Commercial E&S

-

The retail heavyweight uses around 1,000 trading partners to access the wholesale channel.

-

Casualty rate increases largely stabilized in Q2 and Q3 at 5%-10% for general liability.

-

Despite a softening market, underwriters were still able to attain up to 10% above technical pricing.

-

With property getting more competitive, FM pursued an opportunity for growth in E&S with Velocity.

-

Quota share is less common in the medmal space, where layered and shared structures have been dominant.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

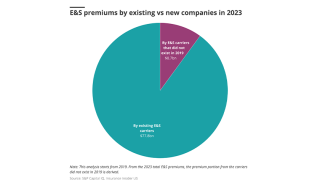

The executive noted that an influx of new entrants in the E&S market is increasing competition.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The insurer continues to exit or reduce unprofitable lines and slowed growth as a result.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

The LA fires were a microcosm of “everything we do well when things go bad”.

-

Jason Keen joined Everest in 2022 as head of international.

-

APIP is one of the world’s largest property programs.

-

Haney will remain on board as a senior adviser.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Old Republic said the acquisition is expected to close in 2026.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Howden is facing fallout from its push into the US retail market via mass hires.

-

The CEO also said that the “bloom is off the rose” in the E&S property market.

-

Since Simon Wilson was elevated to insurance CEO, the firm has been refocusing its underwriting.

-

As the Great Japanese M&A Contest develops, the executive said inorganic expansion is “a top priority”.

-

Mike Mulray joins from Everest, where he was EVP president of North America insurance.

-

The division mostly places higher up the tower, where many insurers have taken action to address SAM losses.

-

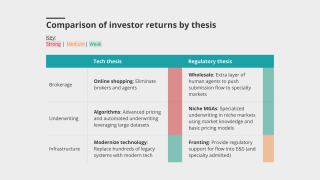

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

The specialty insurer was recently acquired by Korean carrier DB Insurance.

-

The two executives join from Markel and Arch, respectively.

-

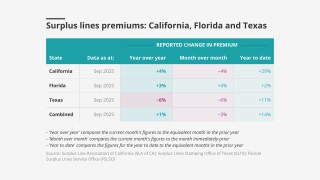

Trailing three month premiums were up 7.2% versus 13.1% in August.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

Economic volatility, including from tariffs and rising interest rates, is reshaping risk profiles for specialty insurers.

-

The MGU is entering the often-difficult habitational GL space with an initial E&S offering.

-

A process has not been launched and a firm timeline for a liquidity event has not been agreed.

-

Following the Golden Age of Specialty, franchise quality will play a bigger role in determining success.

-

The practice group will enhance the company’s existing offerings in E&S.

-

Winners and losers will emerge more clearly, with less opportunity to ride the market wave.

-

Florida led deregulation by eliminating the diligent effort rule in June.

-

One of the options being explored is setting up a dedicated company for the wholesale vertical.

-

The new MGU is expected to formally launch before the annual WSIA marketplace in San Diego.

-

The rest of 2025 appears poised to remain favorable for insureds, however.

-

California, Florida and Texas all saw decreases in monthly premium growth.

-

Third Point purchased 50,000 shares of the E&S insurer, which represents roughly 0.1% of its shares outstanding.

-

Casualty premiums grew 56.7% year on year in Q2 2025.

-

Appointments include leadership in transportation, energy, marine and others.

-

She joins the specialty insurer after working at Hamilton as CUO.

-

Auto, umbrella and excess lines recorded mid-double-digit rate increases in Q2.

-

Commercial liability and commercial property coverage continued to dominate the E&S market.

-

California posted a 47% jump YoY, from a 28.4% rise in June.

-

In liability, the carrier is steering away from where inflation has been volatile.

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

The segment is also seeing double-digit loss cost inflation.

-

Renewal rates fell, despite elevated catastrophe losses.

-

The company also encouraged insurers and brokers to support the initiative.

-

Cardinal E&S expands the carrier's underwriting capabilities and makes it more competitive relative to peers.

-

Nominee Neil Jacobs was warned cuts will cause ‘rising home insurance rates’.

