Allstate

-

The executive said inflation isn’t completely gone but is now “more understood”.

-

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

The promotions are part of the carrier's strategy to increase property-liability market share.

-

Cat losses in August were below historical trends, but we are not in the clear just yet.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

Cat losses in July were below historical trends, but all eyes are on peak hurricane season.

-

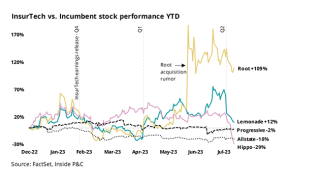

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

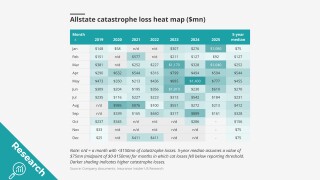

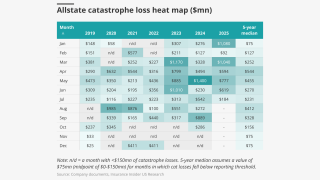

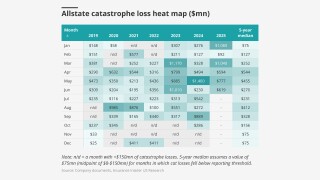

The research team presents the June cat heatmap.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

Allstate attributed the bulk of its losses to three major wind and hail events.

-

Major insurance industry groups and companies have recently pressed lawmakers to include the provision.

-

Two wind and hail events were responsible for 60% of the total.

-

Insurers haven’t announced concrete steps – yet.

-

But automotive repair costs are likely to increase faster than home repair.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier surpassed the retention on its annual aggregate reinsurance cover for the year to March 31.

-

January cat losses continue to run higher than prior years, with no help from latest wildfires.

-

The carrier estimated January cat losses of $1.08bn, or $849mn after-tax, including the fires.

-

The investment firm’s holdings were down to $59mn at the end of Q4.

-

The carrier has not added new business in the state since 2007.

-

The carrier has been reducing its presence in the state since 2007.

-

The move will expand Nationwide’s stop loss insurance sales to SMEs.

-

The estimate includes $102mn from Milton and $114mn Helene development.

-

The activist investor’s position at the end of Q3 was valued around $116.3mn, SEC filings show.

-

Insurers are fighting to recoup claims they have paid out.

-

Fifteen events caused estimated losses of $306mn.

-

The news team runs you through this week’s key M&A deals.

-

Independent litigation threatened a $4bn settlement with wildfire victims.

-

Total catastrophe losses stemmed from 20 events and were estimated at $587mn.

-

NatGen allegedly collected $500mn associated with the fraud.

-

A quick roundup of today’s need-to-know news, including the DoJ/NatGen lawsuit and RenRe's earnings call.

-

The victims claim insurers shouldn’t get settlement cash before they’re made whole.

-

A quick round-up of today’s need-to-know news, including Ryan Specialty, Marsh, Allstate.

-

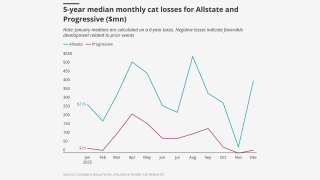

Allstate’s total pre-tax cat losses for H1 2024 were $2.85bn versus an estimated $4.39bn in H1 2023.

-

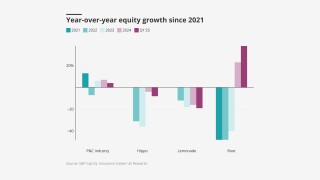

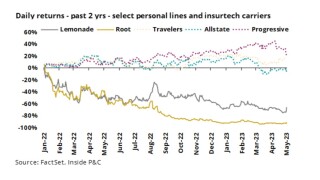

Investor skepticism visible in stock prices and short interest data over first half of 2024.

-

This takes pre-tax year-to-date cat losses to $2.62bn.

-

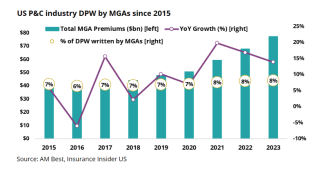

MGAs outpaced the P&C industry for years, but growth has begun to stagnate.

-

Changes in investment strategy and strong results show carriers can weather financial storms.

-

This takes pre-tax cat losses for the calendar year to $1.23bn

-

This follows February’s cat losses coming in below the $150mn reporting threshold.

-

This follows January pre-tax cat losses of $276mn.

-

Two events comprised approximately 80% of the losses.

-

The carrier expects to "get smaller in New Jersey" due to lack of rate adequacy.

-

Insurance Insider US runs you through the earnings results for the day.

-

Unfavorable prior year reserve re-estimates, excluding catastrophes, totaled $199mn in Q4, with approximately $148mn related to personal auto, including costs for litigation claims.

