Aon

-

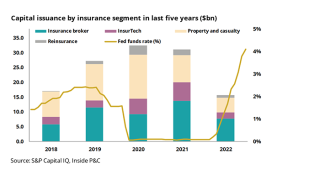

Increased interest rates and unfavorable market conditions led to reduction in capital issuance activity in the P&C insurance industry in 2022.

-

In each case, the broker asked the judge to dismiss with prejudice, barring the parties from bringing the disputes to another US court.

-

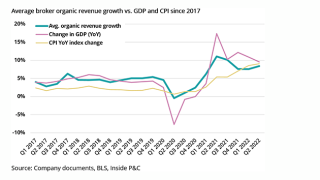

Although 2022 was on balance, a good year, macro-economic issues such as a slowing economy, falling employment, and loss cost reversion could create an overhang for 2023.

-

The broker has pegged the global reinsurance supply demand imbalance at $20bn-$30bn.

-

The broker said clients can move fast in a harder market but need time to review quotes.

-

The transaction will add Latin American hurricane and earthquake modelling capabilities to Aon’s product suite.

-

In Q3, 46% of primary policies renewing with the same limit and deductible received a price decrease, while 16% received a price increase, according to Aon.

-

The brokers asked the judge in the case for a 30-day extension to finalize settlement terms in Aon’s suit against WTW.

-

CEO Greg Case said dislocation in the reinsurance market created “tremendous opportunities” for the firm.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The organic growth figure came in below that of major rivals Marsh McLennan, WTW and Gallagher.

-

As the super-cycle slows and the economic landscape becomes more uncertain, brokers will face pressure, though a cooling labor market may aid margins.

Related

-

Marsh recruits Aon’s Spiridis as US project risk leader

June 25, 2025 -

Aon finds ‘significant increase’ in W&I claims in 2024

June 24, 2025 -

Aon launches AI platform Broker Copilot

June 23, 2025 -

Cyber rates fall for 10th quarter straight: Aon

June 17, 2025