-

The legal setback came as publication of a FEMA reform report was postponed.

-

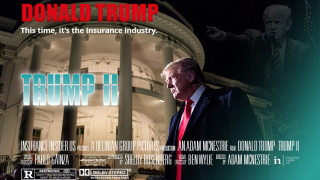

Trump’s shadow loomed over the beachside sessions.

-

NY lawmakers are preparing a legislative package to address insurance costs in the Empire State.

-

The carrier said it anticipates a better market due to recent reforms.

-

Similar bills targeting fossil fuel firms have been introduced in other states.

-

Senators asked for data on fraud but weren’t given any.

-

Whether Clement's promotion was influenced by an inappropriate relationship is in scope.

-

He will be replaced at a time when Fema is considering structural reforms.

-

The deal to reopen the government also extended the NFIP.

-

The Caymans-based reinsurer’s Q3 CoR was 86.6%, down 9.3 points YoY.

-

The mayor-elect has promised to build 200,000 new units in New York City.

-

Industry sources said they expect most larger firms will be able to meet the requirements.

-

California may not be the only state to see non-economic damage caps in medmal get challenged.

-

State regulators have largely avoided enforceable AI regulations, but bad news could change that.

-

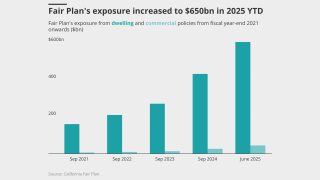

The insurer reached highs of over 1.4 million policies in September 2023.

-

The FIO said it will work with regulators on coverage for digital assets.

-

The regulations are designed to address long-term solvency concerns.

-

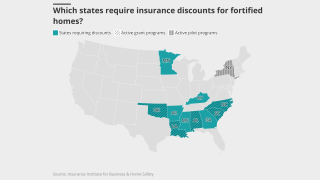

The bill includes provisions to encourage retrofitting homes in high-risk areas.

-

September’s medical care index increase follows a 0.2% drop in August.

-

A former NOAA climatologist who left the agency is running the new operation.

-

Critics claim the dispute system denies consumers' key legal rights.

-

The insurer booked a $950mn policyholder credit expense in September.

-

State Farm is under investigation as its premiums have been rising “drastically".

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

A US district judge ruled a delay could put human life and property at risk.

-

The federal panel hasn’t finalized a timeline for formulating the new rules.

-

The governor has yet to sign a pending bill to create a public cat model.

-

The state’s AG said the case threatens continued offshore oil and gas operations.

-

The executive said record operating income and returns don’t indicate Chubb is “beleaguered”.

-

The request cites use of Verisk’s forward-looking wildfire model.

-

New home sales could be impacted by a prolonged stalemate.

-

Superintendent Harris is stepping down this month after four years of service.

-

The executive has been with ASG since it was formed in 2016.

-

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

-

The insurance industry’s lower reliance on foreign skilled workers softens the blow.

-

Sources said momentum around resiliency laws is growing at the state and local level.

-

The proposed changes aim to establish clear guidelines for intervenors.

-

As data privacy litigation increases, insurers increasingly lean on exclusions.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

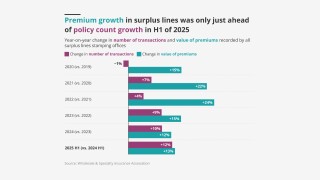

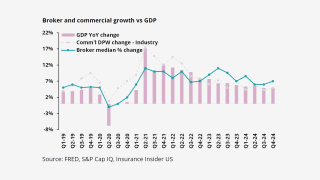

Winners and losers will emerge more clearly, with less opportunity to ride the market wave.

-

A report by the ratings agency challenges current industry wisdom.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

Florida led deregulation by eliminating the diligent effort rule in June.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

The ratings outlook has also been revised to stable from negative.

-

Lawyers said uncertainty raises litigation risks, and signals from the federal government aren’t expected to help.

-

The bi-partisan legislation would make FEMA a cabinet-level agency.

-

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

The violations included not using properly appointed adjusters and failing to pay claims.

-

Lawmakers are seeking input on risk evaluation, limits and other concerns.

-

The group claims the White House is undermining disaster preparedness.

-

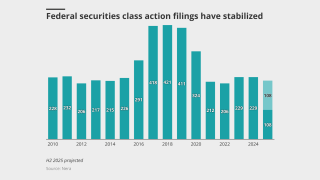

The Delaware high court’s reasoning could find application in other cases.

-

This is the first rate filing to use the recently approved Verisk model.

