Universal

-

The company sees itself in a “very strong position” in the state.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

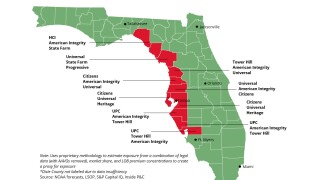

Floir has greenlit at least 14 new companies for operation in Florida in the last few years, contributing to the competition.

-

At least 14 new companies have opened up shop in the state in recent years.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Floridian also secured $352mn of multi-year coverage extending to 2027.

-

Renewal rates were favorable compared to what could have happened after several hurricanes.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Universal submitted allegedly ineligible claims to the Florida fund.

-

Comments came as universal reported a 4.2 CoR jump to 107.9% in Q4.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier is looking at a $600-$900mn hit from hurricanes Debby, Helene and Milton.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

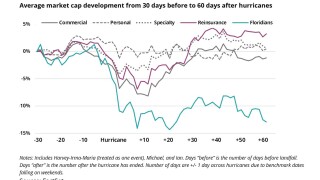

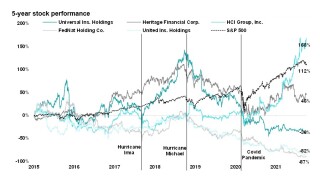

Shares gained after Hurricane Milton did less damage than anticipated.

-

Milton threatens to make landfall in Florida shortly after Helene.

-

The CEO noted that the tort reforms have not led to rate pressure yet.

-

A roundup of today’s need-to-know news, including Commissioner Lara’s FAIR plan reforms.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

This compares to the 2023-2024 tower which covered losses up to $2.83bn.

-

The carrier has completed its 2024-25 reinsurance renewal.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

In addition, the executive is eligible to receive an annual bonus of $262,000 for threshold performance, and up to $437,500 for maximum performance.

-

Cedeño Camacho will expand his insurance carrier holdings to North America.

-

The loss was well within the company’s net retention. Losses from other weather events during the quarter added up to another $10mn-$15mn.

-

AJ Gallagher posts 10.5% Q3 organic growth, lower sequentially but up year-on-year

-

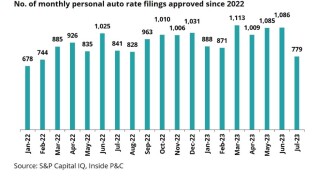

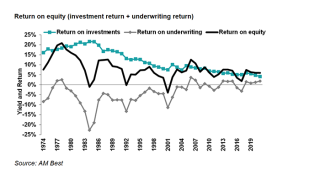

At the same time, insurers are assessing the level needed to address loss cost trends.

-

The executive said that the company reduced its consolidated retention and ceded premium ratio for its 2023 and 2024 treaty program.

-

The Inside P&C news team runs you through the earnings results for the day.

-

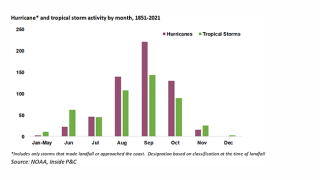

Forecasts for “near-normal” activity may mean the chance at a reprieve for the Florida market, but a history of underestimates warrants caution.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

This compares to the subsidiaries’ 2022-2023 reinsurance tower, in which they secured coverage for losses up to $3.16bn.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The pullback mirrors what the state went through last year before and after June 1.

-

The carrier’s combined ratio totaled 100%, up 2.1 points from Q1 2022, reflecting a higher net loss ratio, partially offset by a lower net expense ratio.

-

The move follows the carrier’s 30-point improvement in its combined ratio to 101.4% after markets yesterday.

-

The carrier reported a Q4 combined ratio of 101.4%, an improvement of 30 points year-on-year, driven by a 27-point reduction in its loss ratio.

-

The carrier reported 76.3% for its loss ratio for the quarter, which resulted from a lower current accident-year net loss ratio and lower adverse prior-year reserve development.

-

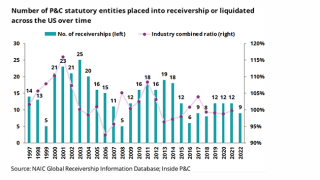

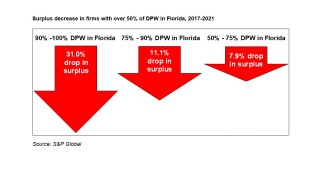

Receivership has been historically lower in the past 20 years, but trouble in Florida breaks away from the overall P&C industry trend.

-

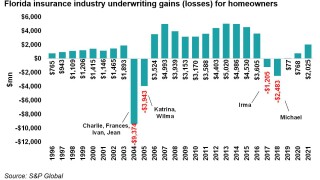

Expanded state reinsurance support and legal reforms will be top priorities as Florida insurers face another retention loss.

-

Discussion on Q3 earnings calls focused heavily on the supply-demand imbalance in cat capacity, as executives discussed how they would navigate a challenging January renewal.

