Ryan Specialty

-

Onex CEO Bobby Le Blanc will retire from Ryan Specialty’s board of directors.

-

The HNW MGA previously had an exclusive distribution agreement under a partnership signed in July 2024.

-

Quota share is less common in the medmal space, where layered and shared structures have been dominant.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The broker continues to expect 20% to 30% property rate reductions, as well as increased market competition.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

Howden is facing fallout from its push into the US retail market via mass hires.

-

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

Jeremiah Bickham will be a strategic adviser until the end of the year.

-

The $20bn+ TIV data center is seen as the leading edge of significant new demand.

-

The executive will initially focus on casualty fac business incoming as the result of the Markel renewal rights deal.

-

Markel’s Bryan Sanders is receiving the Lifetime Achievement Award for his service to the industry.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

The executive succeeds current CEO Petway, who is retiring.

-

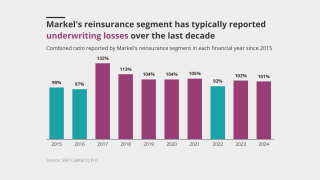

The company was right to drop its reinsurance unit and refocus on its specialty roots.

-

The wholesaler also paid nearly $29mn for the Irish MGU 360 Underwriting.

-

The president expects to see benefits from the deal in H2 2026.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Lion's share of Markel Re staff have been offered roles at Ryan, with others to work on run-off.

-

Nationwide will delegate management of the policies to Ryan Specialty.

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

-

The Michigan-based firm will join Ryan Specialty’s binding authority division.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The executive is departing for a role at Birch Risk.

-

The company completed the acquisition yesterday.

-

The standard market has not ‘meaningfully’ impacted the rate of flow in the aggregate.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The program will offer liability coverage up to $5mn per occurrence.

-

ISA is part of Ryan Specialty National Programs, which launched last month.

-

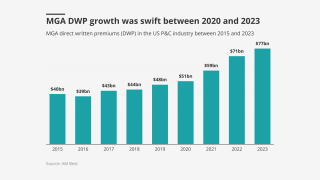

After a period of business building, MGAs will likely spend more time optimizing.

-

The vehicle will take a quota share of all of the risks underwritten by Ryan Specialty’s MGA arm.

-

Keogh worked at Aon for nearly 30 years before retiring in 2022.

-

CEO Kieran Dempsey will relinquish the additional title of president.

-

The executive will join the firm effective May 1.

-

Ryan Specialty National Programs consolidates several RSUM business units.

-

WKFC’s chief executive D’Onofrio will become RSUM’s global CUO.

-

Eric Quinn was named president of Ryan’s MGU operations as Mark Engel joined in marine and energy.

-

This was Ryan’s second-largest 2024 deal, after its $1.4bn Assure purchase.

-

CEO Tim Turner said the firm still has an ambitious M&A pipeline and financial flexibility to execute deals.

-

Acrisure may be the first heavyweight broker to go, with Hub, BroadStreet and Howden also contenders.

-

The deal comes around three years after Markel sold a controlling interest in Velocity for $181.3mn.

-

Richard Winborn joins as president, while Patrick Mitchell takes on the COO role.

-

The MGU also announced a string of promotions to leadership, including RWI CUOs and a new head of Europe.

-

The MGA platform will become part of Ryan Specialty Underwriting Managers.

-

Management is showcasing its ambition, but it’s also dialing up risk.

-

The wholesaler also paid $11.7mn in cash to Alera for the acquisition of Greenhill Underwriting.

-

Rate deceleration in property cat increased in September, and property pricing overall was down in Q3.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The sale is expected to close next month, though terms are not yet final.

-

This follows a spate of program manager deals Ryan Specialty has made.

-

The binding authority market is also “ripe” for consolidation, the CEO said.

-

Howard Siegel remains CEO of the MGU.

-

With the move, RT adds a CEO to its binding authority and a CEO to its RT ProExec businesses.

-

Ethos’ transactional liability MGU is not included in the deal.

-

The executive previously spent over 11 years at Captive Resources.

-

The underwriting units produced revenue of $11mn in the year to June 30.

