Selective

-

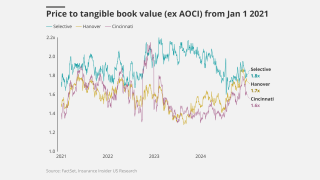

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

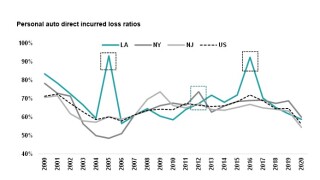

Selective’s CEO earlier attributed Q3 adverse development to the NJ market.

-

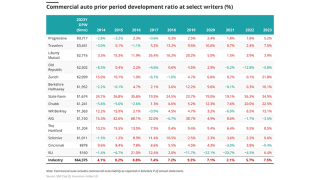

By line of business, $35mn of the charge relates to commercial auto and $5mn to personal auto.

-

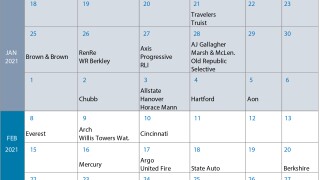

The Insurance Insider US news team runs you through the earnings results for the day.

-

The regional insurer has increased its weighting to OLO and commercial auto, versus comp.

-

Loss trend concerns persist, but insurers are vouching on the opportunity to push for more rate increases.

-

The carrier has been steadily increasing loss trend estimates.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

During first quarter earnings calls, insurers argued that they can mitigate volatility.

-

CEO Marchioni said the overall hit would likely be “in the low single digits”.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Regionals and smaller carriers need to exercise vigilance when expanding commercial casualty lines.

-

The company’s combined ratio rose 6.5 points from 2023.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

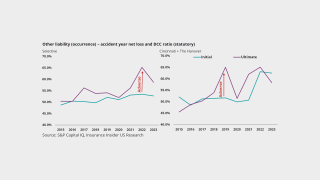

Worrisome trends in the line may be warning signs of worse to come.

-

Modeling misses may have undervalued the storm’s inland wind impacts.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The executive joins Selective after 19 years at Progressive.

-

Regionals may be particularly vulnerable to problematic loss cost trends and volatile cat losses.

-

Travelers and Selective’s releases point to ongoing reserving challenges this earnings season.

-

A quick round-up of today’s need-to-know news, including the Microsoft outage and Travelers' results.

-

The carrier’s CoR increased 15.9 points YoY to 116.1% on unfavorable GL development.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The action comes in addition to a $55mn unfavorable development in GL in Q4 2023.

-

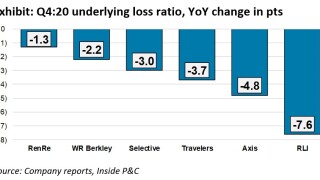

Commercial carrier earnings continue to show mixed prior-year development.

-

The $55mn hit is about 3% of the carrier’s general liability net reserves.

-

Markel, Axis and Selective booked sizeable reserve charges in their liability segments.

-

Insurance Insider US runs you through the earnings results for the day.

-

The company pegged its overall written renewal rate in Q4 at 9% and expects it to be in the range of 20% to 25% in 2024.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Chief accounting officer Anthony Harnett will step in as interim, while Selective conducts a global search process to identify a new CFO.

-

Executives have pointed out that it is becoming increasingly difficult to talk about broader trends as micro-cycles are developing for each line.

-

After launching in West Virginia and Maine in early 2024, the New Jersey-based firm will target expansion in the western half of the country.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Most storms affecting Selective’s results were in the Midwest and on the East Coast, and none were large enough to attach to its catastrophe reinsurance treaty.

-

The firm reported $55.3mn cat losses in Q1, of which $35.1mn were recorded in the standard commercial lines segment and $14.6mn in personal lines.

-

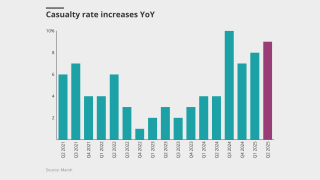

The carrier also increased its casualty loss cost assumption to 6% from 5.5%, driven by increased economic and social inflation.

