Zurich

-

Fears relating to an economic downturn continue to dominate concerns.

-

The fashion brand says the insurer failed to defend it in multiple lawsuits.

-

The reshuffle is likely laying the foundations for the eventual succession to CEO Mario Greco.

-

The MGA secured a “significant strategic investment” from Zurich earlier this year.

-

The executive previously spent more than 16 years at The Hartford.

-

The $20bn+ TIV data center is seen as the leading edge of significant new demand.

-

The insurance industry’s lower reliance on foreign skilled workers softens the blow.

-

The company also encouraged insurers and brokers to support the initiative.

-

The cyber business will continue to operate as a standalone entity.

-

Kirsh was involved in launching an industrywide “legal system abuse coalition”, which now has 350 participants.

-

US national accounts head Paul Lavelle will retire as of June 1.

-

He was most recently middle market casualty leader and EVP at Chubb.

-

The take-up rate will depend on the price discount and market segment.

-

The facility is a nudge towards a structural change, not a full-out assault.

-

Both Chubb and Zurich will underwrite the risks, with Nico as the sleeping partner.

-

The facility provides up to $100mn in claims-made excess casualty coverage.

-

The carrier is looking to accelerate E&S growth after 7% expansion in 2024.

-

The insurer claims Jessica Balsam still holds Zurich confidential information.

-

The division is seeking to place underwriters in regions across the US.

-

Also, John Diaz will lead a customer and distribution management function.

-

The sale of the business was confirmed in June.

-

GWP declined to $11.1bn from $11.3bn in the US and to $484mn from $527mn in the rest of the region.

-

He succeeds Rob Clark, who was appointed global broker account lead.

-

This publication reported yesterday that the two carriers were nearing a deal.

-

The disposal is the latest milestone in AIG’s work to reposition itself as a commercial lines insurer.

-

-

The CEO said he is “optimistic” about the future of the commercial space.

-

Analysis of 2023 statutory data shows that Californian insurers are leaning more heavily on reinsurers but at a nationwide level, premium cessions were more stable.

-

The executive has been with Zurich since 2018.

-

The plaintiffs – three former claims adjusters – were each awarded $25mn in punitive damages.

-

The executive worked on projects with the firm when he was an investment banker.

-

He was most recently cyber product leader at Zurich NA.

-

Zurich NA's operating profit grew to $2.65bn in 2023 from $2bn the prior year.

-

The changes precede the retirement of direct markets head Vince Santivasi.

-

Partnerships can address growing cyber threats such as DDoS attacks and ransomware, as well as AI.

-

The Global Risks Report 2024, made in partnership with Marsh and Zurich, shows that extreme weather events, misinformation and disinformation are top risk severity concerns.

-

Zurich North America has named Eric Cittadino head of programs effective September 1, the carrier announced on Thursday.

-

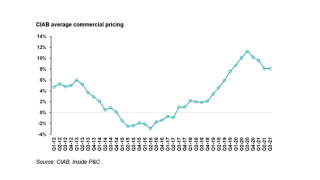

NA commercial rates accelerated 9% in Q2 as property pricing rose 18% and auto pricing went up 9%.

-

The carrier expects NA crop volumes to decrease in 2023 year-over-year due to commodity price developments.

-

Beneva has signed up to net-zero targets as a member of the NZIA, following a period of turbulence in which Munich Re, Zurich and Hannover Re have left the alliance.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Zurich’s decision comes less than a week after Munich Re decided to withdraw from the UN-backed initiative.

-

Fox will report to Zurich North America CEO Kristof Terryn, with a shared reporting relationship to group CUO Penny Seach.

-

The collapse of Silicon Valley Bank is creating investor fear across the global financial services sector.

-

Zurich NA’s P&C CoR decreased to 91.3% in 2022 from 92.4% in 2021 while the group’s CoR remained at 94.3%.

-

The carrier has upped its global all-perils cat coverage to $1.2bn since January last year.

-

Of the 8.5% quota share assumed by Farmers Re, 6.75% was retroceded to Zurich Global.

-

The total raised for the InsurTech has now reached $24.5mn over the past 16 months.

-

Members of the captive receive an assessment of their carbon footprint and energy consumption by Zurich NA

-

The CEO called for the formation of public-private partnerships, akin to those in place for terrorism or earthquakes, to tackle systemic cyber risks.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The executive also said that the firm seeks to grow in Canada and in the middle market space, where it has already increased the number of underwriters by 30%.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Illinois-based carrier said its crop insurance business contributed almost 40% of the growth in the region.

-

The Massachusetts Bay Transportation Authority claims the firms failed to act over the bankruptcy of LMH-Lane Cabot Yard Joint Venture.

-

Penny Seach is to succeed Hayley Robinson, who has decided to step down at year end for family health reasons.

-

Zurich NA grew gross written premium by 14% to over $11.3bn as rates jumped 9% in the period.

-

Zurich is ahead of schedule on its nat cat exposure reduction in the US, the company’s CFO George Quinn said during an H1 earnings call.

-

Morgan joins Zurich North America’s US national accounts business and is based in Atlanta.

-

Molly Dorsett will return to Zurich from Chubb as head of US energy casualty renewables, while Nicholas Haller joins as lead underwriter of renewable energy property.

-

The executive joins Zurich NA from privately held International Financial Group (IFG), a P&C company focused on the E&S market where he served as CEO.

-

Conditions for SPAC D&O are likely to remain turbulent, amid the heightened SEC scrutiny and uncertainty concerning claims resolution.

-

Pavelko joins from WTW, where she worked as senior placement broker and client advocate on the CID team.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

To succeed Lavelle, the carrier also recruited Farmers personal lines president Keith Daly as its new chief claims officer.

