-

Plaintiffs claim climate-induced cat losses have spurred increases in premiums.

-

The subsegment is the latest commercial auto sector to feel the heat of litigation losses.

-

Many carriers are still pricing above technical rate, but could reassess their strategies after Q1.

-

The carrier said it anticipates a better market due to recent reforms.

-

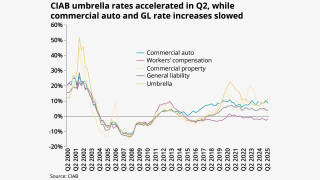

Casualty rate increases largely stabilized in Q2 and Q3 at 5%-10% for general liability.

-

Despite a softening market, underwriters were still able to attain up to 10% above technical pricing.

-

With property getting more competitive, FM pursued an opportunity for growth in E&S with Velocity.

-

Softening rates amid worsening loss costs paints an uncertain future for the industry.

-

The agency cited moderating premium growth and selective underwriting capacity as factors behind the downgrade.

-

The broker said R&W rates rose to 2.8% in Q2 vs 2.5% in Q1.

-

The growth and profitability survey predicts 8.5% median growth for 2025.

-

Workers’ compensation was the only line that saw a YoY decrease.

-

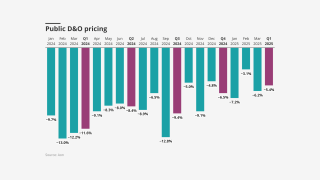

Rate decreases are often in double digits, but high loss trends and systemic risk persist.

-

The insurer reached highs of over 1.4 million policies in September 2023.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

The specialty carrier’s share price fell nearly 7% on the day of the call.

-

Workers’ comp rates dropped again, but the decline slowed from last quarter.

-

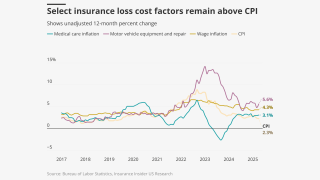

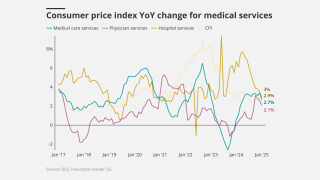

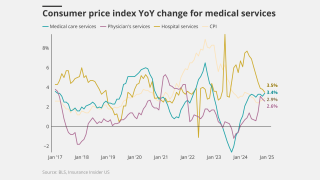

September’s medical care index increase follows a 0.2% drop in August.

-

While limited to only some accounts, it’s a sign of the intense competition in the segment.

-

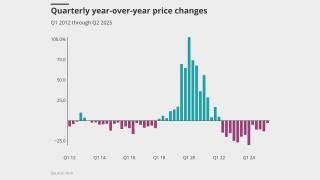

Property insurance rates declined by 9%, the same as in the prior quarter.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

MGAs that are good operators will stick out compared to the rest.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

Rachel Turk was speaking on an Aon Reinsurance Renewal Season panel.

-

An average of 81% of property accounts renewed flat or down.

-

As the Great Japanese M&A Contest develops, the executive said inorganic expansion is “a top priority”.

-

State Farm is under investigation as its premiums have been rising “drastically".

-

Shared and layered accounts are seen as reaping the biggest benefits.

-

Growth concerns were top of mind at this year’s conference.

-

Property underwriters are ‘competing fiercely’ to access mining risks.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

The request cites use of Verisk’s forward-looking wildfire model.

-

Insurers continue to compete on price, especially in the SME sector.

-

Trailing three month premiums were up 7.2% versus 13.1% in August.

-

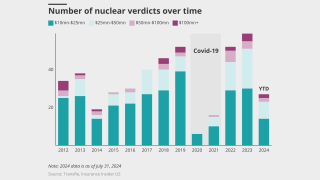

Juries don’t significantly differentiate in cases involving severe injury.

-

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

-

Rates continue to be favorable for buyers across major lines of coverage.

-

Global pricing is now 22% below the mid-2022 peak.

-

The proposed changes aim to establish clear guidelines for intervenors.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

Winners and losers will emerge more clearly, with less opportunity to ride the market wave.

