Top Section

Higher cedant retention on property cat a headwind for reinsurance: Arch CEO

Despite the pricing pressure, margins for the line of business remain attractive, he added.

-

The broker is understood to manage Brown & Brown’s account at Howden.

-

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

Research

Research

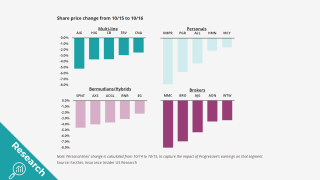

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

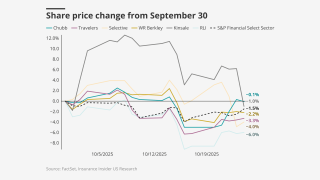

Cat losses in Q3 were light as peak hurricane season passes without incident.

Early Q3 earnings reports point to worsening market conditions.

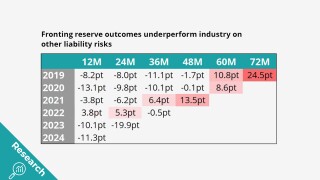

Fronting doesn’t look any better when it’s broken down by segment.

Opinion

Opinion

-

M&A talk once again took center stage at this year's Target Markets conference

Jairo Ibarra and Farhin Lilywala -

Medmal insurance was never designed to cover criminal activity

Kyoung-son Song -

It only takes one undisciplined actor to unravel the value chain

Farhin Lilywala

Latest news

Latest news

A quick roundup of today’s need-to-know news, including AIG, Everest, Brown & Brown and more.

The global insurer will pick up a $650mn portfolio of US casualty business.

The carrier is consolidating its venture capital activity into asset manager MEAG.

The executive’s exit follows CEO Joseph Lacher’s resignation last week.

Featured

Featured

Featured

AIG-Everest: A year’s worth of growth for AIG in a stalled market

The global insurer will need to convince investors on the quality of the book.

Most Read

Perspectives

Perspectives

When owners are not paying attention, discipline and governance are not top priorities.

Unpacking how much excess capital there really is and dissecting the source of its returns.

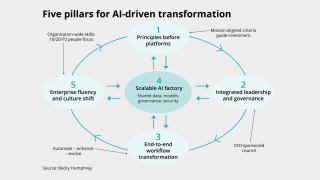

Here’s the five-pillar playbook for insurers ready to move from pilots to profit.

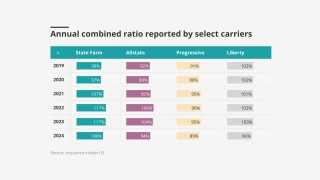

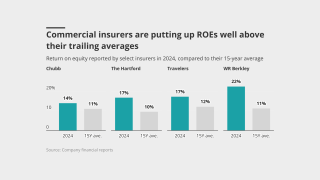

Despite elevated ROEs, insurers have remained disciplined.

Interviews

The company is looking to grow through its new MGA incubator program.

SageSure’s recent M&A in Florida was driven by being selective with policies and smart about claims costs.

As the Great Japanese M&A Contest develops, the executive said inorganic expansion is “a top priority”.

The MGA is also looking to build out its US mid-market professional liability expertise.

Ad slot #2

Analysis

Analysis

While limited to only some accounts, it’s a sign of the intense competition in the segment.

Activists from the left and the right are focusing on insurance, often on the same issues.

Verisk's recent deals and its interest in cyber-analytics firm CyberCube show M&A in the segment has ticked up.

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

Insider on Air

Insider on Air

In Partnership with

FurtherAI

AI has shifted from a theoretical discussion to having a real impact across the entire insurance value chain, said Aman Gour, Founder and CEO, FurtherAI.

In Partnership with

Allianz

Use of technology is likely to separate the “leaders from the laggers” in the MGA/program business space, said Shanil Williams, CEO, Allianz Commercial, Americas.

In Partnership with

Arch

Property remains both a challenge and an opportunity for insurers, said Brian Farrell, SVP Program Management Lead, P and C Programs, Arch.

In Partnership with

Falvey Insurance Group

MGAs need to remain focused to succeed, said Emmy Falvey, Senior Vice President, Head of Capacity, Falvey Insurance Group.

Conferences & awards

Upcoming webinars

-

In Partnership With Markel

-

In Partnership with Moody's

-

In Partnership with M&A Services

Ad Slot #2