Top Stories / Ad / Most Recent

Top Stories / Ad / Most Recent

-

The carrier will offer $10mn per risk, targeting large corporations.

-

Matthew Stitham replaces Donnacha Smyth, who was promoted to global CUO, casualty.

-

The move marks the firm’s intention to broaden its US reinsurance offerings beyond facultative capabilities.

-

Ackman will need leaders like Ajit Jain behind him and make the right bets at the right price at the right time.

-

This was the second issuance completed by Farmers via its Bermuda reinsurance vehicle Topanga Re.

-

The company named two execs to head global wholesale and commercial.

-

Ackman is targeting high-teens RoE at Vantage via underwriting gains and equity investing.

-

The Carlyle and Hellman & Friedman vehicle will sell for 1.5x book value.

-

The executive’s 30-year career includes stints at Neon, Chubb and Arch.

-

Fleming Re bought the James River Re legacy book in 2024.

-

He and Fletcher stand accused of aiding Willis Re in an unlawful team lift.

-

The company had argued the judge missed key info when dismissing the case.

-

The London-based MGA will begin underwriting its international book next month.

-

Habayeb will start next May following Kociancic's retirement.

-

GC continues to pursue Willis Re and individuals in court.

-

Senior Willis Re recruit Jim Summers denied Kevin Fisher had a role at the start-up.

-

GC accused Willis, Lucy Clarke, Jim Summers and John Fletcher of unlawful recruitment.

-

The appointment follows Everest’s $2bn renewal rights sale of its commercial retail business to AIG.

-

Aspen's GWP increased 0.9% to $1.13bn, as it focuses on “robust cycle management”.

-

After outsized losses, the (re)insurer still sees opportunity in a softening market.

-

The reinsurance loss ratio improved by over 20 points with no notable cat losses for the quarter.

-

T&Cs, as well as exclusions, remain largely unchanged, the executive said.

-

The carrier is continuing to reposition its portfolio to drive more consistent returns.

-

Casualty rates in Q3 rose 6.1% driven by increases in commercial auto, energy and excess liability.

-

Interim CUO Nick Pritchard turned in his notice in August of this year.

-

YTD disclosed run-off deals total 26, with $1.36bn of gross liabilities transferred.

-

The global insurer is buying access to distribution and underwriting at a carrier with a 27% GWP CAGR.

-

The Bermuda carrier brought a winding-up petition earlier in October.

-

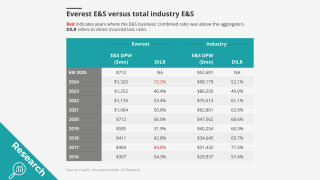

A re-focus on reinsurance nearly brings Everest back where it started.

-

Onex’s own balance sheet will become a 63% owner and AIG takes a 35% stake.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

Despite the pricing pressure, margins for the line of business remain attractive, he added.

-

The global insurer will need to convince investors on the quality of the book.