Negative margin code

Header

WSIA Annual Marketplace 2024

Intro

Insurance Insider US is excited to join WSIA 2024 from 22 - 25 September in San Diego. We'll deliver exclusive news and insights from the ground, available via this hub and our daily email newsletters. Subscribe now for access to our content or email us to connect at the event.

Latest News

Latest News

WSIA counterpoint: All that glitters is not gold in E&S

A large number of new entrants and the growth of litigation finance challenge E&S enthusiasm.

Postcard from WSIA 2024: Property moderates, casualty dislocates

Attendees concurred that they don’t expect the “Golden Age of E&S” to end anytime soon.

E&S market still holding on to property risk: RT Specialty’s Austenfeld

Admitted markets are not coming back to property as strongly as in past cycles, the executive said.

-

With property getting more competitive, FM pursued an opportunity for growth in E&S with Velocity.

-

Quota share is less common in the medmal space, where layered and shared structures have been dominant.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The executive noted that an influx of new entrants in the E&S market is increasing competition.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The insurer continues to exit or reduce unprofitable lines and slowed growth as a result.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

The LA fires were a microcosm of “everything we do well when things go bad”.

-

Jason Keen joined Everest in 2022 as head of international.

-

APIP is one of the world’s largest property programs.

-

Haney will remain on board as a senior adviser.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Old Republic said the acquisition is expected to close in 2026.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Howden is facing fallout from its push into the US retail market via mass hires.

-

The CEO also said that the “bloom is off the rose” in the E&S property market.

-

Since Simon Wilson was elevated to insurance CEO, the firm has been refocusing its underwriting.

-

As the Great Japanese M&A Contest develops, the executive said inorganic expansion is “a top priority”.

-

Mike Mulray joins from Everest, where he was EVP president of North America insurance.

-

The division mostly places higher up the tower, where many insurers have taken action to address SAM losses.

-

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

The specialty insurer was recently acquired by Korean carrier DB Insurance.

-

The two executives join from Markel and Arch, respectively.

-

Trailing three month premiums were up 7.2% versus 13.1% in August.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

Economic volatility, including from tariffs and rising interest rates, is reshaping risk profiles for specialty insurers.

-

The MGU is entering the often-difficult habitational GL space with an initial E&S offering.

-

A process has not been launched and a firm timeline for a liquidity event has not been agreed.

-

Following the Golden Age of Specialty, franchise quality will play a bigger role in determining success.

-

The practice group will enhance the company’s existing offerings in E&S.

-

Winners and losers will emerge more clearly, with less opportunity to ride the market wave.

-

Florida led deregulation by eliminating the diligent effort rule in June.

-

One of the options being explored is setting up a dedicated company for the wholesale vertical.

-

The new MGU is expected to formally launch before the annual WSIA marketplace in San Diego.

-

The rest of 2025 appears poised to remain favorable for insureds, however.

-

California, Florida and Texas all saw decreases in monthly premium growth.

-

Third Point purchased 50,000 shares of the E&S insurer, which represents roughly 0.1% of its shares outstanding.

-

Casualty premiums grew 56.7% year on year in Q2 2025.

-

Appointments include leadership in transportation, energy, marine and others.

-

She joins the specialty insurer after working at Hamilton as CUO.

-

Auto, umbrella and excess lines recorded mid-double-digit rate increases in Q2.

-

Commercial liability and commercial property coverage continued to dominate the E&S market.

-

California posted a 47% jump YoY, from a 28.4% rise in June.

-

In liability, the carrier is steering away from where inflation has been volatile.

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

The segment is also seeing double-digit loss cost inflation.

-

Renewal rates fell, despite elevated catastrophe losses.

-

The company also encouraged insurers and brokers to support the initiative.

-

Cardinal E&S expands the carrier's underwriting capabilities and makes it more competitive relative to peers.

-

Nominee Neil Jacobs was warned cuts will cause ‘rising home insurance rates’.

-

The executive joined The Hartford when it acquired Navigators in 2019.

-

Florida recorded premium growth in June after declines in May and April.

-

The exchange is backed by $100mn in funding from CD&R and others.

-

Markel is simplifying its structure from six US wholesale and two US retail regions to four integrated US regions.

-

The aggregate gross proceeds from the offering are expected to be $113.3mn.

-

The NYC taxi insurance market is on the brink of collapse. Regulatory relief has been nowhere to be found.