-

July’s medical care increase was up from June’s o.6%.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

This follows last month’s takeout of 12,000 Citizens policies.

-

Roughly half a year since the LA fires, brokers said there’s hope things are turning around.

-

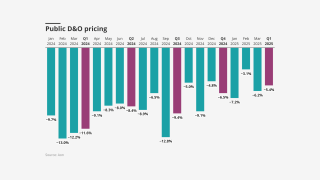

A growing divide in business courts could impact future D&O underwriting, sources said.

-

The company adjusts its rate options to expand California business under the new cat model.

-

Insurers must write policies in high-risk areas in order to incorporate the model.

-

Litigation seeks to block insurers from passing assessment costs to consumers.

-

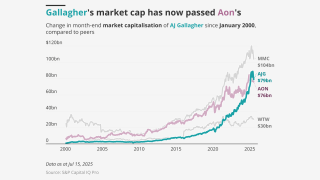

Succession, heavyweight M&A and expanding beyond its core will all test the broker.

-

The Floridian has been approved to potentially assume 81,000 policies total.

-

The broker has emerged as the emphatic winner of the supercycle, but new tests are coming.

-

The suit claims billions of dollars are being illegally withheld.

-

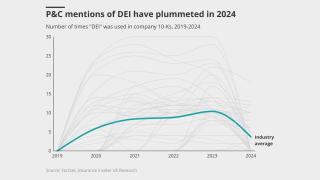

Top companies eliminated or heavily modified language related to DEI this year, analysis shows.

-

State legislation has led to major strides in rate adequacy.

-

The VC firm has been incorporated in Delaware since its founding in 2009.

-

Nominee Neil Jacobs was warned cuts will cause ‘rising home insurance rates’.

-

The FTC granted early termination of the waiting period, leaving the acquisition on track to finish in early 2026.

-

Under the new law, vehicles will only be required to carry $100,000 in PIP per person.

-

The broader legislation narrowly passed the Senate and now heads to the House.

-

The measure could have landed insurers with extra tax on US business.

-

There are now 14 new companies writing homeowners’ policies in the state.

-

The ruling comes as insurers face growing legal pressures following the January blazes.

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

The rules would require paid rest breaks, among other measures.

-

The ratings agency cited support from parent company MSI for the upgrade.

-

The Pennsylvania-based insurer experienced a 10-day network outage this month.

-

The regulatory body is also looking at AI rulemaking and catastrophe resiliency.

-

Florida regulators have also approved takeouts for Mangrove and Slide.

-

Major insurance industry groups and companies have recently pressed lawmakers to include the provision.

-

Rates need to be fair but also should not be “destructive of competition”.

-

Marsh McLennan CEO Doyle dubbed legal system abuse a "tax” on US economy.

-

Lara approved an interim rate increase for the company just weeks ago.

-

The suit, filed in Florida federal court, is Uber’s second Rico case.

-

The regulator said further measures could still be passed in this session.

-

The NYC taxi insurance market is on the brink of collapse. Regulatory relief has been nowhere to be found.

-

The merger is on track to close in H2 2025, CEO Pat Gallagher said.

-

Insurers have termed the Democrat-backed legislation “flawed”.

-

The legislature did pass Twia reforms, however.

-

The company’s credit ratings had been under review since early this year.

-

The collective CoR of 45 Floridians hit 93.1% in 2024

-

Rate cuts are slowing as insurers agonize over claims trends, but capacity is high.

-

The Peak Re subsidiary mainly writes US motor and casualty reinsurance.

-

One measure could give regulators greater leeway to deny rate requests.

-

Florida’s top regulator says he’s eyeing eventual tweaks to the state’s cat fund, too.

-

The company seeks the full 30% homeowners’ rate request it made last June.

-

Kirsh was involved in launching an industrywide “legal system abuse coalition”, which now has 350 participants.

-

"Smoke damage is real damage," Commissioner Lara said.

-

The assumption date for the combined 16,250 policies is August 19.

-

Unpacking how much excess capital there really is and dissecting the source of its returns.

-

Litigation funding is a frequent bogeyman for the insurance industry. The feeling isn’t mutual.

-

State Farm will need to provide its CA subsidiary with a $400mn surplus note.

-

This in turn gives carriers on a tower a little more liberty and less risk to optimize claim outcomes.

-

The reforms limit liability for some small businesses in the state.

-

Growth in construction projects is increasing the need for coverage.

-

Insurers haven’t announced concrete steps – yet.

-

The impact could also raise home-building costs by $10,000 per unit.

-

The Lone Star State has seen rapidly increasing rates in recent years.