-

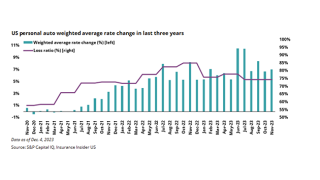

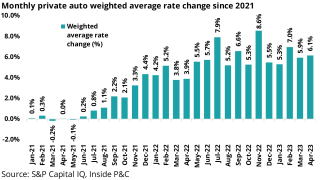

For the month of November, Allstate brand’s auto rate increases totaled $262mn, after implementing $517mn and $1.49bn of rate increases in Q3 and Q2, respectively.

-

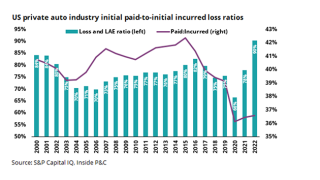

Personal auto carriers risk falling behind in the battle between loss costs and approved rate declines, while homeowners carriers’ double-digit filings might not be enough to keep up.

-

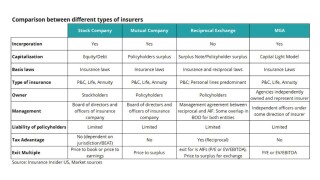

Reciprocals have been cropping up more recently, with a shift toward cat-exposed lines, giving investors a quick way to tap into the hard market with an expectation of a rich multiple at exit.

-

Meanwhile, the company’s October cat losses came in below the reporting threshold of $150mn, compared eith $317mn of cat losses in September and nearly $1.2bn for Q3.

-

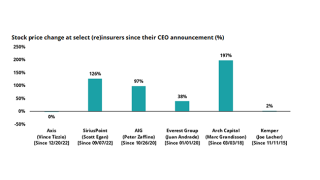

Kemper’s current results and historical trends suggest continued difficulty and remains a TBD story.

-

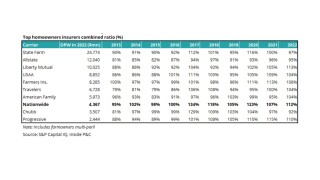

Three states — California, New Jersey, New York — were responsible for adding five points to YTD combined ratio for 2023.

-

The Inside P&C news team runs you through the earnings results for the day.

-

A clear commonality is already emerging much as it did in the previous quarter, when severe convective storms – particularly hail – also dominated.

-

Most of the losses, around 80%, were the result of two wind and hail events.

-

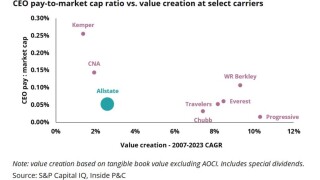

Allstate’s underperformance in results and value creation may be an opportunity for activist investor Trian, but history suggests it will have its work cut out.

-

The carrier has suffered five quarters of losses, largely spurred on by hefty natural catastrophe losses.

-

-

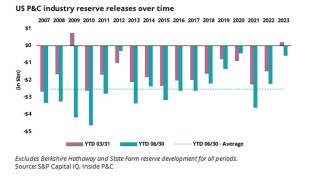

Differing trends in short- and long-tail lines offset each other to create a net positive for the industry, though the releases are slowing significantly.

-

The settlement would resolve claims that Allstate defrauded shareholders by underreporting “skyrocketing” auto claims to artificially boost the stock price, which later crashed.

-

Allstate reported cat losses of $1bn and $885mn for June and May.

-

On the surface, InsurTech results were better than the noise from incumbents, but caution is needed to ascertain the quality of new business coming in during a time when even industry leaders stumble.

-

The downgrades reflect the negative impact of challenging macro-economic trends on underwriting results and risk-adjusted capitalization.

-

In California, the carrier filed for a 35% increase this quarter after implementing a 6.9% rate hike in April.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Q2 cat losses reported by most carriers were significantly higher than a year ago owing to the number of US convective storms and likely higher carrier retentions at reinsurance renewals.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Nearly $148mn of the unfavorable reserve development was related to National General, primarily driven by personal auto injury coverages.

-

Pricing, catastrophes and rising costs are headwinds for this quarter’s insurer results, but brokers should be buoyed by continued inflation.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

An uneven loss environment in personal lines calls for a cautious reading of reserves.

-

California Insurance Commissioner Ricardo Lara was speaking about climate change's impact on insurance pricing at the Bermuda Climate Summit.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The carrier said 70% of the claims stemmed from two wind and hail events.

-

CPI figures show loss costs are cooling, and if rate levels cannot reach adequacy we are likely to see more pausing from the industry beyond State Farm, Allstate and Nationwide.

-

The company reportedly recently applied for a rate increase of about 40% on California homeowners’ business.

-

The loss for the month was 60% comprising losses from two wind and hail events.

-

InsurTech carriers pivot to profitability vs growth.

-

The carrier will continue to push for more auto rates through 2023 as drivers of severity continue to persist.

-

The carrier shifted retentions up and made use of multi-year contracts.

-

Personal lines rates ticked up in April compared to the prior month as insurers try to stay ahead of rising loss costs.