-

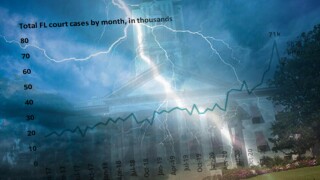

The executive added that while the Florida market has seen benefits from recent legislation, the major issue remaining is one-way attorney fees.

-

The Floridian's loss ratio increased 42.8 points, reflecting $111mn of retained Hurricane Ian losses and a higher attritional initial accident year loss pick.

-

The executive steps into the role at a significant time where the company faces the task of dealing with the consequences of Hurricane Ian.

-

The company estimates its overall gross loss to be approximately $1bn, below its $3bn overall reinsurance tower.

-

As the loss numbers for Hurricane Ian begin to come into focus, three topics to watch are impact from demand surge, litigation trends, and rate activity.

-

Universal P&C, the FHCF, Axis, Berkshire and Nephila are among the firms that will be in focus as the loss develops.

-

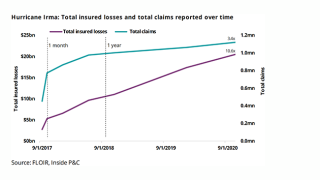

Hurricane Ian’s total effect is still unknown, but lessons from Hurricane Irma give insight into potential outcomes.

-

If current forecasts prove accurate, this will be a pivotal moment for the already off-balance Florida cohort and could result in a new market landscape.

-

With the most active hurricane month just a week away, the moment of truth has finally come for the already strained Floridians.

-

Demotech wrote to more than 15 carriers to warn of a possible downgrade last month.

-

He continued that the program contains full protection for hurricanes and tropical storms with no gaps in coverage and no co-participation.

-

The company cited the challenging Florida claims environment and inflationary and weather trends as the key reasons for the loss ratio increase.

-

For most policy forms, all roof types must be 15 years or newer to write new business in certain counties.

-

Excessive litigation costs and continued losses threaten the Sunshine state’s market.

-

Forecasters have again predicted an active season for storm activity, with the Florida market particularly vulnerable to high cat activity.

-

The reinsurer has put the first layer through its captive, a move that reflects the lack of reinsurance capacity for this high-risk business.

-

Insurers could face pressure if interest rate and recession fears intersect with worsening loss cost trends.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The CEO assured analysts that the company has secured 85% of its core all-state first-even catastrophe tower.

-

Florida-based Universal sees 6.1% drop in policies in force; challenging claims environment pressures underwriting profit.

-

CEO Steve Donaghy said the hires would boost the company’s strategic objectives.

-

Universal Insurance Holdings reported a wider operating loss for the fourth quarter as adverse reserve development offset rising premium driven by rate increases.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Universal Insurance Holdings books $30.7mn reserve charge and sees $21.5mn in weather above plan for Q4, with shares plunging on the news.

-

Inside P&C's Research team looks at the prospects of Florida's wave of new arrivals.

-

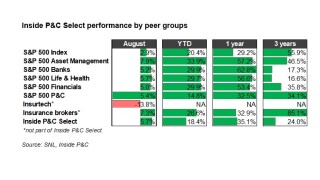

The Inside P&C Select Index outperformed the S&P 500 (5.7% to 2.9%) in August, despite Hurricane Ida making landfall.

-

It was nearly 900% up on the year-ago figure, as the insurer’s executives cautiously welcomed new Florida legal reforms.

-

The Floridian carrier said reinsurance spending was up by 5%.

-

The insurer reported no new above-budget weather losses in the quarter.

-

Senator Jeff Brandes and local insurance law experts tell this publication that the state’s insurance market will be hugely vulnerable without reform.

-

The executive was previously an underwriter at Chubb Tempest Re and Odyssey Re.

-

Hurricanes Isaias and Sally were "full retention events" and the firm took 2,000 new Irma cat claims in Q3, the company said.

-

Universal’s combined ratio deteriorated by 37 points to 134.7%, driven by Laura and Sally losses.

-

In June, the company renewed its reinsurance program, holding the program’s retention for Florida events steady at $43mn.

-

The executive joins from Universal, where he was president of the Floridian’s American Platinum division.

-

Universal said it made ‘significant progress’ in closing Irma claims.

-

The only Covid-related item cited was a decrease in fair value of certain investment securities which recovered in Q2.

-

On its quarterly earnings call the Floridian insurer updated investors and analysts on how it has responded to the Covid-19 crisis and disclosed $50mn of Irma reserve development.

-

The carrier has $1.3bn of public reinsurance cover remaining.

-

Universal also took a modest reserve charge of a little more than $4mn.

-

In its call with analysts, Universal revealed a $150mn rise in the company’s Irma gross loss estimate, to $1.4bn, representing a total increase of $400mn in the second half of 2019.

-

Universal’s earnings were badly hit by a combination of reserve charges and the recognition of prior-year losses that totaled more than $100mn and pushed underwriting margins into much further negative territory than a year ago.

-

The two Florida-based insurers have continued to suffer increased losses from prior year events such as Hurricanes Irma and Michael.