-

The move from Chubb comes at a moment of perceived weakness for AIG.

-

The timing is unhelpful as the global insurer tries to get on the front foot with M&A.

-

The global insurer is buying access to distribution and underwriting at a carrier with a 27% GWP CAGR.

-

The global insurer will need to convince investors on the quality of the book.

-

Dealmaking took centerstage, but other discussed topics were growth, talent and capacity.

-

There’s nothing medical about SAM claims.

-

MGAs that are good operators will stick out compared to the rest.

-

The mood in Orlando was sunny among cedants and reinsurers alike, but there are clouds on the horizon.

-

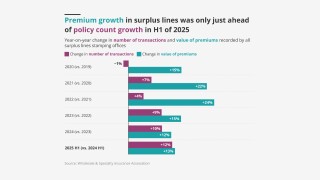

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

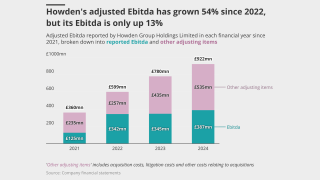

Insurers are pleased, brokers are looking for trade-offs, and everyone’s talking about Howden.

-

Sexual abuse and molestation exclusions are starting to hold in higher layers of hospital towers this year.

-

The as-yet unnamed platform will have to compete in a crowded market for M&A and lift-out opportunities.

-

Winners and losers will emerge more clearly, with less opportunity to ride the market wave.

-

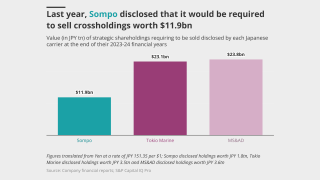

The insurer has chosen a “take two” deal after buying Endurance, betting again on Bermuda.

-

The completion is also good news for Marsh, Aon, WTW and other potential buyers in US retail.

-

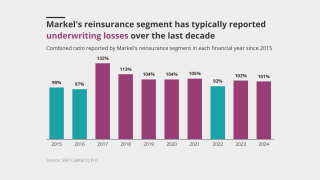

The company was right to drop its reinsurance unit and refocus on its specialty roots.

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

It is slim pickings for quality mega deals and the brokerage has an in-built need for speed.

-

Succession, heavyweight M&A and expanding beyond its core will all test the broker.

-

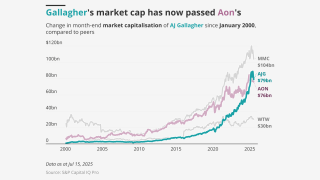

The broker has emerged as the emphatic winner of the supercycle, but new tests are coming.

-

A London wholesaler broker would be a compelling second move.

-

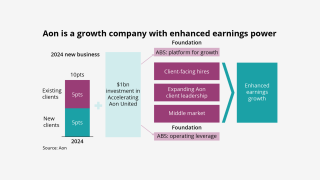

Above-market organic growth, mid-market M&A and talent infusions were all heralded.

-

The $10bn acquisition of Risk Strategies is the biggest broker deal relative to size we have seen.

-

Rates and limits have done the heavy lifting to date – but there are other options.