-

The agency cited SiriusPoint’s recent management moves including lower cat exposure as a driver of the change.

-

A first-of-its-kind resolution adopted this week says subrogation can reduce insurance costs.

-

The carrier forecasts stable profits, but tariffs are creating “high uncertainty”.

-

The law imposes limits on third-party litigation funding, among other changes.

-

The BRIC program helped fund local resiliency programs, which can reduce loss costs.

-

Howard and Moore were among a group to receive letters over links to prior insurance insolvencies.

-

The suit seeks to block insurers from passing through assessment costs.

-

A one-time impact would be a mid-single digit increase to physical injury auto severity.

-

The release followed the filing of an updated Plan of Operation.

-

The deal had HSR approval and was waiting on approval from the UK.

-

The investment recovery will be welcome but Chinese tariffs will contribute to loss-cost inflation.

-

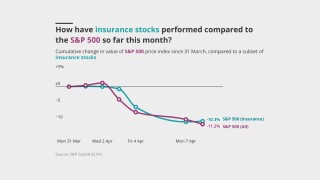

The announcement spurred a quick spike in stock market valuations.

-

Trade credit and marine are among the lines facing direct impacts amid a broader inflationary challenge.

-

P&C has strengths that will help it survive this crisis, but not without some pain.

-

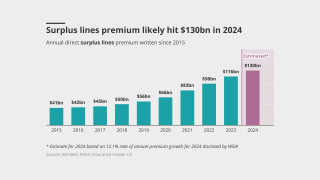

This is shaping up to be a record year, building on momentum in 2024.

-

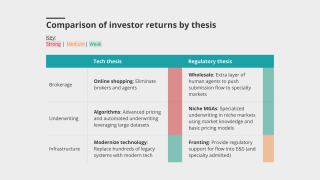

Carriers surveyed cited access to niche markets as a key strength.

-

Universal submitted allegedly ineligible claims to the Florida fund.

-

Capital funding new litigation dropped 16% YoY, however.

-

The bill being considered would effectively eliminate personal injury protection.

-

Coverage will increase to $20mn per building.

-

The decision comes after the agency refused to block a climate related vote at Travelers.

-

Both bills are now on Governor Kemp’s desk awaiting signatures.

-

RBC reports can help regulators identify weakly capitalized companies.

-

The decision is the first of its kind under the new Trump administration.

-

The bill also creates a governing board comprising insurance and consumer reps.

-

The Georgia verdict is one of many legal battles over Monsanto’s herbicide.

-

Inflation, tariffs and climate change are all making for an uncertain 2025.

-

The letter said the FIO is in “direct conflict” with the role of state regulators.

-

The commissioner is eyeing transparency in billing, comparative fault and non-economic damages changes.

-

The regulatory changes have been championed by Governor Brian Kemp.

-

Gallagher already has HSR approval for the $1.2bn Woodruff Sawyer acquisition.

-

Mangrove can take out up to 81,040 polices while Slide’s limit is 15,000.

-

Colorado and New York have already passed regulations regarding insurer AI use.

-

The agency collects gold standard data and conducts research. Without that, there’s more uncertainty.

-

Commissioner Lara also proposed a $500mn cash infusion from parent State Farm.

-

The Democratic senator said increased federal oversight of insurance is not the answer.

-

CEO Greenberg cited ‘competing priorities’ in his annual letter to shareholders.

-

“We do not have the luxury of time,” he said during the Bermuda Risk Summit.

-

Four cat modelers have also submitted their tech for regulatory review.

-

“They've been focused on this for more than 10 years,” said Bermuda’s CIT Agency CEO Mervyn Skeet.

-

There are signs that Florida’s insurance industry is coming under increasing legislative scrutiny.

-

The commissioner said in a legal bulletin that smoke claims can’t be “summarily denied”.

-

The company said it now expects the transaction to close in H2 2025.

-

Insurers and distributors must adapt or risk irrelevance.

-

The ratings agency noted “significant” underwriting improvement in 2023-24.

-

RAA president Frank Nutter says he hasn’t been able to get an update on the project from the now Trump-led NOAA.

-

Florida House speaker Daniel Perez is seeking an investigation into the charge.

-

The company is seeking an emergency rate increase after the devastating Los Angeles wildfires.

-

The first round of the E&S boom has already played out, but this is a long game.

-

State Farm General has asked California regulators for an emergency rate increase.

-

In the absence of interim action, the segment could face an “availability crisis”.

-

Big tort reform packages are on the table, but California steals the show, for now.

