-

HNW family offices are now among investors considering the US MGA segment.

-

Tompkins Insurance is a subsidiary of Tompkins Financial Corporation.

-

The global insurer is buying access to distribution and underwriting at a carrier with a 27% GWP CAGR.

-

The acquisition will expand PHLY’s presence in the niche market.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Gray specializes in contract bonds for mid-sized and emerging contractors.

-

Sources said that the transaction valued the Californian auto F&I business at over $1bn.

-

Onex’s own balance sheet will become a 63% owner and AIG takes a 35% stake.

-

Greenberg has strong links with IQUW management, and praised the firm’s leadership and cultural fit.

-

This publication revealed that Starr was zeroing in on the deal earlier today.

-

The parties could announce the transaction soon, according to sources.

-

Sources said that the businesses in Canada and LatAm were part of Everest’s original plans to sell its retail book.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

The global insurer will need to convince investors on the quality of the book.

-

BP Marsh has agreed the sale of its 28.2% shareholding as part of the deal.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Old Republic said the acquisition is expected to close in 2026.

-

The company and its main debt provider Ares agreed to relax its debt terms in April.

-

Dealmaking took centerstage, but other discussed topics were growth, talent and capacity.

-

Sources said that Piper Sandler is advising the Dallas-based program manager on the process.

-

The Jay Rittberg-led program manager kicked off a strategic process in August.

-

Sources said the PE-backed platform retained IAP to advise on the process.

-

The company is looking to grow through its new MGA incubator program.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

SageSure’s recent M&A in Florida was driven by being selective with policies and smart about claims costs.

-

MGAs that are good operators will stick out compared to the rest.

-

Private capital–backed buyers accounted for 73% of the 513 transactions this year.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The MGA platform wants to expand into Europe and the UK and grow its wholesale business.

-

The broker will now have access to an M&A war chest for inorganic growth.

-

The carrier has renewed and extended its capacity arrangement with the MGA.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

Proceeds will be used to pay off debt maturing at the end of the year and to support new market growth.

-

The business has been ~70% owned by White Mountains since January 2024.

-

The firm posted trailing 12-month organic growth of 23% YoY supported by a three-pillar strategy.

-

Sources said that Howden Capital Markets is advising the fronting company.

-

Spectrum joins investors ForgePoint, Hudson and MTech.

-

Verisk's recent deals and its interest in cyber-analytics firm CyberCube show M&A in the segment has ticked up.

-

The company will continue its capacity partnership with the MGA until 2030.

-

Return horizons are shifting, and entrepreneurial underwriters should start looking at longer tail business.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The transaction marks the largest US market entry by a Korean non-life insurer.

-

With the deal, sources expect backers Tiptree and Warburg Pincus to exit the Floridian insurer.

-

Sources said the start-up has two $10mn+ Ebitda platform deals lined up.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The deal values the Onex-backed P&C broker at over $7bn.

-

The low degree of overlap between the combining portfolios benefits both parties.

-

Other parties that looked at the business include CPPIB, Permira and Carlyle, sources said.

-

A federal judge restricted former Marsh employees from soliciting for Howden.

-

The deal’s benefits headlined AJG’s investor day presentation.

-

Onex is making the investment alongside PSP, Ardian and others.

-

This publication revealed earlier this year that the firm was working with Ardea to explore strategic options.

-

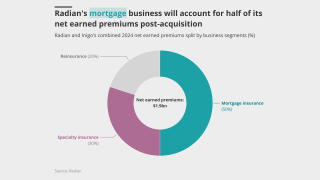

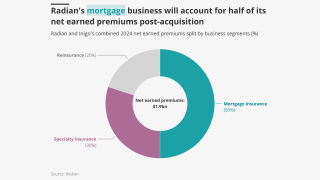

The mortgage insurer said Inigo will continue to operate as a standalone business.

-

The acquisition furthers Howden’s expansion into the US retail space.

-

The Inigo CEO said the lack of portfolio crossover was highly attractive to Inigo.

-

The US mortgage insurer announced its $1.7bn acquisition of Inigo earlier today.

-

The deal becomes part of a wave of carrier dealmaking.

-

Sources said the agency first considered a debt raise but recently pivoted to a sale process.

-

The as-yet unnamed platform will have to compete in a crowded market for M&A and lift-out opportunities.

-

A process has not been launched and a firm timeline for a liquidity event has not been agreed.

-

Tangram will become the inaugural portfolio company of Balavant Insurance.

-

The MGA business was valued at an enterprise valuation of upwards of $1.1bn, sources said.

-

This publication reported earlier today of the asset manager’s foray into the MGA space.

-

The deal represents a first entry into the US MGA market for the $1.1tn asset manager.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

As part of the transaction, PE firm Atlas Merchant has agreed to sell its interest in MarshBerry.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

The boutique retail broker provides P&C and benefits services in the Mexican Caribbean hospitality sector.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

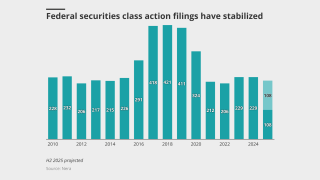

Lawyers said uncertainty raises litigation risks, and signals from the federal government aren’t expected to help.

-

The insurer has been under review with positive implications since March.

-

Andrew Robinson returns to Lloyd’s after his previous involvement via The Hanover’s Chaucer deal.

-

Apollo executives David Ibeson and James Slaughter are committed to the future as a combined entity.

-

The US specialty carrier announced Tuesday that it was buying the Lloyd's business for $555mn.

-

Aon acquired NFP from Madison Dearborn in April last year in a $13.4bn deal.

-

In June, this publication revealed that Apollo had appointed Evercore and Howden to run a process.

-

Arkansas-based RVU provides commercial P&C and some specialty programs.

-

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

A view into PE-fueled activity in the MGA sector, as LatAm carrier M&A accelerates.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

James River said the court was right to dismiss the fraud case.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.