Argo

-

The announcement comes a week after the institutional investor said it would accelerate its pivot to an insurance-led strategy.

-

Arturo Pelaez will continue in his managing director role at Brookfield Asset Management.

-

Argo shelved the sale of its Bermudian insurance business in mid-2024.

-

The agency cited SiriusPoint’s recent management moves including lower cat exposure as a driver of the change.

-

The move comes after Argo Pro announced it will exit professional lines.

-

The executive also served as CCO at Aspen before moving to Vantage.

-

Around $155m of the businesses in-force gross premium will be transferred to Core Specialty.

-

The company is not contemplating any other major structural changes.

-

The business – which writes professional liability, excess casualty and property - was marketed by investment bank RBC.

-

He brings 23 years of insurance industry experience.

-

-

Argo will initially front the business under a 100% quota agreement with ASU.

-

The executive expects the Bermudian to start onboarding programs later in 2024 or early in 2025.

-

“Unfortunately, it's a situation of getting rate to fund [the litigation costs] and being able to stay in the market long term,” Taylor told Insurance Insider US in an interview.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

In tandem, the Bermudian promoted David Corry and Greg Chilson to heads of casualty and professional lines, respectively.

-

Current CEO Thomas Bradley, who announced his intention to retire on the closure of the deal, will receive a one-time cash bonus of $1.2mn.

-

The Inside P&C news team runs you through the earnings results for the day.

-

The appointment follows that of Williams and Drakontaidis as head of contract surety and head of commercial surety respectively.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Argo has also hired former RLI surety head Greg Chilson as an adviser.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The charge was related to a reassessment of potential claims in professional lines, mostly from accident years 2019 and prior, and to losses from businesses Argo has exited.

-

The companies expect to complete the transaction in the second half of the year, subject to regulatory approvals and customary closing conditions.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Argo’s first bids included an implied firm value of $49.71 per Argo common share and $40 per share in cash, among others.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The firm’s US unit recorded $36.6mn of net unfavorable development in Q4 2022, compared with a $121.6mn charge in Q4 2021.

-

S&P said the change reflected uncertainty around Argo’s risk appetite following its $1.1bn acquisition by Brookfield Reinsurance.

-

The member joined the board in August 2022, two and a half years after ending his activist campaign against the carrier’s management.

-

The ratings agency has placed under review with developing implications Argo’s A- financial strength ratings, as well as its credit ratings.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Analysis of Argo’s valuation suggests this is a rich multiple when accounting for potential reserving noise.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The reinsurer said in its Q4 earnings call that Argo’s takeover further diversifies its operations and adds a foundational piece to its expanding P&C activity in the US.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The consideration represents a 48.7% premium to Argo’s share price before the sale of its Lloyd’s business.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Enstar is conducting due diligence around taking on the rest of the Argo back book.

-

Activist investor Capital Returns had nominated Ron Bobman and David Michelson, but withdrew the nominations on Monday.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The withdrawals of the activist investors have come just three days before the insurer’s annual shareholder meeting.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The carrier has called this month’s vote ‘a critical moment in Argo’s history’.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The activist investor’s statement comes as a reaction to Argo’s message to investors last Friday ahead of the carrier’s annual shareholder meeting.

-

The carrier is urging shareholders to appoint all seven of its nominees to the board in an annual meeting next month, amid activist investor pressure.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Completion of the transaction followed receipt of the required regulatory approvals and satisfaction of other closing conditions.

-

The Bermudian claimed Ron Bobman and David Michelson’s directorship would ‘diminish’ the board’s capabilities and expertise.

-

The CEO addressed the progress of the strategic process in his first interview since taking the role.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The insurer received regulatory approval for the LPT yesterday and expects to take the related $100mn charge in Q4 instead of Q3.

-

The specialty insurer booked an $11.9mn overall net adverse reserve development, up from $6.2mn last year, fueled by a $16.2mn charge in the US business.

-

Axis’ pivot away from property reinsurance comes just as the sector reaches one of the biggest inflection points.

