The Hartford

-

Opportunities for growth remain in small and medium commercial accounts.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The state’s AG said the case threatens continued offshore oil and gas operations.

-

The executive previously spent more than 16 years at The Hartford.

-

The insurance industry’s lower reliance on foreign skilled workers softens the blow.

-

The executive was previously Navigators’ head of excess casualty.

-

The executive joined Navigators in 2010 after eight years at White Mountains Capital.

-

Smaller accounts remain less affected by an influx of MGAs.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The insurers sent denial letters to the tech company as lawsuits and damages pile up well into the multi-millions.

-

The executive joined The Hartford when it acquired Navigators in 2019.

-

Major insurance industry groups and companies have recently pressed lawmakers to include the provision.

-

The Hartford’s Q1 CoR increased 4.1 points to 96.9% driven by cat losses.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The industry needs to find a way to rebalance power dynamics.

-

At the PLUS D&O symposium, executives raised concerns over tariffs and the role of reinsurance.

-

The company’s reinsurance business also has some exposure, the executive said.

-

The carrier strengthened its GL reserves by $130mn in Q4.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Sources said that the new paper is replacing PartnerRe capacity that was backing the MGA.

-

'Mo’ Tooker will add personal lines to his current position overseeing SME and distribution.

-

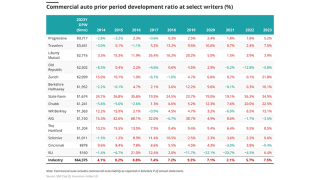

Worrisome trends in the line may be warning signs of worse to come.

-

The insurer also promoted Rick Ciullo to head of global specialty’s US retail businesses.

-

The Hartford made the unusual move of calling out current AY development.

-

The carrier’s estimated pre-tax losses from Milton are $65mn to $110mn.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Hartford and Aon also posted notable, though more muted, stock bumps.

-

The contraction so far this year is in line with the executive’s expectations.

-

A roundup of today’s need-to-know news, including Commissioner Lara’s FAIR plan reforms.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

A roundup of today’s need-to-know news, including leadership changes at Chubb.

-

Michael Fish will become head of group benefits after Jonathan Bennett’s retirement.

-

The carrier is also targeting E&S growth in property brokerage and global specialty.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Carriers expressed confidence on the line’s ability to withstand medical inflation.

-

Commercial carrier earnings continue to show mixed prior-year development.

-

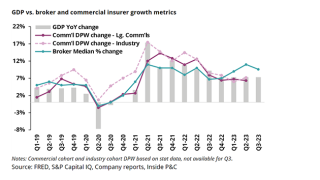

Commercial property pricing rose 11%, while personal auto grew 21.9%.

-

Insurance Insider US runs you through the earnings results for the day.

-

The insurer said it will continue to renew existing homeowners’ business.

-

The commercial lines market is generally rational and disciplined, the CEO told analysts at the Goldman Sachs 2023 US Financial Services Conference.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

In tandem, the carrier announced that Stephanie Bush, who leads small commercial and personal lines, will retire after more than three decades with the company.

-

The Hartford is "starting a conversation” about complex risks and possible solutions with its Risk Monitor Report 2023, the executive said.

-

Broker and commercial carrier trends separate as inflation slows but rates stay elevated.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The carrier’s Spectrum property business grew 13%, general property in the middle market segment was up 13% as well, and large property grew 16%.

-

AJ Gallagher posts 10.5% Q3 organic growth, lower sequentially but up year-on-year

-

Secondary perils are adding uncertainty, while modelling is still relatively unsophisticated.