ESG

-

Similar bills targeting fossil fuel firms have been introduced in other states.

-

The charity said that improved ecosystems could help protect from disasters.

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

-

Economic volatility, including from tariffs and rising interest rates, is reshaping risk profiles for specialty insurers.

-

The awards, now in their fifth year, will be held in New York at 583 Park Avenue on September 25.

-

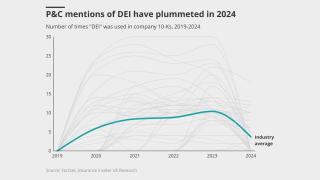

Top companies eliminated or heavily modified language related to DEI this year, analysis shows.

-

It is the second deliverable of the FIT Transition Plan Project.

-

A first-of-its-kind resolution adopted this week says subrogation can reduce insurance costs.

-

The decision comes after the agency refused to block a climate related vote at Travelers.

-

The decision is the first of its kind under the new Trump administration.

-

The suit accuses CEO Brian Cornell and other Target executives.

-

Anti-DEI shareholder activist groups are targeting directors and officers with increasing threats of litigation.

-

Frequency and severity of claims is starting to rise, and comes after sharp softening of rates.

-

The report aims to plug the gap in insurance-specific guidance.

-

The plaintiff is seeking damages in excess of $35,000 as well as a trial by jury.

-

The US regulator faces litigation from both sides of the climate issue.

-

The companies originally established the capacity agreement in January 2023.

-

A more business-friendly approach will be offset by increased uncertainty.

-

ECLiC discussed how climate litigation can impact the Lloyd’s market.

-

A new Geneva Association report says the early involvement of (re)insurers is key to supporting the growth of emerging technologies.

-

Directors and officers face an increased risk of litigation next year, according to a report.

-

With this approval, Aon brokers and clients can begin placing insurance through wholesaler and MGU Embrace.

-

The 30-strong segment will combine reinsurance and capital markets with data, analytics and technology.

-

A summary of commentary from the second day of Inside P&C New York, with insights on InsurTechs, MGAs and Vesttoo.

-

The report also highlighted general liability policies as an area of potential exposure to insurers.

-

The Net-Zero Insurance Alliance has said its Target-Setting Protocol will now serve as a “voluntary best-practice guide”.

-

A six-month deadline for carriers to publish emissions targets could be dropped.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

While insurance regulators are making headway in accounting for climate-related risks, these efforts are preliminary and fragmented across states.

-

The executive worked for WTW for more than two decades.

-

California Insurance Commissioner Ricardo Lara was speaking about climate change's impact on insurance pricing at the Bermuda Climate Summit.

-

The Canadian mutual only announced its membership to the NZIA less than two months ago, joining several high-profile carriers to have exited the alliance.

-

The investigation enquires into how the US insurance industry evaluates, invests in or underwrites fossil fuel expansion projects.

-

The structure envisages bringing in philanthropic capital to provide project funding to mitigate disaster risk as part of ILS deals.