WTW

-

The parties now have 60 days to file a stipulation to dismiss the action.

-

The deal valued the tech-driven broker at over ~21x 2025 adjusted Ebitda, suggesting a hefty premium.

-

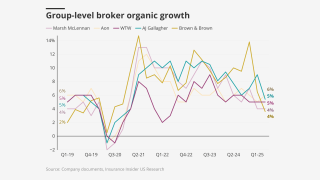

Several lines had price decreases, while growth in most sectors slowed from previous quarters.

-

WTW still has meaningful capital to deploy next year but will provide details on its next earnings call.

-

Newfront’s business units will be combined with Risk & Broking and Health, Wealth & Career.

-

Investors recalibrate their expectations for the segment as the soft market approaches.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

He and Fletcher stand accused of aiding Willis Re in an unlawful team lift.

-

GC continues to pursue Willis Re and individuals in court.

-

Senior Willis Re recruit Jim Summers denied Kevin Fisher had a role at the start-up.

-

Success in the soft market will be had when careful preparation meets opportunity.

-

The broker is monitoring whether the economic environment will limit discretionary spending.

-

The broker said it was on track to hit its financial goals despite macro uncertainty.

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

WTW’s Jessica Klipphahn will take over as head of North America mid-market.

-

Bonnet has spent more than four years at WTW in increasingly senior roles.

-

WTW claims at least two $1mn accounts were also unfairly lost to Howden.

-

Property underwriters are ‘competing fiercely’ to access mining risks.

-

-

Former head of construction Bill Creedon will assume the role of chairman.

-

Not everyone will emerge unscathed as brokers navigate the slow-growth environment.

-

Verita leadership and staff will remain intact and “seamlessly functional”.

-

WTW is “particularly interested” in growing markets like wealth management with bolt-on M&A.

-