WR Berkley

-

The Japanese P&C carrier agreed a deal to buy 15% of WR Berkley shares in March.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

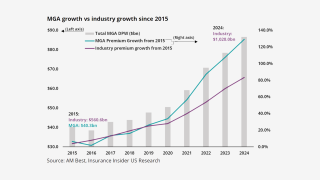

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

The CEO also said that the “bloom is off the rose” in the E&S property market.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

She joins the specialty insurer after working at Hamilton as CUO.

-

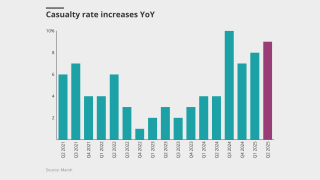

Insurers did not see a slowdown in rate but some are still fine-tuning their portfolios following the LA fires.

-

On Q2 calls, carrier executives called out fierce competition in various lines of business, and a misalignment of interest.

-

Loss trend concerns persist, but insurers are vouching on the opportunity to push for more rate increases.

-

Recent inbound offers can “oftentimes” be a leading indicator that the market is slowing, he said.

-

The Insurance Insider US news team runs you through the earnings results for the day.