-

The company filed its S-1 in March, with a 2024 CoR of 93.9%.

-

The executive said he left the company in September.

-

The company’s credit ratings had been under review since early this year.

-

The once niche product is generating interest in a growing number of industries and sectors.

-

The settlement requires Dellwood’s Price to write an apology to Peter Zaffino.

-

Lloyd’s traditionally avoided US middle market property, but head of P&C Matt Keeping says times have changed.

-

The moves come as the company said it will "double down" on US E&S.

-

Rates have fallen an average of 10%, though changes can be highly specific to each property.

-

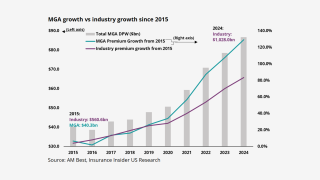

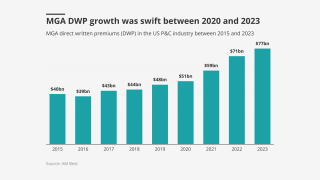

The MGA market now makes up 10% of the overall P&C market.

-

The company has reduced its exposure on large commercial auto and property.

-

Sills added that Bowhead doesn't expect a reversal of compressed limits being offered.

-

Richard Schmitzer will retire as E&S president and CEO, and Todd Sutherland will succeed him.

-

The unit grew Q1 NWP by 23% overall, led by a 27% growth in casualty.

-

The standard market has not ‘meaningfully’ impacted the rate of flow in the aggregate.

-

Customers are demanding more in a larger move towards the E&S market.

-

The firm acquired total assets of $65mn and assumed liabilities of $11mn.

-

Secondary perils are no longer so secondary, but the losses are already priced in for commercial property.

-

The ex-Ategrity CEO launched Pivix Specialty in September 2024.

-

MGA growth is still strong but has passed its 2022 peak.

-

Everest’s US wholesale business is seeking to expand its market presence.

-

The program is being launched through subsidiary Southern Marine.

-

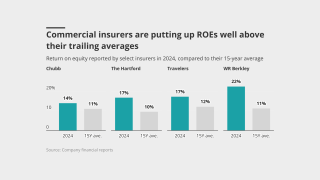

Despite elevated ROEs, insurers have remained disciplined.

-

California, Texas and Florida rose 15.7% in February and 29.1% in January.

-

Coverage will increase to $20mn per building.

-

The executive said AIG’s E&S arm can grow 20% a year and generate $4bn of new business.

-

After a period of business building, MGAs will likely spend more time optimizing.

-

Construction defects, GL and risk-managed professional liability lines saw the greatest headwinds.

-

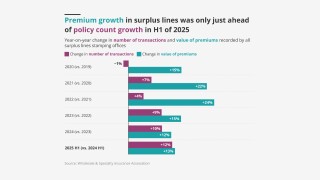

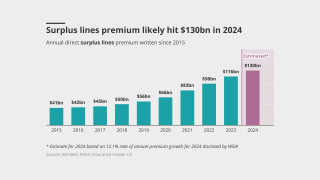

Surplus lines are still strong, but not the standout they used to be.

-

The partnership will launch a new umbrella excess insurance product.

-

Admitted insurer withdrawals and rising demand are pushing more entrants into E&S.

-

Insurers and distributors must adapt or risk irrelevance.

-

Industry veteran Tonya Courtney will lead the company’s newest E&S business.

-

Q4 net retention was impacted by the previously announced ADC.

-

The group posted a 15.7% gain for February and 29.2% for January.

-

The first round of the E&S boom has already played out, but this is a long game.

-

Sources said that the MGA has been working with investment bank Waller Helms to find a potential investor.

-

The Nationwide subsidiary is a $750mn-premium wholesale brokerage that serves about 10,000 local agents.

-

The figure represents a 12.1% increase over full-year 2023.

-

Admitted carriers are dropping middle-market business due to large verdicts.

-

The group posted a 27.5% gain for January and 23.7% for December.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Finnis was formerly head of commercial lines at WTW.

-

The E&S lines division adds property, casualty and financial lines.

-

Sources said Dowling Hales is advising the professional lines quoting platform on the process.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company will now focus on growing its E&S and InsurSec offerings.

-

Piyush Patel and Sandra Russo have joined Dellwood as head of programs and AVP, respectively.

-

Rates are now falling, but submissions are still rising, according to wholesale brokers.

