-

There’s nothing medical about SAM claims.

-

Northeast Insurance said 55 claims were brought under the Child Victims Act.

-

Since Simon Wilson was elevated to insurance CEO, the firm has been refocusing its underwriting.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Critics claim the dispute system denies consumers' key legal rights.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

As the Great Japanese M&A Contest develops, the executive said inorganic expansion is “a top priority”.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

A US district judge ruled a delay could put human life and property at risk.

-

The federal panel hasn’t finalized a timeline for formulating the new rules.

-

Shared and layered accounts are seen as reaping the biggest benefits.

-

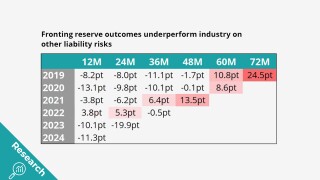

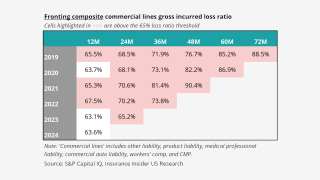

Fronting doesn’t look any better when it’s broken down by segment.

-

Trade credit insurers are expected to respond with tighter buyer limits and stricter wordings.

-

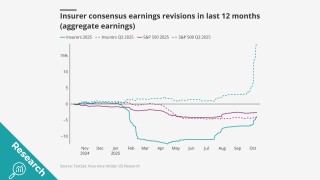

Growth concerns were top of mind at this year’s conference.

-

The governor has yet to sign a pending bill to create a public cat model.

-

Lighter cat losses a plus, while top-line, organic growth and reserving concerns persist.

-

Moretti has relocated to California from London.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

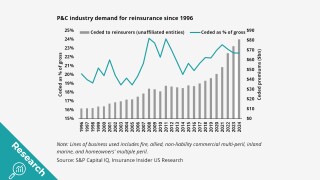

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

Expansion into adjacent markets, capital return and M&A among top means of capital deployment.

-

Insurers continue to compete on price, especially in the SME sector.

-

The ratings agency cited a reduction in exposure to nat cat risk as a reason for the change.

-

Sexual abuse and molestation exclusions are starting to hold in higher layers of hospital towers this year.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

The jump in the latest estimate could be due to damage to seasonal properties only being recently discovered.

-

The NHC also warned that a hurricane watch could be required in Bermuda as early as Monday afternoon.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The tropical cyclone is expected to be named Imelda.

-

Juries don’t significantly differentiate in cases involving severe injury.

-

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

-

Rates continue to be favorable for buyers across major lines of coverage.

-

Despite the formation of Gabrielle, there is "a very high probability" of a below-average season.

-

The risk also ranked as a top three concern for companies of all sizes.

-

Whether in property or casualty, areas of the market will be profitable even with new entrants, the executive said.

-

The proposed changes aim to establish clear guidelines for intervenors.

-

Cat losses in August were below historical trends, but we are not in the clear just yet.

-

Following the Golden Age of Specialty, franchise quality will play a bigger role in determining success.

-

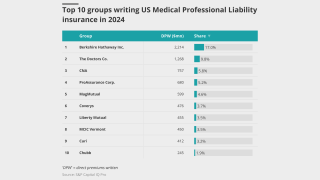

Despite tort reform, physicians’ insurers are struggling with the same loss inflation challenges as other liability peers.

-

Average incident costs for SMEs were up nearly 30%.

-

The MGU is entering the often-difficult habitational GL space with an initial E&S offering.

-

As data privacy litigation increases, insurers increasingly lean on exclusions.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

While the Fed is more concerned with jobs, other macroeconomic concerns trouble the industry.

-

This follows the news that AmTrust will spin off some of its MGA businesses.

-

The specialty MGA said it didn’t experience direct losses from the LA wildfires.

-

Reinsurers will not back business indefinitely where loss ratios continue to exceed the industry by a wide margin.

-

The Berkshire subsidiary is seeking coverage for a $22mn antitrust loss.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

A report by the ratings agency challenges current industry wisdom.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The wildfire MGA is expecting to write higher value homes soon and may expand into new states.

-

Ransomware claims have made up the majority of recent large losses.

-

The company saw a 53% decrease in cyber claims after a surge in 2024.

-

The fundraising round brought in $50mn for the insurer.

-

A survey from PwC described the sector as “stable”, “evolving” and “dynamic”.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

Clients in the segments that AIG trades in may not be as receptive to the idea as the insurer would like.