TransRe

-

The company also encouraged insurers and brokers to support the initiative.

-

The reinsurer said the market was unprofitable and pricing needed to increase immediately.

-

Andy Taylor will also retire after over 25 years with the company.

-

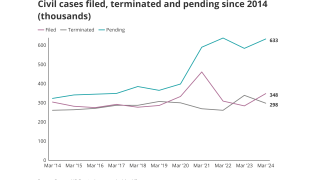

Civil case, nuclear verdict and claims count data show worrying trends.

-

The promotions will help TransRe strengthens its cyber focus.

-

-

This publication recently noted that ongoing rate declines and questions about past accident years are leading to calls for D&O price discipline.

-

As part of a number of senior role changes, the reinsurer promoted Ben Hodge to the role of head of US property, treaty and facultative.

-

Sources said the executive, who has over two decades of experience in the (re)insurance sector, will take a position at regional intermediary Reasinter.

-

Industry veteran Paul Bonny will continue to offer advice to the company through his ongoing role as non-executive director.

-

The companies will likely “benefit from the vast financial resources and financial flexibility,” the agency said after the completion of the merger deal with Berkshire Hathaway.

-

In tandem, the reinsurer elevated Stephanie Danbrowney to take over Crutchley’s previous role as head of US facultative casualty.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The firm's ethos will remain the same, but the bigger balance sheet may help it win clients and absorb volatility.

-

As part of senior role changes, TransRe has also promoted Brian Gallahue to the role of deputy CFO.

-

The executive will lead the team for global product strategies, financial planning and applied data, reporting to CEO Brandt.

-

Adriana Cisneros was AIG’s LatAm property product leader for more than three years in south Florida.

-

The outgoing underwriter has worked at the Bermudian for just over six years, having joined from Hiscox.

-

The transaction will create a reinsurance entity roughly on a par with Scor in terms of net reinsurance premium.

-

Berkshire Hathaway has agreed to buy the TransRe owner in an all-cash deal worth $11.6bn.

-

The deal’s exposures are focused in the troubled personal auto market where loss costs have been running ahead of rates.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The overall combined ratio for (re)insurance operations narrowed by 9.9 points to 89%, driven by lower cat losses.

-

In a letter to shareholders, the CEO said underpriced property risks are mostly in the reinsurance industry.