Arch Capital

-

Carriers underweight in E&S could lead the charge in the next round of M&A.

-

A re-focus on reinsurance nearly brings Everest back where it started.

-

Despite the pricing pressure, margins for the line of business remain attractive, he added.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Reinsurers are mostly aligned on cat reinsurance, but goals are otherwise diverse.

-

The Bermudian said its pursuit of SMEs through M&A will provide sustainable improvements to its bottom line.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The appointments will be effective as of August 1.

-

The unit will include both ocean and inland marine coverage.

-

Ed Short was previously VP, digital partners, at Arch.

-

Sources said MarshBerry was retained earlier this year to run the sale.

-

The days of 30%+ growth are probably behind the firm, he said.

-

Overall, the company’s underwriting income fell 43% to $417mn in the first quarter.

-

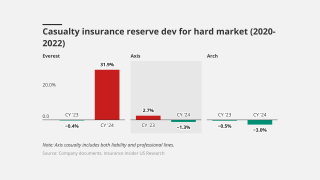

GAAP reserve triangles reveal the struggles of some hybrid franchises.

-

The company, meanwhile, is bullish on E&S US casualty.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Robin Hamilton has been appointed head of energy and marine liability.

-

New CEO Williamson will likely continue walking the hybrid path, with an emphasis on fixing US casualty.

-

Tim Watson most recently served as a senior credit and political risk underwriter.

-

Jelle Ouwehand joined Arch from Marsh, where he was a senior terrorism, PV and war broker.

-

A signal around Q4 adverse development has brought the carrier into the spotlight.

-

Both appointments are effective immediately.

-

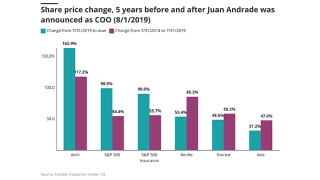

Arch stands out among hybrids, but Axis and Everest grind it out.

-

Arch is assuming an industry loss related to Helene in the $12bn-$14bn range.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Grandisson's sudden retirement could mean a complicated future for Arch.

-

The chief executive will also receive a yearly bonus of 200% of base salary.

-

Arch announced the retirement of CEO Marc Grandisson on Monday, with immediate effect.

-

The executive has been group CUO since 2021.

-

He replaces Richard Goldfarb, who will remain as head of strategy.

-

The carrier writes all of its E&S business in the state through Arch Specialty Insurance Company.

-

A quick round-up of today’s need-to-know news, including Ryan Specialty and Skyward Specialty.

-

Mark Lange, chief middle-market executive, will oversee the new businesses.

-

The slowdown was based on a conviction of “higher likelihood of frequency events” this year.

-

A quick roundup of today’s need-to-know news, including AIG's earnings.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Both parties expect to close the transaction on August 1, 2024.

-

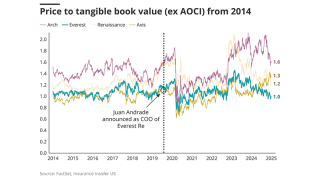

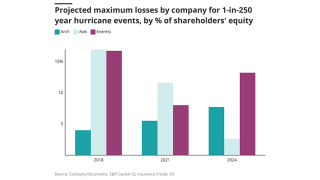

Investor skepticism visible in stock prices and short interest data over first half of 2024.

-

A standalone syndicate could offer capital, trading, and licensing advantages.

-

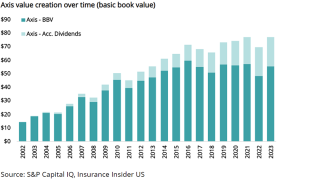

Industry trends show the Axis book value growth goal may be hard to hit.

-

-

Analysis of 2023 statutory data shows that Californian insurers are leaning more heavily on reinsurers but at a nationwide level, premium cessions were more stable.

-

Strack has worked at Arch for close to four years.

-

There was no material development on long-tail casualty lines across all years, he said.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Kirsten Valder has been with Arch for 10 years and before then was a partner at Kennedys Law.

-

Will Arch’s new acquisition be another success story, or more trouble than it’s worth?

-

The deal includes an LPT of ~$2bn loss reserves for 2016-2023 years with Arch Re.