Aon

-

The executive brings more than 15 years of industry experience, having worked for Neon and Validus Reinsurance.

-

The new deadlines set last week after a hearing suggest that recent settlement negotiations between the brokers to end the case via private mediation did not come to fruition.

-

CFO Christa Davies will also take responsibility for Aon Business Services as Simon transitions to the industry.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

While still too early to assess the damage fully, Aon believes the impact on property, infrastructure and agriculture will be significant.

-

Public companies’ primary prices renewed with the same limit and deductible were down 0.5% year on year in Q2 2022, marking the first decline in 17 quarters.

-

The discovery process will run through August and September, and the court will hold a hearing on Aon’s motion for a preliminary injunction on October 12.

-

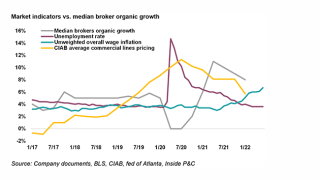

The broker said inflation should positively impact its ability to navigate another recession.

-

Initial loss estimates from convective storms and flash flooding place the economic impact in the hundreds of millions, although Aon warned losses may rise further.

-

The broker reported organic expansion slightly below rivals Marsh McLennan and AJ Gallagher.

-

Gartner accuses the broker of breaching its fiduciary duty and negligent misrepresentation for selling policies that didn’t cover its losses from pandemic-canceled events.

-

While brokers continue to report positive earnings, the possibility of a downturn shouldn’t be discounted.

Related

-

Marsh recruits Aon’s Spiridis as US project risk leader

June 25, 2025 -

Aon finds ‘significant increase’ in W&I claims in 2024

June 24, 2025 -

Aon launches AI platform Broker Copilot

June 23, 2025 -

Cyber rates fall for 10th quarter straight: Aon

June 17, 2025