-

The executive will oversee Zurich NA US national accounts, which include large corporate and captive customers.

-

Zurich's F&I Agency operations was launched in January under the leadership of Todd Kaminski, the firm’s head of business development.

-

The executive will work to accelerate commercial insurance revenue and develop new channels and geographies.

-

Let’s get you up to speed on some of this week’s key M&A deals.

-

Trey Martino jumps from Sompo International to take on US middle market unit for Zurich North America.

-

AIG joins Aon, Zurich in industry apprenticeship program that aims to draw in young talent, improve diversity efforts.

-

The insurance giant also is moving its operation chief for direct markets, Dawn Hiestand to be the new head of captives, and Alban Laloum to be its new chief customer officer.

-

Respondents to the WEF’s Global Risk Perception survey also cited cyber security as a medium-term threat, signaling a potential ‘blind spot’ in risk perceptions.

-

Commercial lines loss ratios may move slightly higher, while personal auto carriers see the light at the end of the loss-cost tunnel.

-

The carrier recruited Steve Lezaj from Travelers to serve as national complex casualty underwriting director.

-

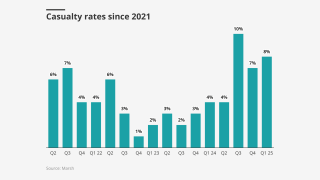

Casualty rate hikes moderate, though areas like wildfire liability remain difficult amid an ever-more litigious environment.

-

Inside P&C’S news team runs you quickly through the key developments from the last week.

-

Sources have said the carrier is looking establish a unit with its own P&L, intended on establishing a clear dividing line between the wholesale and retail businesses.

-

Zurich will hire about 70 apprentices in at least nine cities where the carrier has offices, beginning in August 2022.

-

The deal will expand Zurich’s supplemental health insurance offerings and is expected to close in early 2022.

-

The initiative follows the launch of Zurich's construction weather parametric solution, a project designed to support sustainability.

-

Zurich’s apprenticeship program helps young talent develop skillset and has "great” retention rate, says North America CEO Terryn.

-

Linda Schultz joins the industry practices leadership team and reports to John Mizzi, head of industry practices for US middle market.

-

With a $3mn commitment from Z Zurich Foundation, the program will address social issues in Houston and Boston.

-

Trucking companies, having already increased self-insured retentions by millions, will need to contend with further rate increases into 2024.

-

The carrier said the portfolios "no longer support" its core strategy.

-

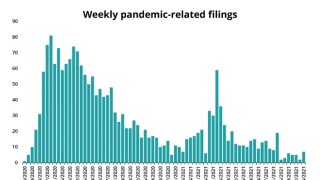

With hundreds of coronavirus-related BI suits working through state and federal courts, insurers still face a multi-billion-dollar challenge to keep judges and juries ruling in their favor.

-

The executive will report to Alex Wells, head of middle market at Zurich’s Illinois-based operations.

-

The executive will take on a leading role in all aspects of the carrier’s data management.

-

The newly created role is part of the firm’s strategy to split its construction business into two segments, property and casualty.

-

The carrier posted a strong turnaround after suffering heavy Covid-19 claims last year.

-

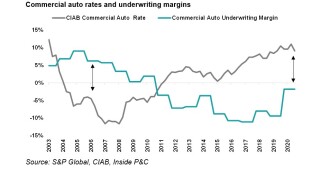

While the pandemic offered some relief to commercial auto insurers, maintaining margins will be tricky to achieve given rate moderation.

-

The read-across from the extreme weather to losses is not simple and insurers may do better than would be assumed.

-

He will report to regional CEO Kristof Terryn and will also have responsibility for business development.

-

Policyholders are homing in on loose policy wordings to convince courts that insurers have acted in bad faith.

-

The former financial lines CUO will start at the end of the month and be based in Switzerland.

-

Zurich’s Boston-based global head of cyber risk Lori Bailey is set to leave the business, Inside P&C understands.

-

The restaurant chain is seeking over $50mn from the insurer to cover expenses arising from Covid-19.

-

Brian Dusek will develop and grow the start-ups North America cyber portfolio and report to Yosha DeLong.

-

The new operation will provide advisory services to both Zurich and non-Zurich customers.

-

Zurich is reshaping its middle market team following the arrival of Mizzi from Blackboard.

-

Henderson Road Restaurant Systems filed suit after having its Covid-19 BI claim denied in March.

-

The Zurich-owned carrier retains a financial strength rating of A2 and a surplus note rating of Baa2.

-

The ratings agency will conduct a review of the carrier's capitalization.

-

The new arrival at the M&A insurance specialist follows the departure of paper provider AGCS earlier this year.

-

Largest insureds scale back on purchasing in response to tough casualty pricing.

-

The product is now also available in South Carolina, North Carolina and Virginia.

-

The changes stem from the creation of a new digital services unit at the Swiss carrier.

-

A public insurance certificate unearthed by Reuters shows that the insurers are involved despite pledges to fight climate change.

-

Gerber was a giant of the Swiss business world in the 1970s and 1980s.

-

The mid-market commercial insurer also gains authorisation in Washington State.

-

Fema deputy administrator for resilience Daniel Kaniewski said it could be argued the agency created a “moral hazard.”

-

The case exemplifies the complications historic opioid claims are causing in the market.

-

The cyber specialist joins the MGA’s California office as head of underwriting.

-

The product will be underwritten by Dovetail Insurance, a Victor subsidiary focused on InsurTech.

-

The transaction has now received regulatory approval and has closed.

-

AIG, Chubb, Markel, Swiss Re and Zurich are among the carriers which face potential losses from the tour operator's collapse.

-

Swiss Re, Allianz and Zurich are among those backing the UN initiative.