John Smith, president and CEO at Pennsylvania Lumbermens Mutual (PLM), told Inside P&C there could be a “shake out” of these smaller cedants as a result.

He said: “So I think there is an awful lot of companies, particularly small regional companies, mutuals in many cases, that relied on cheap, or let's say aggressively priced, reinsurance and handed off a lot of losses. And the business model probably doesn't work for them if the price of reinsurance goes up.

“They're not equipped to handle more retention because then they have to eat more of their own cooking.”

Nearly $70bn of cat losses were taken by the (re)insurance market in the first half of 2023, with Hurricane Idalia set to be yet another retention event for cedants. The distribution of losses between insurers and reinsurers in H1 demonstrated how higher retentions in reinsurance programs and the falling away of aggregate covers led to cedants shouldering more of the loss burden.

This shift is said to be pressuring mutuals and smaller Midwest regional players which are facing much higher losses this year, as well as higher reinsurance rates.

Small mutual insurers have often relied on multi line risk treaties sold by domestic reinsurers, which are pulling back after substantial losses, sources told Inside P&C during the annual CIAB event in Colorado Springs this year.

Expectations for January 1

PLM is expecting higher rates and tighter terms and conditions at January 1 renewals, but is hoping for a more orderly process than what was in some cases an “unprofessional” renewal last January, according to Smith.

“I didn't hear about anybody wanting to take riot and social unrest out of the programs until after Christmas, and it went from no one talking about that to like everyone talking about it in a five-day period,” Smith said.

He added that post-January 1 commentary from major reinsurance CEOs suggested “they didn’t know what was going on at the front of their company”.

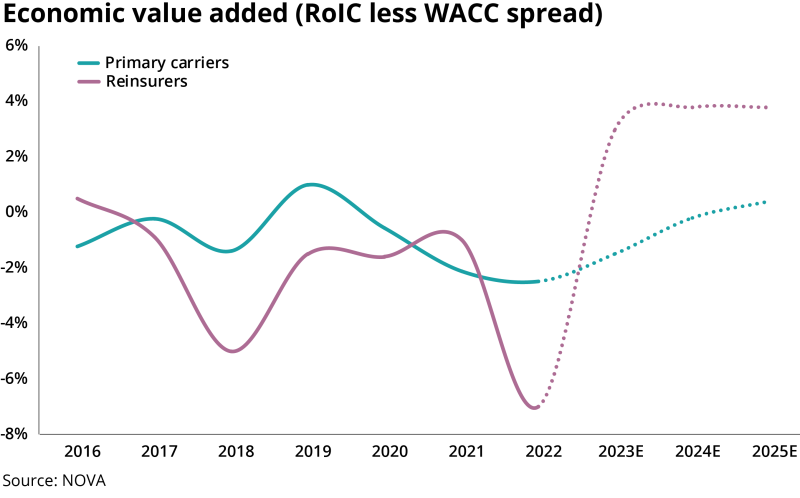

General market expectations are for a more orderly renewal at January 1, as last year’s dynamics on uncertainty around the availability of capacity and cat coverage have fallen away. Reinsurers are also under pressure to sustain the progress made on bettering returns, after many years of disappointing results.

Howden Tiger said in its interim market update that reinsurers are set to earn their cost of capital in 2023 for the first time in this insurance cycle.

PLM, a $400mn premium company, spends over $100mn on reinsurance, and looks for long-term partnerships with its reinsurance partners, Smith said.

“You know, before I walk into that meeting, I want to understand and I think companies should understand not only what [their] strengths and weaknesses are, but what that reinsurer’s strengths and weaknesses are and what they're looking to accomplish.

“So we're looking for those long-term relationships to be solid and mutually beneficial.”

PLM has built its reinsurance relationships over time, starting in some cases with “watch lines” of 1% that quickly grew to 2%, then 5%, “and we’re off to the races”, Smith said.

PLM prefers reinsurers to take small positions across its portfolio, which includes property and casualty excess of loss as well quota share programs, rather than picking specific layers or coverage areas.

Drivers of market conditions

Smith’s pre-January 1, 2023 visits with reinsurers gave him an insight into what might occur at January 1 in terms of higher rates and tightening T&Cs.

“I came back from one of my trips last summer, and said to our senior underwriting officer, you know, it's a little frightening. These guys are all saying basically the same thing and a lot of it makes sense, you know, so we could be in for a rough renewal. And in fact, you know, that's what happened.”

The market isn’t attracting as much capital as it might have in the past, however, as generally higher interest rates mean more options for investors.

“Now you're going to hold different fixed income instruments and make decent returns.”

The tight capacity situation and rising rates is a result of worsening, and changing, weather loss patterns, Smith said, echoing thoughts from other market participants and reports.

“From my perspective, you know, the first thing that jumps off the page is [2023] losses. Weather-related cat losses that were simply huge. And they had been getting bigger for years.”

PLM is seeing the impact of weather-related losses on its property book this year more than last, partly because of the shifting location of weather events.

Convective storms in 2022 largely affected less populous Midwestern states, while in 2023 that pattern shifted to more populous ones like Illinois.

“Then you lay on top of that inflation,” Smith said. “And you lay on top of that supply chain issues right now.” Both factors are affecting property losses while social inflation is also pressuring casualty classes.

“The actual law surrounding that [casualty] loss really becomes secondary. Juries today are looking at and saying, you know, someone has to be punished,” Smith said.

All of these factors mean reinsurance capacity is hard to predict come January 1.

“They're talking about capacity starting to return and I think that's probably true at this point in time in the property marketplace. But we still have three months to go here, right? That doesn't mean it's gonna be there by 1.1.”