-

The carrier has paid $1.75bn on around 9,500 claims filed from the wildfires.

-

The proposed reforms are championed by Governor Brian Kemp.

-

Berkshire Hathaway’s "float" rose to $171bn in 2024 from $169bn in 2023 as Buffett praised Geico’s Todd Combs.

-

Priorities include risk-based capital modernization and cybersecurity issues.

-

The bill was introduced shortly after a similar bill failed in Mississippi.

-

A quick roundup of our best journalism for the week.

-

Sources said California regulators need to show they’re receptive to private insurer needs.

-

The insurer is seeking a 22% interim raise, but the request is currently on hold.

-

Commissioner Lara calls the 10 bills a ‘comprehensive legislative package.’

-

At the first Insurance Insider US Miami Forum, Floridian industry players pointed to signs of stability.

-

The bill seeks prompt claims payments and settlements, and greater transparency.

-

The insurer disclosed the estimates as it seeks emergency rate hikes from regulators.

-

A report from the reinsurance broker said fast rate approvals are key to stabilizing the California marketplace.

-

The NFIP’s strategy is to use "short-term borrowings" to meet what could be $10bn in claims.

-

Citizens approved an average 8.6% rate hike and decreases for one-fifth of policyholders.

-

The state is building an insurer of last resort from scratch, taking notes from California.

-

The Florida of 2022 lacked stability and saw many carrier insolvencies.

-

Democrats pushed back during the hearing, urging rules to encourage mitigation.

-

The agency said it does not expect a “material impact” from the charge.

-

The company says the recent wildfires will be the costliest in its history.

-

Included are tweaks to state premises liability law and reforms to trial procedure.

-

Commissioner Lara said 31,000 claims have been filed for disaster-related needs.

-

James Keating received 20 months in prison and three years of supervised release.

-

The NFIP and NOAA were both targets in the Project 2025 crosshairs.

-

Legal experts say the bill, SB 222, stands a good chance of becoming law.

-

The bill would put new restrictions on bad faith claims, close loopholes.

-

The FIO has limited power, but it has attracted fierce industry opposition.

-

The laws mandating payments were enacted after devastating fires in 2018.

-

It is among the first bills to pass the House during Donald Trump’s presidency.

-

The much-anticipated creation of a DOGE office is already being challenged in court.

-

The regulator also emphasized the need for private flood insurance after hurricane Helene.

-

The all-items index posted a 2.9% rise for the last 12 months.

-

Many are confident the regulatory changes will still stabilize the market in the near-term.

-

America’s longest-serving insurance commissioner was one of the first regulators to focus on climate.

-

III also denies its CEO made anti-gay remarks or harassed a gay employee.

-

CA insurers can now use forward-looking cat models in ratemaking.

-

Insurers are also required to increase coverage in wildfire-prone areas.

-

California’s crisis spurred the biggest reforms in decades.

-

The FIO is “entirely devoid of usefulness and duplicitous in its actions”, the letter to DOGE leadership reads.

-

A separate Senate report found climate change is also increasing non-renewals.

-

Homeowners’ insurance rates have spiked almost 60% since 2018.

-

The insurance industry countered that the committee ignored a “toxic mix” of risks driving up costs.

-

CEO Trevor Carvey said the revision reflected Conduit’s “favourable reception”.

-

The Federal Insurance Office has data collected from over 300 insurers.

-

Most US states have been silent on the regulation of parametric insurance.

-

The regulations are part of a state effort to expand wildfire coverage.

-

The law takes effect January 1.

-

The decision reflects CNA’s “consistently positive” operating performance.

-

TDI is urging legislators to incentivize more resilient housing construction.

-

The firm said the UK hub demonstrates its commitment to expanding in Europe.

-

Elevated casualty and high property claims are concerns, however.

-

Cybersecurity basics could reduce cyberattack costs by up to ~75%.

-

Other key leaders come from Virginia, Rhode Island and Utah.

-

Insurers and their allies hope to capitalize on increased attention to pass a slew of reforms.

-

The regulation is a key component of Lara’s effort to stabilize the state’s sputtering property market.

-

The company said Helene claims have surpassed those of Hurricane Ian.

-

The expectation – and strong hope – is that deregulation will spur growth and bring benefits to the D&O line.

-

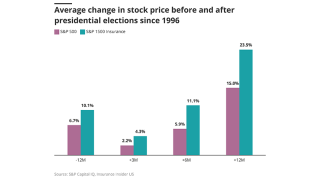

Experts see the president-elect’s position as potentially positive force on taxes, antitrust and noncompete concerns.

