WTW

-

The US government reportedly has around 20 attorneys at work in case it decides to sue to block the deal.

-

The executive had previously been the head of third-party capital at Axis.

-

Brokers’ first-quarter performance was highly positive, but the real rewards are still to come.

-

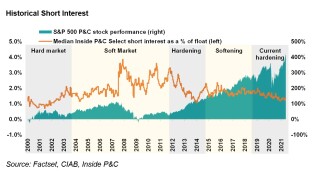

Management should examine the relationship between company strategy, broader market cycles and short interest.

-

The Commerce Commission has delayed its decision for the third time.

-

The merging brokers have also agreed a two-year non-compete agreement on transferring Willis business.

-

The combination still needs sign-off from US, EC and other international authorities.

-

With the planned disposal of a further $240mn of Ebitda, the parties are showing their commitment to closing the overall deal.

-

The transaction accelerates Gallagher’s evolution into a big global broker and risk management consultant.

-

The $3.57bn side deal is contingent on the closing of the bigger merger, which itself needs approval from regulators including the European Commission and Department of Justice.

-

Despite the sizable divestitures at a painful price, the deal maintains its appeal across most strategic and financial aspects.

-

The AJG CEO vowed to invest in Willis Re assets while stressing the quality and security of the team.