AIG

-

Before retiring from GE in 2018, Rice served as president and CEO of the GE Global Growth for seven years.

-

The commercial lines turnaround is a remarkable achievement, but to succeed in the next phase it must pivot from its command-and-control culture.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Edwards had extensive experience in procurement and global sourcing roles before joining AIG in December.

-

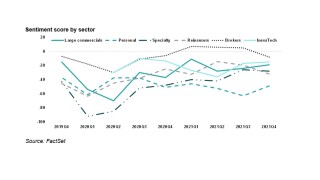

Insurance carriers tailor their comments to leave investors walking away with an optimistic view.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The global insurer has added a "net-zero emissions" goal of 2050 for investments and underwriting.

-

The firm posted positive quarterly earnings – is this the beginning of a trend?

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

AIG has kept the Q2 2022 target to land the life and retirement unit IPO, and still expects to retain more than a 50% stake after the event.

-

The executive said the business model in the high-net-worth space “simply needs to change” as loss costs have risen, fueled by increased frequency and severity.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

Related

-

AIG becomes minority equity investor in Salford City FC

August 12, 2025 -

Former Lexington and Ironshore CEO Kelley dies

August 08, 2025