-

Industry campaign cash favors Republicans, except when it comes to the presidential election.

-

The NFIP can take on more debt, but climate-fueled disasters aren’t going anywhere.

-

In an interview with this publication, Lara said "everything’s on the table" for future reforms.

-

A bill in Congress would expand a similar pilot tried earlier in New York City.

-

The plaintiff claims he was terminated for testifying to anti-gay harassment.

-

The looming collapse of the city’s biggest livery insurer may not be cause for national concern.

-

Current efforts to battle third-party litigation funding are focused on disclosure.

-

The government flood insurance program now carries $21bn in debt.

-

October 17 has been set as the deadline for written comment.

-

The residual insurer’s pricing is far from rate adequacy, and it is undercutting the commercial market.

-

While Republicans are typically perceived as best for business, there are several factors at play.

-

State regulators have been monitoring climate risk for over a decade.

-

The effort will draw from California’s research and higher education communities.

-

The Heritage Foundation think tank behind the plan argues that the private sector could do things better.

-

The ratings reflect the balance sheet strength of parent Core Specialty.

-

Citizens’ auto-renewal controls were down from February 2023 to August 2023.

-

The ratings agency also assigned the insurer an a- issuer credit rating.

-

States are grappling with first responder claims litigation as some move to expand presumptions to more worker types.

-

The decision comes weeks before the rule was set to take effect in September.

-

House Bill 672 adds regulation to the Louisiana MGA market.

-

The regulations have been officially published online, with a hearing to be held next month.

-

The ruling only applies to a Florida retirement community.

-

Insurance industry representatives meanwhile say they’re common sense and necessary.

-

A letter wants an update on progress towards addressing climate-related financial risks.

-

Commissioner Andrew Mais said AI is also a priority for regulators.

-

Reforms would seek to tamp down legal costs that can drive insurance costs up.

-

The action follows the completed acquisition of Accredited by Onex Partners.

-

The measures include stricter timelines for rate application approvals and follow-ups.

-

A quick roundup of today’s need-to-know news, including CrowdStrike and Slide’s IPO.

-

-

Three states passed restrictions on commercial litigation funding in 2024.

-

The reforms will be included in a new plan of operation for the state’s insurer of last resort.

-

A roundup of today’s need-to-know news, including Commissioner Lara’s FAIR plan reforms.

-

The proposed class says the plan does not cover smoke damage.

-

House Bill 672 will take effect on August 1.

-

Underwriters are getting increasingly granular, rewarding mitigation and prevention with better terms.

-

-

A draft bill would require the disclosure of third-party financing in federal courts.

-

The all-items CPI increased 3% year-over-year, down from 3.3% in May.

-

The standard is a ‘step forward’, but cross-company comparisons are difficult.

-

The groups highlighted technical hurdles to implementation at a Wednesday hearing.

-

The Bermuda courts will assess Onex’s lower, revised offer for the fronting unit.

-

In high-capacity, global E&S property, London has continued to be aggressive.

-

Commercial and residential carriers have different requirements.

-

The all-items CPI has increased 3.3% over the last 12 months.

-

The long-term issuer credit rating on Fairfax Financial Holdings was revised to BBB+ from BBB.

-

Excess capacity rebounded in June 2023 after hitting a decade-low just 12 months earlier.

-

Regulatory compliance risks were listed as the third-greatest concern.

-

Of that total, $312.5mn was allocated to resolve the PFAS claims.

-

Ten companies have filed a 0% increase and at least eight companies have filed a rate decrease to take effect in 2024.

-

The CEO is one of more than 20 executives who received letters from Floir citing Statute 624.4073.

-

The CEO said companies are still taking charges on years 2013 to 2019.

-

The ratings agency flagged the “increasingly favourable” underwriting results.

-

The market has advanced in sophistication but must tackle talent, tax and diversification issues.

-

Concern about vague cat modeling language was a theme at a Tuesday workshop.

-

Existing non-competes for senior executives can remain in force, however.

-

A total of 8% of issuers under criteria observation received negative rating actions.

-

A litany of underwriting and quoting constraints has made it much harder to write business.

-

The ratings agency cited erosion in the company’s surplus position, among other developments.

-

FHCF rates are also projected to decrease by a statewide average of 7.38%.

-

Ten states joined in the original suit.

-

The deal will create a personal lines firm controlling £3bn in premiums.

-

Bermuda liquidators had earlier objected to out-of-court agreements between parties.

-

A more business-friendly approach will be offset by increased uncertainty.

-

The body’s budget committee is again pressing Citizens over solvency concerns.