Chubb

-

The proposal says oil companies cause climate change and, thus, increased cat losses.

-

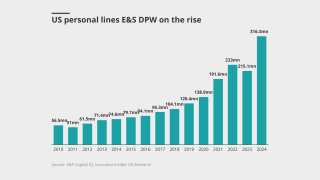

Carriers underweight in E&S could lead the charge in the next round of M&A.

-

The insurer plans to automate around 85% of key functions surrounding underwriting and claims processes.

-

The move from Chubb comes at a moment of perceived weakness for AIG.

-

Approached for comment, Chubb denies that it submitted “an offer” for AIG.

-

A jury awarded $32.3mn for repair costs, and $80mn for business interruption.

-

The move comes after Everest sold renewal rights for its global retail business to AIG.

-

The Marsh-placed account renews its all-risks cover on 16 November.

-

This publication exclusively reported the executive’s plans last month.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

Total pre-tax favorable prior period development in the quarter was $361mn, up nearly 48% YoY.

-

Pre-tax cat losses were down 63% from the prior year quarter to $285mn.

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

The federal panel hasn’t finalized a timeline for formulating the new rules.

-

Brian Church has spent 20 years at Chubb.

-

Lupica moved to the role last year as part of a staggered handover of responsibilities to Juan Luis Ortega.

-

The executive said record operating income and returns don’t indicate Chubb is “beleaguered”.

-

He will drive the growth of Chubb's claims-made excess casualty facility.

-

He joins the company after 22 years in casualty leadership roles at Chubb.

-

The Delaware high court’s reasoning could find application in other cases.

-

The state’s Supreme Court upheld two lower court decisions finding no liability.

-

Teresa Black will succeed him as division president of North American surety.

-

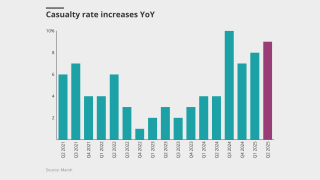

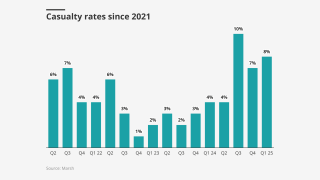

Insurers did not see a slowdown in rate but some are still fine-tuning their portfolios following the LA fires.

-

The carrier agreed to acquire Liberty Mutual’s P&C firms in Thailand and Vietnam in March.

-

Loss trend concerns persist, but insurers are vouching on the opportunity to push for more rate increases.

-

The carrier's Q2 reserve releases rose to $249mn from $192mn on favorable NA personal development.

-

The company also encouraged insurers and brokers to support the initiative.

-

In March 2024, Cowen was appointed to lead Chubb’s new international transactional liability platform.

-

When it comes to sympathetic juries, high net worth individuals are under the same pressure as corporations.

-

The January wildfires did little to hamper their appetite, apart from California.

-

The transition will be implemented starting October 15.

-

The broader legislation narrowly passed the Senate and now heads to the House.

-

Jim Williamson said litigation funding had evolved into an investment class.

-

Major insurance industry groups and companies have recently pressed lawmakers to include the provision.

-

Marsh McLennan CEO Doyle dubbed legal system abuse a "tax” on US economy.

-

Chubb told insurers to look inward in the fight against LitFin, but insurers are also tied to that industry.

-

The panel aimed to highlight “synergies” between insurance and litigation finance.

-

The executive replaces Mike Warwicker, who left the firm earlier this year.

-

Burford’s CEO said Chubb is inappropriately using its corporate power.

-

Philip Enan joins following 11 years at Chubb.

-

The two parties seek to delay a judge’s summary judgment order.

-

The executive had served as chief investment officer since 2000.

-

The program will succeed the previous buyback launched in 2023.

-

The CEO spoke after Chubb chief executive Evan Greenberg’s call to action at RIMS.

-

Writing credit wraps for LitFin firms and steering third-party assets to them should stop.

-

The take-up rate will depend on the price discount and market segment.

-

The carrier said it is prepared to drop asset managers, lawyers, banks and brokers.

-

During first quarter earnings calls, insurers argued that they can mitigate volatility.

-

The facility is a nudge towards a structural change, not a full-out assault.

-

Both Chubb and Zurich will underwrite the risks, with Nico as the sleeping partner.

-

AIG, HDI Global and others have settled. Chubb’s fight continues.

-

The facility provides up to $100mn in claims-made excess casualty coverage.

-

The executive will begin serving as Hiscox USA’s CUO as of May 5.

-

Of the $170mn cat losses outside LA wildfires, US cat activity accounted for 74% and international cats 26%.

-

Reserve releases at Chubb rose to $255mn from $207mn a year ago.

-

The executive has spent over 20 years at Chubb.

-

A positive outcome could significantly curb insurers’ exposure to the loss.

-

Joe Cala will leave the carrier after nearly 13 years on the product recall team.

-

The decision comes after the agency refused to block a climate related vote at Travelers.

-

Of the 178 passengers and crew on board, no serious injuries have been reported.

-

CEO Greenberg cited ‘competing priorities’ in his annual letter to shareholders.

-

The move combines two units in the North America middle market division.

-

Last year, the firm consolidated financial and excess liability lines under the leadership of Richard Porter.

-

Delegated underwriters are seeing an opportunity to write in the PVT market as an add-on to property coverage.

-

Under the new guidelines, the carrier is requiring more distance from the brush.

-

Former PRS president Ana Robic was promoted to regional president.

-

Ana Robic will succeed Furby as EMEA regional president.

-

The executive succeeds Lou Capparelli, who becomes global casualty chairman.

-

Andy Houston will be based in London, reporting to Mark Roberts, division president UKISA.

-

Changes in cat activity and social inflation have impacted carriers focused on the mid- and small commercial market.

-

The carrier has been reducing its exposure to the area where the wildfires occurred by over 50%.

-

Chubb’s Q4 cat losses more than doubled to $607mn, driven by Hurricane Milton.

-

The carrier named Jason Neu, financial lines EVP for its E&S subsidiary Westchester, to succeed Stapleton.

-

The E&S lines division adds property, casualty and financial lines.

-

The company’s stock price has plummeted in the wake of the LA wildfires.

-

A Delaware judge ruled that a “bump-up” exclusion was inapplicable.

-

The storm caused major damage to one of the drinks company’s warehouses in Tennessee.

-

The carrier had $300mn of favorable development in Q3, mostly led by short-tail lines and ex-workers' comp.

-

The commercial carrier also reported a Hurricane Milton pre-tax net loss forecast of $250mn-$300mn.

-

The appointments will enhance Chubb’s Latin American leadership structure.

-

Greenberg said London behavior in cat market “is almost aberrant relative to everybody else”.

-

The CEO noted, however, that the UK retail market remains a big business growing well.

-

The Insurance Insider US news team runs you through the earnings results for the day.