Treaty Reinsurance

-

This estimate would rank Eunice as the most damaging European windstorm event since Kyrill in 2007.

-

Topsail Re currently underwrites more than $500m of property and casualty reinsurance business.

-

The insurer increased its occurrence treaty coverage by $300mn as the aggregate deal shrank, following a full loss to reinsurers in 2021.

-

The reinsurer said the deals would enhance its abilities to provide innovative solutions for clients.

-

The year saw a substantial uptick in natural disaster losses compared with 2020 and 2019.

-

Inside P&C’s news team runs you through the key developments from the last week.

-

The broker and ratings agency AM Best said total deployed capital grew 2.7% in 2021.

-

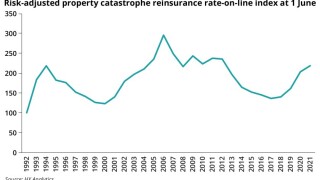

The broker’s property cat RoL index jumped by almost 11% as capacity was more constrained for retrocessional and frequency-exposed property treaties.

-

Property deals got done with rate uplifts, private placements and buyers leveraging profitable long-tail lines deals, but many reinsurers were disappointed by the overall scale of improvement in property.

-

The company also completed this year its first significant casualty placement, a European cedent placement and several loss-making renewals.

-

Deals for CNA, Zurich, AIG, Sompo and Axa XL highlight the intense demand among reinsurers for casualty and professional liability pro rata business.

-

The BMS meteorologist said early data indicated “truly historic outbreak”, and that similar events typically cost the industry in the low-single digit billions of dollars.