Top Section

Berkshire’s primary unit swings back to profitability in Q3, offsetting weaker Geico

Both the primary and reinsurance segments benefitted from a light cat year.

-

The broker is understood to manage Brown & Brown’s account at Howden.

-

It is understood the permanent reinsurance capital vehicle is called Highline Re and will sit behind fronting carriers.

Research

Research

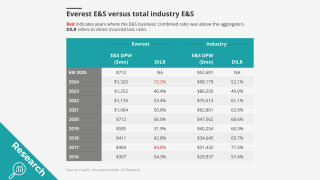

A re-focus on reinsurance nearly brings Everest back where it started.

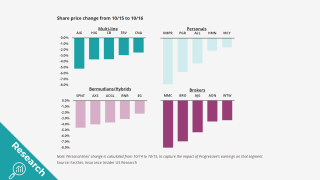

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

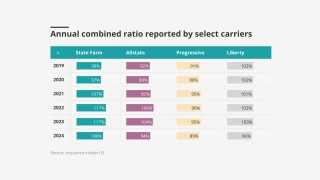

Cat losses in Q3 were light as peak hurricane season passes without incident.

Early Q3 earnings reports point to worsening market conditions.

Opinion

Opinion

-

The Everest deal gives AIG a year’s worth of growth in a stalled market

Adam McNestrie and Mehr Gill -

M&A talk once again took center stage at this year's Target Markets conference

Jairo Ibarra and Farhin Lilywala -

Medmal insurance was never designed to cover criminal activity

Kyoung-son Song

Latest news

Latest news

A quick roundup of today’s need-to-know news, including an ISC QS and Corebridge’s CFO transition.

CEO Greg Case said data center demand could generate over $10bn in new premium volume in 2026.

The broker grew earnings per share by 12.1% during the quarter.

Gallagher said that the firm is ready to engage in large deals again after the acquisition of AP.

Featured

Featured

Featured

As private flood grows, reinsurers quietly expand capacity

The NFIP expiration and a successful Neptune IPO got attention, but some reinsurers moved earlier.

Most Read

Perspectives

Perspectives

When owners are not paying attention, discipline and governance are not top priorities.

Unpacking how much excess capital there really is and dissecting the source of its returns.

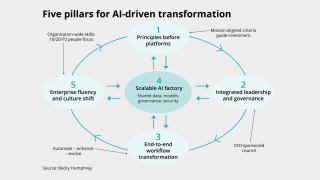

Here’s the five-pillar playbook for insurers ready to move from pilots to profit.

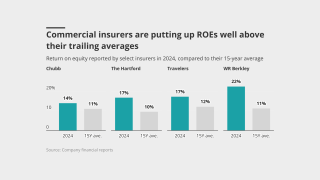

Despite elevated ROEs, insurers have remained disciplined.

Interviews

Greenberg has strong links with IQUW management, and praised the firm’s leadership and cultural fit.

The company is looking to grow through its new MGA incubator program.

SageSure’s recent M&A in Florida was driven by being selective with policies and smart about claims costs.

As the Great Japanese M&A Contest develops, the executive said inorganic expansion is “a top priority”.

Ad slot #2

Analysis

Analysis

While limited to only some accounts, it’s a sign of the intense competition in the segment.

Activists from the left and the right are focusing on insurance, often on the same issues.

Verisk's recent deals and its interest in cyber-analytics firm CyberCube show M&A in the segment has ticked up.

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

Insider on Air

Insider on Air

In Partnership with

FurtherAI

AI has shifted from a theoretical discussion to having a real impact across the entire insurance value chain, said Aman Gour, Founder and CEO, FurtherAI.

In Partnership with

Allianz

Use of technology is likely to separate the “leaders from the laggers” in the MGA/program business space, said Shanil Williams, CEO, Allianz Commercial, Americas.

In Partnership with

Arch

Property remains both a challenge and an opportunity for insurers, said Brian Farrell, SVP Program Management Lead, P and C Programs, Arch.

In Partnership with

Falvey Insurance Group

MGAs need to remain focused to succeed, said Emmy Falvey, Senior Vice President, Head of Capacity, Falvey Insurance Group.

Conferences & awards

Upcoming webinars

-

In Partnership With Markel

-

In Partnership with Moody's

-

In Partnership with M&A Services

-

In Partnership with Moody's

Ad Slot #2