ESG

-

Similar bills targeting fossil fuel firms have been introduced in other states.

-

The charity said that improved ecosystems could help protect from disasters.

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

-

Economic volatility, including from tariffs and rising interest rates, is reshaping risk profiles for specialty insurers.

-

The awards, now in their fifth year, will be held in New York at 583 Park Avenue on September 25.

-

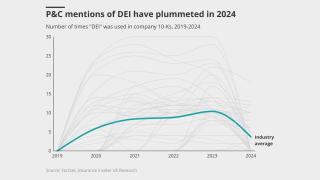

Top companies eliminated or heavily modified language related to DEI this year, analysis shows.

-

It is the second deliverable of the FIT Transition Plan Project.

-

A first-of-its-kind resolution adopted this week says subrogation can reduce insurance costs.

-

The decision comes after the agency refused to block a climate related vote at Travelers.

-

The decision is the first of its kind under the new Trump administration.

-

The suit accuses CEO Brian Cornell and other Target executives.

-

Anti-DEI shareholder activist groups are targeting directors and officers with increasing threats of litigation.

-

Frequency and severity of claims is starting to rise, and comes after sharp softening of rates.

-

The report aims to plug the gap in insurance-specific guidance.

-

The plaintiff is seeking damages in excess of $35,000 as well as a trial by jury.

-

The US regulator faces litigation from both sides of the climate issue.

-

The companies originally established the capacity agreement in January 2023.

-

A more business-friendly approach will be offset by increased uncertainty.

-

ECLiC discussed how climate litigation can impact the Lloyd’s market.

-

A new Geneva Association report says the early involvement of (re)insurers is key to supporting the growth of emerging technologies.

-

Directors and officers face an increased risk of litigation next year, according to a report.

-

With this approval, Aon brokers and clients can begin placing insurance through wholesaler and MGU Embrace.

-

The 30-strong segment will combine reinsurance and capital markets with data, analytics and technology.

-

A summary of commentary from the second day of Inside P&C New York, with insights on InsurTechs, MGAs and Vesttoo.

-

The report also highlighted general liability policies as an area of potential exposure to insurers.

-

The Net-Zero Insurance Alliance has said its Target-Setting Protocol will now serve as a “voluntary best-practice guide”.

-

A six-month deadline for carriers to publish emissions targets could be dropped.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

While insurance regulators are making headway in accounting for climate-related risks, these efforts are preliminary and fragmented across states.

-

The executive worked for WTW for more than two decades.

-

California Insurance Commissioner Ricardo Lara was speaking about climate change's impact on insurance pricing at the Bermuda Climate Summit.

-

The Canadian mutual only announced its membership to the NZIA less than two months ago, joining several high-profile carriers to have exited the alliance.

-

The investigation enquires into how the US insurance industry evaluates, invests in or underwrites fossil fuel expansion projects.

-

The structure envisages bringing in philanthropic capital to provide project funding to mitigate disaster risk as part of ILS deals.

-

Munich Re, Swiss Re, Hannover Re and Zurich have all abandoned the project in the past eight weeks.

-

A report from WTW and the Institute of International Finance has found little correlation between companies’ operation emissions intensity and their climate transition value-at-risk.

-

The Swiss reinsurer follows Munich Re, Hannover Re and Zurich in withdrawing from the alliance.

-

In the latest threat to the NZIA, 23 state AG have warned members that collaboration on decarbonization targets may not square with federal law.

-

Beneva has signed up to net-zero targets as a member of the NZIA, following a period of turbulence in which Munich Re, Zurich and Hannover Re have left the alliance.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Zurich’s decision comes less than a week after Munich Re decided to withdraw from the UN-backed initiative.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Industry climate alliances have received allegations from conservative politicians and regulators in the US that such commitments are illegal group activities that violate antitrust laws.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Maria Guercio, Melanie Markwick-Day and Jared Concannon join the unit as executives.

-

The decision is the carrier’s latest step in its ambition to transition to a low-carbon economy.

-

Human rights groups have issued a complaint to a US mediation body alleging that Marsh has violated OECD guidelines for corporate standards.

-

The insurance industry must use its extensive risk management expertise to mitigate the risks of climate change, the chair says.

-

The company has also employed Margaret Peloso as global climate officer.

-

Several structural factors, including the pricing cycle, make insurers more insulated from US activist states.

-

The correlation between a good ESG score and low loss ratio is strongest in property insurance, the report shows.

-

The project, funded by Agence Française de Développement, was revealed during the G20 Leaders’ Summit in Bali.

-

Marsh McLennan is mobilising the insurance industry to support the UN’s Race to Resilience initiative, starting by featuring 17 climate adaptation projects.

-

The broker warned that more insurers will restrict or drop oil and gas business in the coming years.

-

The Federal Insurance Office seeks to collect underwriting data on homeowners’ insurance from carriers writing above $100mn in premium.

-

The transport sector has the largest investment gap, needing an estimated $114tn to build greener infrastructure.

-

The tool scores (re)insurers’ books on a scale of one to five on how well they serve communities.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

While regulations and shareholder proposals draw concerns, the insurance industry also sees ESG efforts as tool for drawing new blood to the business.

-

Sources noted that competition has expanded from excess layers into the primary market – and that has been a major development since the beginning of the year.

-

The hydrogen industry is a key pillar of the energy transition, but securing insurance coverage is challenging.