-

The activist investor has been trying to join the board of the struggling firm and has been interviewed by Argo.

-

The company said the resignation was due to “professional and personal commitments”.

-

Argo Group has been sued by investors, who claim the company has engaged in inadequate underwriting and misrepresentation of facts which resulted in a 60% drop in the specialty carrier’s common stock value this year.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Bobman said the board of directors “demonstrated poor judgment” by approving the recruitment of Jessica Snyder as president of Argo’s US insurance division.

-

Capital Returns Master has proposed its president Ronald Bobman and David Michelson, president of DWM Consulting, as two new Argo board members.

-

A broader approach to deal structure leaves room open for a private firm to reverse into the company to go public.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Westfield will take on 2021 and 2022 as part of the agreement, but it is not yet clear if 2020 will be included in a legacy deal Argo struck this year for 2018 and 2019 in the run-up to sale.

-

Goldman Sachs has reapproached potential bidders as the Bermudian moves rapidly following the recent legacy deal and divestiture.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The deal price represents 1.16x tangible book value.

-

A sale of the managing agency and Syndicate 1200 would represent tangible progress in Argo’s strategic process.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The specialty insurer continues to face obstacles in finding a buyer, and a period of independence might now be the better option.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The executive will report to CEO and executive chairman Tom Bradley, who recently took over the role on a permanent basis.

-

With the addition of roughly 512,000 shares, Enstar’s interest in Argo was valued at ~$62.7mn at the end of June.

-

Odyssey Group’s cyber chief Robert O’Connell is looking to raise up to $1bn of capital for a monoline cyber reinsurer.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The dip follows a nearly 18% decline in the company’s stock price on Tuesday.

-

Yesterday, Argo disclosed that it entered into a loss-portfolio transfer agreement with Enstar and will accept an after-tax charge of $100mn in Q3 to secure the cover.

-

The stock was down $5.91 early trading hours from its close of $32.22 on Monday.

-

The deal also includes a $75mn loss corridor that must be eroded before adverse development passes to the legacy firm.

-

The scourge of former CEO Mark Watson will finally join the board after wielding major influence over the last three years.

-

Argo sued K2 in May claiming that the team lift-out was accomplished through breaches of fiduciary duty and contract.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The Goldman Sachs-run process drew limited interest and does not offer a path to takeout at a premium valuation.

-

The sector was hit by a rough first half of 2022, with more to come in the second half of the year.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

It is understood that the carrier, which is currently going through a sale process, is being advised by TigerRisk.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The board retained Goldman Sachs to advise in April, and the investment bank has been running a sales process.

-

Current CEO Bradley will receive 78,760 shares of restricted stock over a 12-month period, as well as 135,000 stock appreciation rights with an exercise price of $43.80.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Kevin Rehnberg, who has been out on leave for health reasons since March 2022, is stepping down from the top role and the board of directors.

-

KPMG has been appointed to succeed its Big Four rival as the up-for-sale Bermudian tries to turn the page on its delayed annual filings.

-

Selling Argo may be harder than you think given its Lloyd’s operation and questions around balance sheet strength.

-

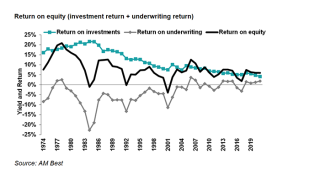

Insurers could face pressure if interest rate and recession fears intersect with worsening loss cost trends.

-

Last month, Argo’s board announced they were looking at an “exploration of strategic alternatives” for the company.

-

The remark addressed Argo’s Q4 $132mn reserve charge that fueled activist claims that the company should be sold.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Q1 net adverse prior year reserve development was $3.4mn, or 0.7 points on the LR, up from last year’s $1mn net reserve charge.

-

Inside P&C’s news team canters through the week’s key developments.

-

The firm initiated an exploration of strategic alternatives – including a potential sale or merger.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Ron Bobman first called for the sale of the firm back in September 2021, and recently launched a proxy campaign to join its board.

-

The embattled carrier has faced mounting pressure from investors to sell the business.