-

The company booked pre-tax net cat losses of $45.7mn, which included $46.1mn of net losses from Winter Storm Elliott.

-

In its preliminary Q4 earnings announcement, the carrier estimated a combined ratio of 94.7% for the quarter.

-

The regionals continue to find success in small and middle market business, as their pivot to a commercial focus has benefitted them.

-

In the third quarter, the company's underlying combined ratio, stripped of catastrophe losses and reserve development, totaled 94.7%, compared to 90.4% in the corresponding period.

-

The company posted lower cat losses despite a $10mn net loss attributed to Hurricane Ian.

-

With pricing decelerating and loss-cost trends potentially reversing, regionals should continue to execute on their present strategy.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

In Q2, Selective's headline combined ratio deteriorated 5.7 points to 95.5%, driven by higher catastrophe losses and lower favorable casualty reserve development.

-

The firm’s specialty pivot seems to be paying off in premium growth and value creation.

-

The underlying combined ratio was 91.4% this quarter, compared to 89% a year ago.

-

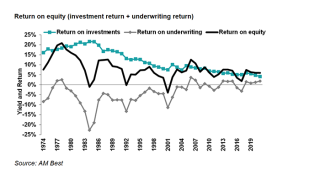

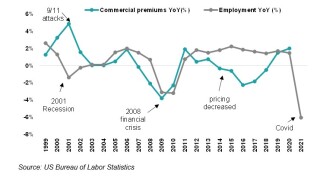

Insurers could face pressure if interest rate and recession fears intersect with worsening loss cost trends.

-

Selective Insurance's rate increases buck the industry trend of moderation as they continue to rise into Q2.

-

The results were driven primarily by higher non-catastrophe property losses and less favorable prior year casualty reserve development.

-

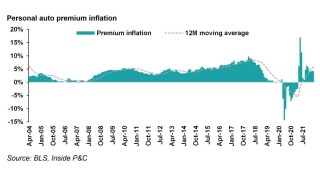

March’s CPI report shows elevated inflation levels, including vehicle CPI of 10.5% and average used car price increase of 24.7%.

-

Insurance stocks mixed following swath of earnings results; Aon gains nearly 7% in Friday trading.

-

Despite decreasing underwriting income, the company’s Q4 2021 performance was above the $1.41 earnings per share that analysts had estimated for the period.

-

The latest report shows even higher inflation pushing up severity, forcing carriers to take rate.

-

The monthly CPI report shows that inflation continues to push severity higher as carriers take rate in response.

-

The board intends to maintain lead independent director and chairperson elect John Marchioni following the meeting.

-

Supply chain disruptions are impacting material costs and timelines, but the Biden administration’s legislation promises growth.

-

The ratings agency praised the insurer’s strong balance sheet and operating performance as well as its adequate risk management.

-

The carrier’s results during the quarter were driven by lower underwriting gains in its commercial lines segment.

-

Ida soaks the tri-state – and has the potential to affect personal auto carriers more than comparable storms of the past.

-

Employment data indicates that easy growth and margin expansion may slow soon.

-

CEO John Marchioni also said he expected increases in social inflation trends to return as the economy reopens.

-

The New Jersey-based insurance group has rebounded from prior-year Covid-19-related challenges, calling this its "strongest capital position in history".

-

Management at Selective Insurance has updated the carrier’s profit guidance for 2021, saying it now expects the company to report a combined ratio of 90% for the full year.

-

Selective’s operating profits more than doubled year on year to $102.8mn for the first quarter of 2021, as the carrier benefitted from a $30mn prior-year reserve release and a 24% rise in investment income during the period.

-

Insurers face the difficult balancing act of signaling optimism to investors as they seek to push rate rises.

-

The first week’s reporters present a conundrum around whether or not we will see ROE expansion in 2021.

-

The executive says pricing increases in lines such as property and GL during the quarter were less pronounced.

-

Despite the continuing impact of Covid-19, the insurer’s combined ratio for the period improved by 3.7 points to 88.1%.

-

Inside P&C’s research team examines some of the areas that will be closely watched during the results season.