AIG

-

Excluding the effects of cats and reserve developments, AIG’s core loss ratio also improved, decreasing to 59.2% from 60.3%.

-

Insurance stocks mixed following swath of earnings results; Aon gains nearly 7% in Friday trading.

-

Commercial lines loss ratios may move slightly higher, while personal auto carriers see the light at the end of the loss-cost tunnel.

-

The executive will have responsibility for global treasury activity, including financing plans and banking.

-

The Mayfield Consumer Products candle factory is one of the two most high profile large individual risk losses from the quad state tornado to date.

-

Carriers are planning for inflationary threats and have been responding to major catastrophes, while the InsurTech and broking markets have driven M&A drama.

-

Constance Hunter previously served as KPMG’s chief economist and has nearly three decades of experience in the financial sector.

-

Casualty rate hikes moderate, though areas like wildfire liability remain difficult amid an ever-more litigious environment.

-

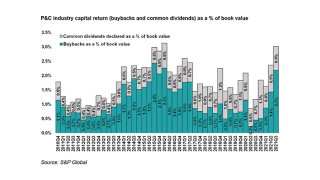

The higher level of repurchases seen in Q3 will likely last longer than expected.

-

Are this quarter’s positive results a sign of change for the company or a temporary blip?

-

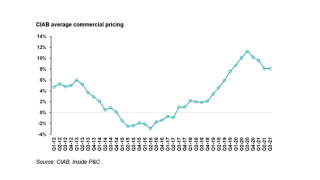

Rates in the P&C market continued to rise in the third quarter, with outsized increases for cyber insurance driving up the average change, according to data revealed in company third-quarter conference calls.

-

AIG’s CEO Peter Zaffino said Friday the insurer’s life & retirement IPO plans are progressing, but may be pushed back to 2Q 2022.

Related

-

AIG becomes minority equity investor in Salford City FC

August 12, 2025 -

Former Lexington and Ironshore CEO Kelley dies

August 08, 2025