-

The executive joined The Hartford when it acquired Navigators in 2019.

-

Florida recorded premium growth in June after declines in May and April.

-

The exchange is backed by $100mn in funding from CD&R and others.

-

Markel is simplifying its structure from six US wholesale and two US retail regions to four integrated US regions.

-

The aggregate gross proceeds from the offering are expected to be $113.3mn.

-

The NYC taxi insurance market is on the brink of collapse. Regulatory relief has been nowhere to be found.

-

The company filed its S-1 in March, with a 2024 CoR of 93.9%.

-

The executive said he left the company in September.

-

The company’s credit ratings had been under review since early this year.

-

The once niche product is generating interest in a growing number of industries and sectors.

-

The settlement requires Dellwood’s Price to write an apology to Peter Zaffino.

-

Lloyd’s traditionally avoided US middle market property, but head of P&C Matt Keeping says times have changed.

-

The moves come as the company said it will "double down" on US E&S.

-

Rates have fallen an average of 10%, though changes can be highly specific to each property.

-

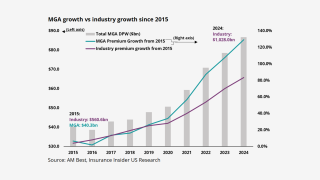

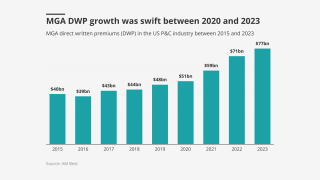

The MGA market now makes up 10% of the overall P&C market.

-

The company has reduced its exposure on large commercial auto and property.

-

Sills added that Bowhead doesn't expect a reversal of compressed limits being offered.

-

Richard Schmitzer will retire as E&S president and CEO, and Todd Sutherland will succeed him.

-

The unit grew Q1 NWP by 23% overall, led by a 27% growth in casualty.

-

The standard market has not ‘meaningfully’ impacted the rate of flow in the aggregate.

-

Customers are demanding more in a larger move towards the E&S market.

-

The firm acquired total assets of $65mn and assumed liabilities of $11mn.

-

Secondary perils are no longer so secondary, but the losses are already priced in for commercial property.

-

The ex-Ategrity CEO launched Pivix Specialty in September 2024.

-

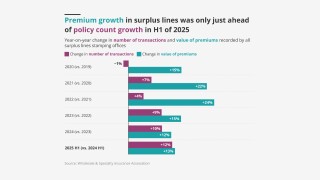

MGA growth is still strong but has passed its 2022 peak.

-

Everest’s US wholesale business is seeking to expand its market presence.

-

The program is being launched through subsidiary Southern Marine.

-

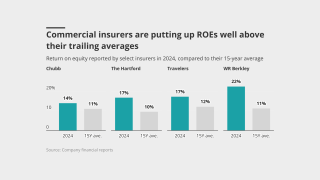

Despite elevated ROEs, insurers have remained disciplined.

-

California, Texas and Florida rose 15.7% in February and 29.1% in January.

-

Coverage will increase to $20mn per building.

-

The executive said AIG’s E&S arm can grow 20% a year and generate $4bn of new business.

-

After a period of business building, MGAs will likely spend more time optimizing.

-

Construction defects, GL and risk-managed professional liability lines saw the greatest headwinds.

-

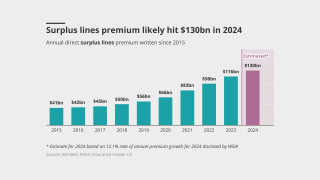

Surplus lines are still strong, but not the standout they used to be.

-

The partnership will launch a new umbrella excess insurance product.

-

Admitted insurer withdrawals and rising demand are pushing more entrants into E&S.

-

Insurers and distributors must adapt or risk irrelevance.

-

Industry veteran Tonya Courtney will lead the company’s newest E&S business.

-

Q4 net retention was impacted by the previously announced ADC.

-

The group posted a 15.7% gain for February and 29.2% for January.

-

The first round of the E&S boom has already played out, but this is a long game.

-

Sources said that the MGA has been working with investment bank Waller Helms to find a potential investor.