-

-

Litigation funders are promoting “aggressive” tactics in the UK, Holland and Israel.

-

Despite high profile losses, there’s ample capacity in marine and aviation, while PV has seen healthy profits.

-

All rates were up on a year-over-year basis, except for workers’ compensation.

-

Rates will remain elevated in a period of structurally higher risk premia.

-

Growth in the SME sector could help stabilize the market, however.

-

The rest of 2025 appears poised to remain favorable for insureds, however.

-

California, Florida and Texas all saw decreases in monthly premium growth.

-

Some 32% of survey respondents expect property cat rates to fall by more than 7.5%.

-

Rates are finally flattening, but it’s unclear if stabilization is enough for insurers’ bottom line.

-

Last year marked the second consecutive year in which carriers made a positive return.

-

Capacity has gone up slightly, with new entrants and incumbents feeling better about their books.

-

The program is aimed at affluent homes valued between $1mn and $6mn.

-

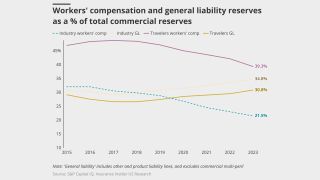

GL and workers’ comp, however, may benefit from a more competitive environment.

-

Ongoing pricing headwinds stand to weigh on carriers’ returns and valuations.

-

This is the first rate filing to use the recently approved Verisk model.

-

Commercial auto saw the largest rate change, which was down about a half point by the end of July to 7.96%.

-

July’s medical care increase was up from June’s o.6%.

-

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.

-

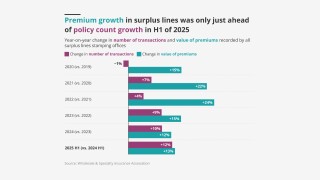

Commercial liability and commercial property coverage continued to dominate the E&S market.

-

The risk of cyber incidents that cause physical damage is also rising.

-

California posted a 47% jump YoY, from a 28.4% rise in June.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

The pace of increases ticked down in the second quarter compared to Q1.

-

The company adjusts its rate options to expand California business under the new cat model.

-

Casualty rates increased 4% globally but shot up 9% in the US.

-

Renewal rates fell, despite elevated catastrophe losses.

-

The company also encouraged insurers and brokers to support the initiative.

-

All lines except workers’ comp are up year over year, however.

-

Rate gains are easing across many commercial and personal lines.

-

June’s increase was up from May’s 0.2%.

-

Renewable energy premium written in London and international markets amounts to $2bn.

-

Demand and growth opportunities remain ample despite competitive pressures.

-

Marsh’s property book saw an average decline of 9% in Q1, a trend that appears to have continued through Q2.

-

Elevated cat losses in H1 weren’t enough to stop a further softening of the market.

-

Florida recorded premium growth in June after declines in May and April.

-

The soft market continued through H1 2025, especially on shared programs.

-

Cedants were able to “challenge the status quo” with aggregates back on the table, the broker said.

-

Premium rose across the top 15 P&C risks in 2024.

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

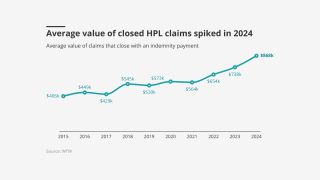

The impact of SAM claims is reverberating through the tower and the broader marketplace beyond hospitals.

-

Coverage has broadened while limits have increased, the broker said.

-

The medical care index numbers were below April’s 0.5% rise.

-

Increases dropped to 5.3% from 5.6% for the previous quarter.

-

Insurers have termed the Democrat-backed legislation “flawed”.

-

Catastrophe losses in Q1 exceeded $50bn, the second highest on record.

-

Companies often purchase policies with limits far exceeding their actual exposure needs.

-

A 20% increase in FHCF retention levels sent cedants to the private market.

-

The collective CoR of 45 Floridians hit 93.1% in 2024

-

Rate cuts are slowing as insurers agonize over claims trends, but capacity is high.

-

Florida’s top regulator says he’s eyeing eventual tweaks to the state’s cat fund, too.

