Renewals

-

An average of 81% of property accounts renewed flat or down.

-

The decision impacts 5% of the reinsurer’s North America P&C facultative premiums.

-

Shared and layered accounts are seen as reaping the biggest benefits.

-

The mood in Orlando was sunny among cedants and reinsurers alike, but there are clouds on the horizon.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

Reinsurers and their cedants are feeling their books are in better shape, although the market is still uneven.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

Despite rate reductions accelerating, the sector-wide combined ratio is set to remain below 90% through 2027.

-

Capacity has gone up slightly, with new entrants and incumbents feeling better about their books.

-

The CEO said the carrier will prioritise margin over top-line growth.

-

The specialty reinsurer also saw several bad investments hit the books.

-

The risk of cyber incidents that cause physical damage is also rising.

-

The president expects to see benefits from the deal in H2 2026.

-

The CEO said business remains adequately priced in most classes.

-

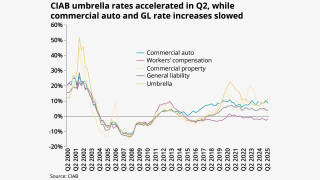

All lines except workers’ comp are up year over year, however.

-

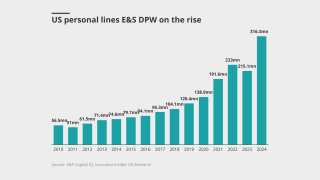

PL coverage is being stripped out of admitted, packaged policies and increasingly purchased in the E&S market.

-

While official return to office mandates have gathered steam, what they look like in practice can vary widely.

-

In the US, the index fell 6.7% year on year.

-

Marsh’s property book saw an average decline of 9% in Q1, a trend that appears to have continued through Q2.

-

The January wildfires did little to hamper their appetite, apart from California.

-

Elevated cat losses in H1 weren’t enough to stop a further softening of the market.

-

The transition will be implemented starting October 15.

-

The soft market continued through H1 2025, especially on shared programs.

-

The LA wildfires accounted for 59% of loss activity over Q1.

-

Cedants were able to “challenge the status quo” with aggregates back on the table, the broker said.

-

The company said the reduction was due to years of steady improvements.

-

The program’s total limit this year is down $594mn to $1.36bn.

-

The broker noted a “significant variation” in renewal outcomes.

-

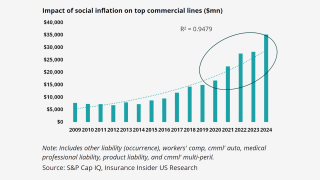

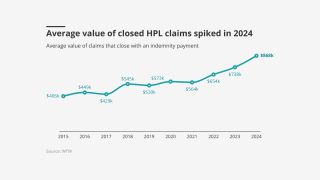

The impact of SAM claims is reverberating through the tower and the broader marketplace beyond hospitals.

-

This is up from last year’s $1bn protection for its Florida treaty.

-

HCI secured three towers with $3.5bn in XoL coverage.

-

The program includes all perils coverage and subsequent event protection.

-

The total cost excluding a 15% quota share was $201.85mn, with rates down 12.2% from last year.

-

The Floridian also secured $352mn of multi-year coverage extending to 2027.

-

A 20% increase in FHCF retention levels sent cedants to the private market.