-

The Nationwide subsidiary is a $750mn-premium wholesale brokerage that serves about 10,000 local agents.

-

The figure represents a 12.1% increase over full-year 2023.

-

Admitted carriers are dropping middle-market business due to large verdicts.

-

The group posted a 27.5% gain for January and 23.7% for December.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Finnis was formerly head of commercial lines at WTW.

-

The E&S lines division adds property, casualty and financial lines.

-

Sources said Dowling Hales is advising the professional lines quoting platform on the process.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company will now focus on growing its E&S and InsurSec offerings.

-

Piyush Patel and Sandra Russo have joined Dellwood as head of programs and AVP, respectively.

-

Rates are now falling, but submissions are still rising, according to wholesale brokers.

-

Irwin joins the firm from Beazley, where she’d worked since 2019.

-

Brokerage co-presidents Jeff McNatt and Sam Baig discussed the E&S market, rates and M&A.

-

At Zurich, Hirs served as group head of M&A and CFO for North America.

-

The review follows Velocity’s acquisition by FM Group.

-

The change comes after an ownership restructuring.

-

A look back at the stories that defined the year in P&C for 2024.

-

Overall, the “Golden Age” of E&S continues, but with a few new caveats, such as moderation in property pricing.

-

Shawn Parker takes up Gatt’s previous role as COO of Westchester Programs.

-

Florida is a state where the company is seeing more capacity in the market, especially admitted availability.

-

Rate inadequacy and inflationary pressures represent significant headwinds, however.

-

The 2025 State of the Market report also touched on E&S and MGA growth.

-

The group posted a 15.1% gain for October and 27.4% for September.

-

This would allow the former Truist Insurance to place binders on its MGAs itself and open other growth opportunities in EC3.

-

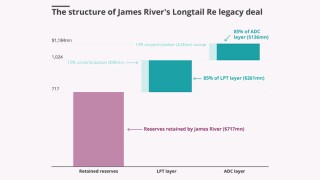

Enstar and Gallatin’s move into the common equity is a bull sign, but it will take years to know if the ADC will hold.

-

James River also amended the convertible preferred equity held by Gallatin Point and closed its strategic review.

-

Casualty submissions rose over 70% while property increased over 20% YoY in Q3.

-

The average for October was roughly half of that for September.

-

Management is showcasing its ambition, but it’s also dialing up risk.

-

Sources said the E&S insurer is seeking to draw a line and trade forward as an independent business.

-

Westhoff will also spearhead the launch of QBE’s E&S property offering.

-

The agreement will bolster Asic’s surplus and expand underwriting capacity.

-

The two senior positions will be based in London.

-

A large number of new entrants and the growth of litigation finance challenge E&S enthusiasm.

-

Attendees concurred that they don’t expect the “Golden Age of E&S” to end anytime soon.

-

Admitted markets are not coming back to property as strongly as in past cycles, the executive said.

-

In Q2, median property price increases decelerated to 2.3%.

-

The carrier’s initial casualty offering will be wholesale-only, the executive said.

-

Coverage options will extend up to $5mn.

-

Andrew Rowland will oversee the portfolio, offering up to $7mn per risk.

-

The deal provides Honeycomb with up to $24mn of capacity.

-

The future of E&S, the wholesale landscape and casualty pricing are topics up for discussion.

-

The 17.4% DWP growth, however, was a deceleration from 2021’s 25% peak.

-

Andrew Knight will fill the newly created role of country manager.

-

Expansion of the middle-market book is an ongoing focus.

-

The top three states averaged a 3.7% year-over-year gain, compared to July's 16.1%.

-

It will offer additional capacity to WTW US property clients with a limit up to $25mn.

-

-

Negotiations come after Insurance Insider US revealed that the Bermudian was running an auction.

-

The top four lines posted low-single digit to high-single digit policy count growth.

-

The CEO said there’s only one public pure wholesale broker, Ryan Specialty, and its IPO was in “favorable conditions”.

-

Stephen Buonpane will lead the division, with Danielle Stewart as COO.

-

James River will also oppose a Fleming motion to uncover additional documents.

