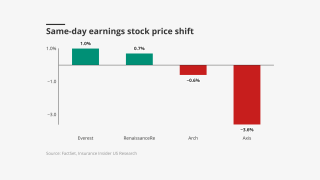

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier recently expanded its reinsurance product suite in Bermuda.

-

Northeast Insurance said 55 claims were brought under the Child Victims Act.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

The carrier has been exploring launching into P&C organically or via acquisition.

-

The MGA is also looking to build out its US mid-market professional liability expertise.

-

Mike Mulray joins from Everest, where he was EVP president of North America insurance.

-

The division mostly places higher up the tower, where many insurers have taken action to address SAM losses.

-

The carrier has renewed and extended its capacity arrangement with the MGA.

-

The ratings agency cited a reduction in exposure to nat cat risk as a reason for the change.

-

The Bermuda-based executive joined the Ardonagh Group’s reinsurance broking arm in March 2023.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

The company will continue its capacity partnership with the MGA until 2030.

-

Marlon Williams will focus on the placement of reinsurance and retro business.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

Vantage Group Holdings received a BBB- long-term issuer credit rating.

-

The business said it was experiencing strong momentum on the Island.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

Bill Bouvier has spent more than three years at the legacy firm in this role.

-

Fleming’s attempt follows those of other legacy carriers that have had recent successes raising capital.

-

The executive most recently served as head of North American treaty reinsurance.

-

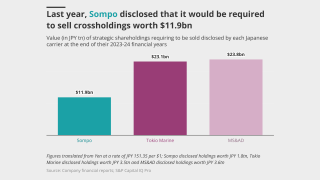

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

CFO Liam Caffrey has been elected as Rountree’s successor.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

James River said the court was right to dismiss the fraud case.

-

Analysis of market conditions, reserves show that this might not lead to an overnight consolidation boom.

-

Group CEO Mikio Okumura cited “solutions that have not been fulfilled”.

-

Sources see Aspen as the right fit for Sompo, with Apollo getting a full cash exit.

-

Angus Hampton, meanwhile, has been promoted to head of casualty in place of Mario Binetti.

-

The lawsuit has been filed as sales talks with Sompo yielded a deal.

-

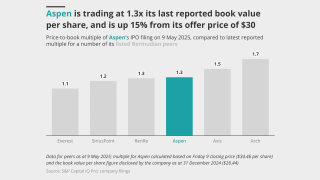

The Japanese company announced the $3.5bn deal today, three months after the Bermudian completed its IPO.

-

Cavello Bay Re will provide paper for the MGA’s business written out of Bermuda.

-

The Japanese carrier has agreed to buy Aspen for a realization of $3.5bn.

-

The all-cash deal values the Bermudian’s stock at a 36% premium.

-

This publication first reported deal talks last week.

-

-

The insurer has chosen a “take two” deal after buying Endurance, betting again on Bermuda.

-

This publication revealed yesterday that the two were in detailed takeover talks.

-

Sources said that detailed discussions have taken place, with a clear path to a deal.

-

Life-threatening surf and rip currents are expected on the east coast of the US.

-

The company said the judge overlooked key issues in dismissing its fraud case.

-

Besides Russia-Ukraine losses, the Air India crash losses totaled $26mn.

-

Peter Vogt will act as a strategic advisor at Axis until the end of 2026.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

Net adverse development for the quarter increased 30% year on year to $89.2mn.

-

Company alum David Murie will lead the new business unit.

-

Property MGA Arden Insurance Services specialises in multi-family habitations.

-

The announcement comes a week after the institutional investor said it would accelerate its pivot to an insurance-led strategy.

-

The executive said the floor on D&O pricing is in sight.

-

The company bolstered casualty reserves by $18mn, mostly from discontinued lines.

-

The carrier reported an increase of 82% in pre-tax income.

-

The move will impact around $50mn of gross written premiums in total.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The loss was driven by nat cats and reserve adjustments in US casualty.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company has also expanded its relationships with US and UK MGAs.

-

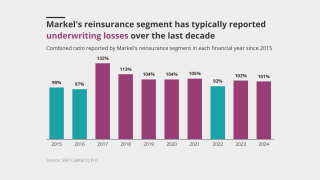

The company was right to drop its reinsurance unit and refocus on its specialty roots.

-

The carrier also benefitted from favourable reserve development in property and A&H.

-

Reinsurers are mostly aligned on cat reinsurance, but goals are otherwise diverse.

-

Nadia Beckert was promoted to Bermuda CUO in March.

-

Specialty casualty now accounts for around 22.2% of its insurance business mix.

-

The vehicle will support Ascot’s casualty business in the US and Bermuda.

-

The Bermudian said its pursuit of SMEs through M&A will provide sustainable improvements to its bottom line.

-

Pricing was “virtually flat” in the second quarter.

-

The CEO said business remains adequately priced in most classes.

-

The carrier is reducing its exposure to quota shares and shifting to XoL.

-

The carrier said market dynamics were shifting due to increased capacity.

-

The Bermuda SPI will write a quota share of SageSure’s captive Anchor Re.

-

The legacy player is working to secure its first deal, and could look to expand to US E&S.