-

The company seeks the full 30% homeowners’ rate request it made last June.

-

Lloyd’s traditionally avoided US middle market property, but head of P&C Matt Keeping says times have changed.

-

Third-party litigation financing remains the thorn in the sides of casualty insurers.

-

Competition and ample capacity are pushing premiums lower.

-

Inflation indices fell in April, but some items related to P&C are still elevated.

-

Most sectors saw lower premium increases, with five reporting decreases.

-

Strong underwriting performance and aggressive repricing of risks in most lines has aided stability.

-

The result has been a sharp increase in the use of captives.

-

The medical CPI is up 3.1% for the last 12 months.

-

Growth in construction projects is increasing the need for coverage.

-

“Models aren't going to tell you what the emergent risks today are,” Dolan said.

-

Median organic growth decelerated to 7.9% in Q1 from 9% in Q4 and 8.4% a year ago.

-

The conference came at a particularly tumultuous time for the US insurance industry and the economy at large.

-

In casualty, getting significant blocks of capacity remains a major challenge.

-

The unit grew Q1 NWP by 23% overall, led by a 27% growth in casualty.

-

The reinsurer said the market was unprofitable and pricing needed to increase immediately.

-

Inflection sets in for insurance stocks as macro albatross gets heavier.

-

The broker said the burgeoning class of business was still finding its stride.

-

The broker's share price dipped 11% in morning trading after its Q1 earnings missed expectations.

-

Macroeconomic volatility could also create top-line headwinds.

-

The only major product line to see rate increases was casualty.

-

Rates for umbrella accelerated to 9.26%, from 8.76% in Q4 2024.

-

California wildfires had ‘little or no impact’ on property cat pricing at April 1, Dean Klisura said.

-

After seven years of premium rate growth, rates are down 5% to 40% across the US.

-

The release followed the filing of an updated Plan of Operation.

-

Despite positive inflation headlines, there are issues for insurers under the surface.

-

Technical pricing is insufficient in some areas and inflation is biting into margins.

-

The medical CPI is up 3% for the last 12 months.

-

The Gallagher Re executive called on the market to “prepare to grow sustainably together”.

-

Even if M&A activity picks up, Atlantic does not expect R&W rates to jump significantly.

-

The costs of accident/casualty-related claims continue to rise.

-

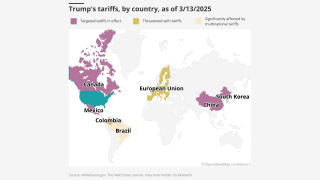

Inflation, tariffs and climate change are all making for an uncertain 2025.

-

The rating allows IQUW to access $1bn in group capital.

-

Last month’s inflation figures were lower than expected, but tariffs continue to loom.

-

The Democratic senator said increased federal oversight of insurance is not the answer.

-

Four cat modelers have also submitted their tech for regulatory review.

-

Excess/umbrella liability and commercial auto broke the trend with high price increases, however.

-

Commercial auto was the exception, ticking up slightly from January.

-

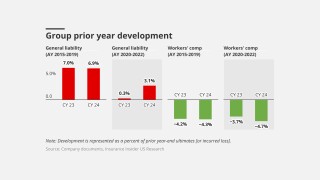

Workers' comp continued to offset GL adverse development, but the bucket is running dry.

-

GL and commercial auto rates accelerate at year-end as social inflation worsens.

-

Insureds, however, are often reinvesting savings into purchasing increased limit.

-

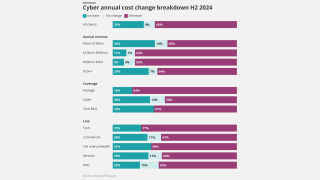

Cyber premiums dropped 1.8%, while commercial auto was up 8.9%.

-

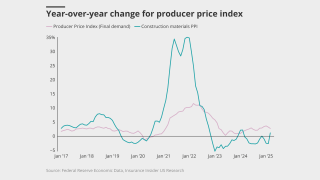

January CPI/PPI heats up but won’t translate to higher loss costs.

-

The insurance commissioner said the carrier has not shown the need for price increases.