-

Commercial liability and commercial property continue to dominate.

-

Dellwood claims allegations in AIG’s latest filing are still barred by res judicata.

-

The top three states averaged a 14% YoY gain, compared to June’s 3.3%.

-

As property momentum slows, personal lines excess and surplus could start outperforming.

-

The CEO estimated that the loss trend is running in the high 5% range, slightly below the carrier’s rate increase.

-

The arrangement enables PCS to expedite growth.

-

Axa's newly formed teams join the company's "complex cyber" unit.

-

Executives flagged elevated packaged auto loss activity in Q2.

-

For many, it could be a “wake-up call” to the systematic exposures inherent in cyber.

-

Average rate increases went to 5.6% in June 2024 from 28.2% in June 2023 .

-

The Longtail Re deal buys the specialty insurer time to secure its future, or an exit for shareholders.

-

Fleming files claims against James River, its CEO Frank D’Orazio and group CFO Sarah Doran.

-

The tower now represents a 47% increase from 2023.

-

State National is providing $160mn of adverse development reinsurance coverage.

-

It is understood that the executive will report to Scott Meyer, now COO for NA Insurance.

-

Dellwood recently appointed Aspen’s Felicia Rawlin as head of property.

-

The top three states averaged a 3.3% YoY gain, down from May’s 15.8%.

-

Tara Hill launched last month and is headed by Core Specialty’s Peter McKeegan.

-

-

This follows AIG’s voluntary dismissal of claims against Dellwood’s top execs.

-

AM Best assessed Dellwood’s balance sheet strength as “very strong”.

-

Industry veteran Peter McKeegan will lead the firm.

-

Ryan Specialty CEO Pat Ryan opened the event, which was held last week in New York.

-

In high-capacity, global E&S property, London has continued to be aggressive.

-

Kinsale CEO Mike Kehoe said social inflation is unabating, but losses fuel the industry.

-

Ryan Specialty’s CEO opened the Insurance Insider US 2024 conference.

-

State National has been lined up to front for the vehicle, which would be a rare example of third-party capital in this space.

-

In an interview with Insurance Insider US, Robinson spoke about life after the IPO, talent, litigation financing and cat.

-

His experience includes HPR engineering, facultative reinsurance and E&S underwriting.

-

The acquisition allows AM Specialty to expand its E&S offerings.

-

The review reflects the group’s ongoing ownership-level restructuring.

-

The H2 rate predictions mark a slight moderation from those in H1.

-

Latin America and the Caribbean accounted for 4.6% of GWP for Lloyd's in 2023.

-

The move comes as the wait for a deal for the whole group passes the six-month mark.

-

Business written in California, Florida and Texas averaged a 15.2% YoY gain.

-

The firm has zero pre-2020 reserves, no MGA relationships, and management with a strong record.

-

The distribution model itself prioritizes the need for due diligence.

-

An overview of Q1 earnings shows upsides, but also plenty of concerns going into the rest of 2024.

-

The carrier’s goal for its specialty arm is to achieve $10bn in written premiums and a sub-90% CoR by 2030.

-

The firm will no longer have to compete with one hand tied behind its back.

-

The partnership will increase K2's capacity for US hurricane and earthquake exposure.

-

The appointment is part of Axa XL's plans for a more client-centric approach.

-

Business written in California, Florida, and Texas averaged a 22.7% YoY gain last month.

-

The policy offering expands third-party liability coverage and wage and hour liability.

-

The company reported 25.5% increase in GWP, down from the 40% growth in prior years.

-

The carrier is also targeting E&S growth in property brokerage and global specialty.

-

The US large property team will support middle-market and corporate clients.

-

Focus on reserves to continue as gap between cautious reservists and others emerges.

-

The casualty segment posted $18mn of favorable reserve development across multiple accident years.

-

The MGA’s underwriting capacity for casualty programs now totals $17mn.

-

The unit has hired Everest’s Chris Curtin and Axa XL’s Brian Quinn.

-

Current CEO John Mulvihill is retiring after 34 years with the specialty insurer.

-

Westchester’s Kyle Garrett was named VP, executive underwriter for property.