-

Irwin joins the firm from Beazley, where she’d worked since 2019.

-

Brokerage co-presidents Jeff McNatt and Sam Baig discussed the E&S market, rates and M&A.

-

At Zurich, Hirs served as group head of M&A and CFO for North America.

-

The review follows Velocity’s acquisition by FM Group.

-

The change comes after an ownership restructuring.

-

A look back at the stories that defined the year in P&C for 2024.

-

Overall, the “Golden Age” of E&S continues, but with a few new caveats, such as moderation in property pricing.

-

Shawn Parker takes up Gatt’s previous role as COO of Westchester Programs.

Videos

Videos from WSIA 2024

-

In Partnership With Everest EvolutionA recent panel discussion at the WSIA Annual Marketplace in San Diego highlighted how speed, creativity, and relationships are driving growth in the E&S market despite challenges including talent retention, social inflation, and natural catastrophes. Speakers included Stephen Buonpane, President, Everest Evolution; Brenda Austenfeld, President - RT Specialty / CEO - National Property; Jeff McNatt, President, AmWINS Brokerage; Andrew Grim, Executive Director of Specialty, Brown & Riding; and Kristyn Smallcombe, Casualty Practice Group Director, CRC.

-

In Partnership With AspenBill McElroy, Portfolio Director of Casualty for Aspen discusses social inflation, litigation financing, and the industry's response, at the WSIA Conference in San Diego.

-

In Partnership With Crum & ForsterSteve Dubiel discusses the evolving risks in construction and market responses to rising costs, at the WSIA Conference in San Diego.

-

In Partnership With Westfield SpecialtyJack Kuhn, President of Westfield Specialty discusses market trends, growth opportunities, and challenges in the insurance industry.

-

In Partnership With AXISMichael Carr, Head of E&S Property for AXIS discusses the stabilizing E&S property market, valuation challenges, and growth opportunities.

-

In Partnership With Bridge SpecialtySteve Boyd, President of Bridge Specialty Group on the changing wholesale broker role, E&S market growth, and global expansion.

-

In Partnership With Argo GroupCEO, Jessica Buss reflects on Argo's first-year transformation, growth strategies and market outlook, at the WSIA Conference in San Diego.

-

In Partnership With Argo GroupDavid Corry, Head of Casualty at Argo, discusses the booming E&S casualty market, key growth areas, and challenges in underwriting large programs, at the WSIA conference in San Diego.

-

In Partnership With DualJon Knouse, Chief Property Officer at Dual shares insights into the evolving E&S property market landscape.

-

In Partnership With MarkelGuenter Kryszon, Chief Underwriting Officer at Markel Specialty, discusses the thriving E&S market, key challenges in casualty and professional liability, and Markel's growth strategies.

-

In Partnership With Falvey Insurance GroupTom Nasso, CUO for Falvey discusses how the booming logistics sector tackles workforce shortages and theft risks.

-

In Partnership With One80Rick Grimes, National Wholesale Practice Leader at One80 Intermediaries talks about current trends, market pressure, and innovation in products, at the WSIA Conference in San Diego.

-

In Partnership With ArchArch Insurance EVP Sue Srinivasan discusses integrating Fireman's Fund and new opportunities for growth, at the WSIA Conference in San Diego.

-

In Partnership With ArchJason Conkin, EVP of Arch’s E&S Casualty Group discusses the fast-paced growth and challenges in the E&S casualty market, highlighting the demand for solutions and maintaining strong broker relationships.

-

In Partnership With SkywardJohn Burkhart discusses the challenges and trends in the true E&S market, social inflation, and how technology is reshaping the underwriting process, at the WSIA conference in San Diego.

-

In Partnership With Crum & ForsterBlair Bartlett, VP of Financial Institutions for Crum & Forster discusses FinTech trends, regulatory risks, and insurance solutions.

-

In Partnership With Everest EvolutionStephen Buonpane, President of Everest Evolution, discusses the new brand launch, market growth, and innovations shaping the E&S sector.

-

Lucy Pilko, CEO of the Americas at AXA XL, discusses the growth in E&S markets, cyber risk preparedness, and industry challenges in an evolving risk landscape at WSIA.

-

In Partnership With ISCMatt Grossberg, CEO of ISC discusses market cycles, new programs, and growth opportunities at WSIA.

Sponsor logos

Sponsors