Cincinnati Financial

-

The LA fires were a microcosm of “everything we do well when things go bad”.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

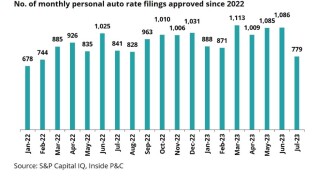

Insurers did not see a slowdown in rate but some are still fine-tuning their portfolios following the LA fires.

-

New business written premiums were up in the commercial and E&S segments, but decreased in personal lines.

-

This brings the carrier’s total limit on the program to $1.8bn.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The January wildfires did little to hamper their appetite, apart from California.

-

The LA fires and spring storms drove CinFin's CoR up 19.7 points to 113.3%.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier is only going to write new business on E&S paper, sources said.

-

Regionals and smaller carriers need to exercise vigilance when expanding commercial casualty lines.

-

The losses do not change the near-term assessment of CinFin’s balance sheet strength.

-

The estimated net effect on Q1 premium revenue is a decrease of $50mn to $60mn, executives said.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The promotions are in the commercial/life and personal/specialty operations.

-

Cincinnati Re reported $38mn of cat losses in Q3 that included $18mn for Hurricane Helene.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Regionals may be particularly vulnerable to problematic loss cost trends and volatile cat losses.

-

CinFin added reserves in Q2 after incurred losses emerged higher than expected.

-

A roundup of today’s need-to-know news, including Commissioner Lara’s FAIR plan reforms.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

This was offset by a $108mn reserve charge for years 2021 and prior.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Umbrella was "modestly profitable" in 2023, despite challenges in 2022.

-

Insurance Insider US runs you through the earnings results for the day.

-

Current CEO Steven Johnston will remain as executive chairman.

-

“The loss ratio has certainly been under pressure with inflation and increased cat activity, but we're confident in where it's headed and seeing a lot of opportunity out there,” Spray told analysts on Friday.

-

AJ Gallagher posts 10.5% Q3 organic growth, lower sequentially but up year-on-year

-

At the same time, insurers are assessing the level needed to address loss cost trends.

-

Overall, the executive said the company feels “really good and bullish” about the personal lines business for both its HNW and middle market books.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The regional cohort keeps pace with nationals on pricing, and stays ahead on reserving trends.

-

The events were widespread, but each was under $100mn in size.

-

Overall, the carrier reported a combined ratio of 100.7% for the quarter, which was 10.8 points higher than the prior year period.