-

The event now includes a casualty portion and has officially been re-branded as the Property and Casualty Symposium.

-

Guy Carp CEO Dean Klisura said LA wildfires could slow rate reductions at 1 April.

-

Changes in cat activity and social inflation have impacted carriers focused on the mid- and small commercial market.

-

The impact of the devastating California wildfires is too early to ascertain, executives said during earnings calls.

-

The insurer’s strong Q4 results might not read across to the rest of its peer group.

-

Insurers are increasingly trying to push attachment points for excess layers up to $10mn.

-

Commercial auto ended the year with its biggest gains at 9.82%, compared to 9.71% in Q3 2024.

-

Loss-cost indicators are high for liability, low for property.

-

Rate increases averaged 0.0% in December 2024, from 16.3% in December 2023.

-

The all-items index posted a 2.9% rise for the last 12 months.

-

Supply generally exceeded demand and trading relationships were strong, CEO Tom Wakefield said.

-

CEO Trevor Carvey said the revision reflected Conduit’s “favourable reception”.

-

More competitive pricing is predicted for the commercial insurance market.

-

Third-party liability, auto, medmal and premises liability remain challenging.

-

CMP and BOP reached their highest levels in over a decade.

-

The all-items index rose 2.7% for the last 12 months.

-

The 2025 State of the Market report also touched on E&S and MGA growth.

-

The decision reflects CNA’s “consistently positive” operating performance.

-

Commercial property and workers' comp were down, while GL was flat.

-

The group posted a 15.1% gain for October and 27.4% for September.

-

Umbrella recorded the highest premium increase, at 8.6%.

-

The all-items index is up 2.6% for the last 12 months.

-

Earnings call commentary shows pockets of casualty reserve strengthening for AY 2020-2023.

-

Rates fell across all premium lines, especially for property and GL.

-

Excess casualty rates were up 10% and have been double-digit all year, the executive said.

-

The average for October was roughly half of that for September.

-

Andrade flagged expected 5% to 10% increases in the US and Europe.

-

Greenberg said London behavior in cat market “is almost aberrant relative to everybody else”.

-

Total insured losses are expected to range from $34bn to $54bn.

-

The price for policies with the same limit and deductible decreased 6.0%.

-

However, rate gains again accelerated year over year for all lines except workers compensation.

-

Overall, insurance rates fell by 1%, led by competition in property.

-

Sources said that Milton may slow the pace of rate deceleration.

-

This could change if Milton losses turn “ugly”.

-

CEO John Doyle said global property rates were down 2% versus flat in Q2.

-

Current rates at 2% to 2.5% translate to an 86% incurred loss ratio.

-

Deal flow is still far below levels seen in 2021.

-

Twia filed for the rate hike in August after an actuarial analysis showed that rates were inadequate.

-

The all-items CPI increased 2.4% over the last 12 months.

-

The looming collapse of the city’s biggest livery insurer may not be cause for national concern.

-

Interest in these vehicles has increased recently, but market softening could throw a curve ball at growth.

-

D&O direct written premiums fell 8% YoY as of June 30, and direct earned premiums declined 16%.

-

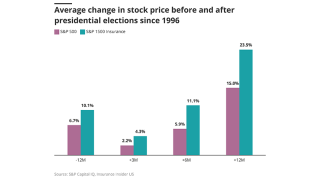

While Republicans are typically perceived as best for business, there are several factors at play.

-

In Q2, median property price increases decelerated to 2.3%.

-

The all-items CPI increased 2.5% over the last 12 months.

-

Commercial auto and excess umbrella continue to face upward pressure.

-

Expansion of the middle-market book is an ongoing focus.

-

Rate increases on primary liability placements range from 10% to 20%.

-

The rate change will be implemented in November.

-

The report flagged “opportunistic underwriting” by many of the major markets.

-

Premiums increased 5.6% across all major lines, down from last quarter.

-

The all-items CPI increased 2.9% over the last 12 months.

-

The action follows the completed acquisition of Accredited by Onex Partners.

-

The measures include stricter timelines for rate application approvals and follow-ups.