-

Greenberg said Chubb will not set a net-zero timeframe until the carrier finds out how to monitor the reduction of carbon footprint in its underwriting portfolio.

-

As the federal government tightens rules on PFAS and lawsuits swell, calculating the exposure for the insurance industry is a daunting task.

-

Shareholders also narrowly voted against a proposal relating to a third-party racial equity audit.

-

Clients face under-insurance for BI if their coverage is not adjusted to reflect energy price rises.

-

The carrier has also disclosed carbon emission breakdowns across its underwriting portfolios, as well as D&I figures for its workforce, in an ESG report.

-

Shareholders approved a second proposal asking for a report detailing how Chubb is addressing greenhouse gas emissions.

-

Capgemini’s report said insurers needed to embed climate strategies into operating models and fundamentally change data strategy.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The expectation that we would be talking about the slowing of the brokerage supercycle proved to be misplaced.

-

The new Coaction has also converted to a public benefit corporation (PBC), making it the first commercial P&C insurer to do so.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Through the collaboration, the two companies will work together to help clients with their investment strategy decisions by providing data sets, analytics and insights into ESG portfolio-level exposures.

-

Chubb has also received demands from shareholders for more information on its climate-related policies.

-

Chubb and Travelers are targeted as “climate laggards” by a shareholder group that wants the insurers to step up monitoring the impact of underwriting and investment activities.

-

The council comprises Cindy Bruyère, Henk Dijkstra, Kenneth E Kunkel and Park Williams.

-

Carriers are planning to increase their allocation most significantly to private equity (44%) and green or impact bonds (42%).

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The carrier has introduced a number of ESG-focused roles, which sees Cathal Carr, SVP, underwriting, appointed as global head of climate and sustainability strategy.

-

To help achieve its goal, Marsh McLennan has selected seven carbon-offset projects across the world.

-

The SEC intends to make information around climate-related risks more transparent.

-

Liberty Mutual will provide US and Canadian clients that sign up for Marsh’s tool with ESG risk advisory services.

-

The global insurer has added a "net-zero emissions" goal of 2050 for investments and underwriting.

-

The UN’s Principles for Sustainable Insurance is helping to ensure ESG practices are embedded across all aspects of the insurance industry.

-

The recommended range for absolute emissions reductions by 2025 should be 49%-65% or more of members’ portfolios.

-

The broker said terms and pricing were not significantly impacted by new capacity from oil and gas players.

-

The broker said the last three years of hardening had led to a “substantial technical correction”.

-

Project Leaf will see environmental, social and governance (ESG) information issues woven into Aspen’s decision making for its credit and political risk portfolio.

-

A panel of Aon experts discussed cyber, ESG, cat risk and consumer behavior in 2022.

-

Carriers are planning for inflationary threats and have been responding to major catastrophes, while the InsurTech and broking markets have driven M&A drama.

-

Constance Hunter previously served as KPMG’s chief economist and has nearly three decades of experience in the financial sector.

-

A new report sets out how to scale insurance and capital for environmental protection projects, for a sector estimated to reach $50bn in size by 2030.

-

In his new role, Francis Bouchard will work closely with executives and climate leaders across the company’s four businesses.

-

The group’s first event will be held in Los Angeles, with more chapters to follow.

-

Local officials have warned that the cost of rebuilding in British Columbia could exceed C$1bn ($790m).

-

Record rainfall has caused floods and landslides across the Canadian province of British Columbia, leading to at least one death and cutting all rail access to the country’s largest port in Vancouver, according to Reuters.

-

The broker said that weather-related losses had become more severe in the past decade because of climate change.

-

The insurance industry is uniquely positioned to bolster the transition to net zero and improve resilience to climate shocks, according to Selwin Hart, UN assistant secretary-general for climate change.

-

Survey results found that 69% of P&C carriers believe disregarding ESG factors would lead to “elevated reputational risk”.

-

ESG is emerging as a key threat to D&O insurers as pressure grows on companies to provide disclosures.

-

It is possible to imagine the emergence of forces that could disrupt the new status quo on corporate responsibility.

-

The carrier will phase out thermal coal business and invest $20mn in a green investment fund.

-

With a $3mn commitment from Z Zurich Foundation, the program will address social issues in Houston and Boston.

-

The growing trend of InsurTech MGAs looking to transition to balance sheet companies has exposed the shortcomings of the MGA InsurTech model, TigerRisk president Rob Bredahl has said.

-

Increasing cat losses, combined with social inflation, put ESG and climate change at top of the mind even as the market sees strong growth, says Guy Carpenter’s John Trace.

-

The executive said such a move would result in the business being written elsewhere.

-

A watertight ESG strategy would be focused around paying more tax, approving more claims and pro bono advisory work from the brokers at scale.

-

The broker warned that the risk of a systemic cyber loss “is beginning to feel more like an inevitability.”

-

In the months leading up to (Re)Connect and the wider conference season, the discussion around climate and ESG has become noticeably more urgent.

-

The US Treasury’s Federal Insurance Office is requesting information on climate-related financial risks within the insurance industry.

-

Lloyd’s report details how the Corporation will support carriers and their clients across the main themes of greener energy, industry and transport.

-

The RAA pushes plan to use public, private dollars to shore up communities most at risk from climate-related disasters.

-

The insurer has published its first-ever ESG report, detailing diversity and equality initiatives, along with pledges to cut carbon emissions.