-

Wind season remains an important variable, but also might not change current dynamics significantly.

-

Jill Beggs was most recently COO for reinsurance.

-

The judge ruled the deal relied too heavily on Bermuda law for US law to apply.

-

-

Last year, the firm obtained a Class 4 license in Bermuda.

-

The appointments will be effective as of August 1.

-

The take-private deal was announced in July 2024.

-

The changes affect operations in Switzerland, Bermuda and the US.

-

Andrew Pryde succeeds Andreas Kull, who will stay on until September.

-

Willis’ continued reinsurance build-out has targeted London and Bermuda marine and retro specialists.

-

The appointments are pending regulatory approval.

-

The company has also promoted Alex Baker and Tim Duffin.

-

The carrier has scaled up its international insurance offering in recent years.

-

The executive brings nearly 30 years of liability experience to the role.

-

Rachel Bardon will also join the board of Compre's Bermuda-based reinsurer Pallas Re.

-

The Bermuda-based team is led by John Fletcher.

-

Argo shelved the sale of its Bermudian insurance business in mid-2024.

-

The reinsurer has also appointed Mehdi Benleulmi as global head of credit.

-

The broker has been building out its Bermuda reinsurance presence.

-

With fee income less understood, a primary acquisition or merger could reset the narrative.

-

The reinsurer confirmed Andrew Phelan’s exit, as of 15 May.

-

The executive replaces Mike Warwicker, who left the firm earlier this year.

-

A 20% increase in FHCF retention levels sent cedants to the private market.

-

Bredahl has been appointed CEO and Bonneau as chairman.

-

The Peak Re subsidiary mainly writes US motor and casualty reinsurance.

-

She will continue to work with the executive team on key projects and initiatives.

-

The company has settled, or is in the settlement stage, for 80% of the exposure.

-

The Bermudian's first quarter cat losses totalled $333.3mn, compared to $103mn a year ago.

-

The CEO said Ascot would deploy capital where it sees opportunities.

-

New CEO Eckert said Conduit had taken “decisive action” after the LA wildfires.

-

Neil Eckert has been chair since the carrier was founded.

-

The company completed its upsized IPO last week and traded up to 1.3x book.

-

The company’s upsized public offering priced at $30 per ordinary share.

-

Hamilton also expects rising demand and stable supply for June 1 renewals.

-

The IPO was announced at the end of April, targeting ~$2.6bn-$2.9bn.

-

IGI saw opportunities in energy, ports and terminals and marine cargo but remains cautious in long-tail lines.

-

The specialty carrier is braving volatile macroeconomic conditions in a second effort to list.

-

The executive was previously a top US casualty broker.

-

Space pricing experienced double-digit increases after the 2023 capacity retreat.

-

The appointment follows the recent exits of CUO Chatterjee and SVP Dharma-Wardana.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

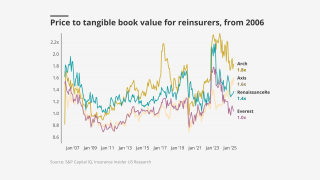

We assess the Bermudian’s standing amid waning investor sentiment and economic uncertainty.

-

The reduction was due to impacts from investments and less favourable PYD.

-

Primary and excess casualty in the US saw double-digit rate growth and remained above loss trends in Q1.

-

The remediation process is on track for completion in the fourth quarter.

-

The days of 30%+ growth are probably behind the firm, he said.

-

Overall, the company’s underwriting income fell 43% to $417mn in the first quarter.

-

The carrier is targeting an IPO valuation between $2.6bn and $2.9bn.

-

The carrier is offering shares priced at $29-$31.

-

The agency cited SiriusPoint’s recent management moves including lower cat exposure as a driver of the change.

-

However, the firm will take a “conservative approach” until the improvements are shown in data.

-

The Kelso and Arch-backed run-off player has retained Evercore to advise.

-

The legacy carrier reported an operating loss of $45.3mn for the year.

-

The CUO’s turnover closely follows that of the CEO.

-

ISA is part of Ryan Specialty National Programs, which launched last month.

-

The executive was named group CEO in January.

-

Joe Fobert will report to William Hazelton, EVP of Everest.

-

Jeanmarie Giordano joined the company last September.

-

The MGA will likely expand its D&O book as well, but excess casualty will grow faster.

-

PartnerRe's $5mn commitment will enable the MGA to expand its D&O line size.

-

Nadia Beckert joined the carrier as an underwriter in 2021.

-

The executive was Everest CEO from 1994 to 2013 and has served as board chair since 1994.

-

Former CEO Buss had been appointed in November 2023.

-

The rating allows IQUW to access $1bn in group capital.

-

Industry sources estimate the market to be around $3bn.

-

A quick roundup of our best journalism for the week.

-

Shareholders say the stock has declined around 59% in the past year while book value has dropped ~30%.

-

He also joined Everest’s board last week as an independent director.

-

Last year, the firm consolidated financial and excess liability lines under the leadership of Richard Porter.

-

Aviation reserve strengthening added 10.1 points to the combined ratio.

-

The company is seeking to promote growth in its US excess casualty book.

-

“They've been focused on this for more than 10 years,” said Bermuda’s CIT Agency CEO Mervyn Skeet.