Core Specialty

-

The search for a CFO had been underway since last July.

-

CEO Jeff Consolino will undertake CFO duties on an interim basis.

-

LAU will become the new Core Specialty Aviation & Aerospace Division.

-

Around $155m of the businesses in-force gross premium will be transferred to Core Specialty.

-

The company sees the surety market as a ‘highly attractive’ segment

-

“Consoloonan” are set to return to the public markets over a decade after their last conference call.

-

The specialty insurer founded via a recapitalization of StarStone US is likely to go public in Q4.

-

The ratings reflect the balance sheet strength of parent Core Specialty.

-

The insurer appointed industry veteran Tim Martin as surety division president.

-

The transaction for the financial services book leaves the legacy behind.

-

The Specialty Markets Group produced DWP of $388mn in 2023.

-

Woodlands Financial Services listing is likely in Q2, but overall environment is subdued.

-

The specialty insurer agreed to pay $2.5mn in cash for the exclusive right to underwrite the security and alarm business through October 2025, and the unit’s renewal rights.

-

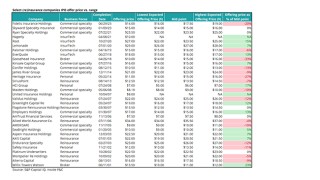

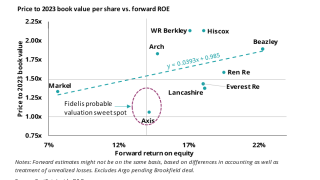

After pricing below the expected range at its IPO, the Fidelis stock price slipped on the first day of trading - here's how other (re)insurance IPOs have gone since 2000.

-

Anat health insurance leader Jim Stelling will join Core as part of the deal.

-

Strong results reflect tailwinds in the E&S space, but social inflation will be a trend to watch.

-

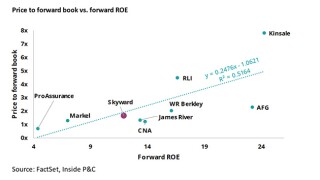

The Fidelis IPO has no clear precedent, but there is an appetite for investment in the specialty space, as seen earlier this year with the Skyward public listing.

-

The new programme marks Core Specialty’s first offering in the tech E&O and cyber market and offers up to $5mn of coverage.

-

The insurer will continue growing via M&A and is looking for $50mn-$500mn specialty businesses with strong leadership to expand its portfolio.

-

Enstar is conducting due diligence around taking on the rest of the Argo back book.

-

The second PRF program to receive Core Specialty paper will provide excess coverage limits up to $5mn, attaching between $1mn and $5mn.

-

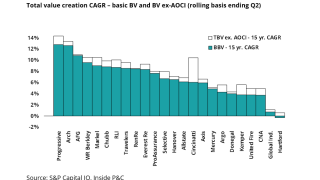

The two specialty insurers reported strong Q3 2022 earnings, continuing to outperform the commercial industry in underwriting gains and value creation.

-

Core Specialty CEO Jeff Consolino noted that the recent Hallmark deal places the firm among the 20 largest E&S writers.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

AM Best placed Hallmark under review with negative implications immediately after the confirmation of the deal with Core.

-

The deal would add upwards of 200 staff to the specialty insurer’s staff, and take its E&S business close to $1bn of premiums.

-

The ratings agency also affirmed the company’s financial strength rating (FSR) of A- and long-term issuer credit ratings of a-.

-

The executive will report to Bill Fischer, president of the company’s agriculture unit.