-

Geo Europe CEO Walter Craft will remain with the financial lines business.

-

The Houston, Texas-based program manager will join Ryan Specialty’s healthcare MGU Sapphire Blue.

-

Ascot will evaluate other options for its ~$140mn-premium transactional liability unit.

-

The wholesaler is shifting its business mix towards delegated underwriting, which should help sustain growth.

-

The promotion follows a distribution trading partnership deal with MGU PCS.

-

The acquisition includes up to $400mn of performance-based contingent considerations measured through 2026.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The announcement confirms news this publication revealed in July.

-

A roundup of today’s need-to-know news, including Commissioner Lara’s FAIR plan reforms.

-

The arrangement enables PCS to expedite growth.

-

A quick roundup of today’s need-to-know news, including the DoJ/NatGen lawsuit and RenRe's earnings call.

-

The facility will write management, financial and professional lines.

-

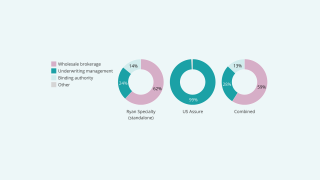

US Assure has been exploring a potential sale through a narrow process run by Dowling Hales.

-

-

Jeremiah Bickham and Janice Hamilton have also been promoted as part of the succession plan.

-

Ryan Specialty’s CEO opened the Insurance Insider US 2024 conference.

-

The promotions are within RT Specialty's environmental and construction professional practice.

-

The consideration in this deal will also include $2.2mn of Ryan Specialty Class A common stock.

-

President Tim Turner noted two pricing trends: property “stabilization” and casualty “acceleration”.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier will reassess the market in the fourth quarter, or early in 2025.

-

The MGA platform has been under auction since last year.

-

-

Ryan entered into a £200mn currency forward to manage the appreciation risk of the Castel deal.

-

The deals completed in 2023 represented over $140mn of annual historic revenue, Ryan said.

-

Devers’ was on the board of Ryan Specialty since 2013.

-

The deal follows this publication’s report that the Bank of America-run sale process of Castel was drawing robust interest.

-

The subsidiary will offer clients and capital providers a wide-ranging, single platform of financial lines products, with operations across the US, Europe, LatAm and London.

-

He was previously president of Kelly Underwriting Services, now part of CorRisk.

-

In Q3, inorganic growth added over four percentage points to the brokerage’s top line, as multiples remain “pretty consistent”.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Anthony Kuczinski has over 38 years of (re)insurance experience, including 15 years as president and CEO of Munich Reinsurance US Holdings.

-

The medical stop-loss MGU produces annual revenue of around $25mn.

-

Rate declines have not been as pronounced in private D&O, though competition is increasing.

-

Guerville has worked at Ryan Specialty for nearly seven years in various positions, including actuarial director, director of underwriting and deputy CUO.

-

Additionally, the recent takeovers of medical stop-loss firms Ace Benefit and Point6 accounted for an aggregate cash consideration of $46.8mn.

-

The company has yet to see the standard market meaningfully impact rate or flow in the aggregate.

-

The Inside P&C news team runs you through the earnings results for the day.

-

The pair will retain their leadership roles for MGUs WKFC, CorRisk and AgRisk.

-

Onex reduced its position in the wholesaler by almost two-thirds to nearly 3.7% from around 11.3%, while president Tim Turner sold ~700,000 of his nearly 4.9 million shares.

-

Founded in 1997, Socius provides management, professional and cyber liability and P&C insurance.

-

Executives were speaking after the broker reported Q4 earnings, in which organic growth accelerated 2.6 points sequentially but slowed 7.2 points year-on-year to 12.9%.

-

The company also named Jeff Smith as president and CUO of the MGU.

-

Both executives were serving as presidents of their respective divisions at the brokerage arm.

-

Singhvi most recently served as the company’s COO after joining the firm in 2018.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

In addition, the wholesale broker disclosed a $7.7mn consideration in the takeover of certain assets of Centurion Liability Insurance Services.

-

The firm said the loss is related to replacement coverage costs from policies that were placed in 2022 but were underwritten by an unsatisfactory carrier.