Extended free trial

As a Truist team member we'd like to offer you extended 14-day trial access to Insurance Insider US.

Register here:

-

Gain a competitive advantageHear first about tactical developments in the US P&C market

Gain a competitive advantageHear first about tactical developments in the US P&C market -

Make better decisionsUnderstand market dynamics in crucial lines of business, from small commercial and personal lines right through to reinsurance and Bermuda

Make better decisionsUnderstand market dynamics in crucial lines of business, from small commercial and personal lines right through to reinsurance and Bermuda -

Act firstReference insight about the long-term forces reshaping the industry

Act firstReference insight about the long-term forces reshaping the industry -

Profit from foresightLeverage our analyst team’s calls on various companies within the industry

Profit from foresightLeverage our analyst team’s calls on various companies within the industry

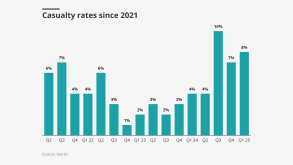

Our latest coverage

Our latest coverage

What we do

Real-time intelligence sourced and written by independent journalists drawing on an extensive network of senior sources

Authoritative analysis of company strategy and key sector developments, produced by a team of certified financial analysts