ESG

-

Similar bills targeting fossil fuel firms have been introduced in other states.

-

The charity said that improved ecosystems could help protect from disasters.

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

-

Economic volatility, including from tariffs and rising interest rates, is reshaping risk profiles for specialty insurers.

-

The awards, now in their fifth year, will be held in New York at 583 Park Avenue on September 25.

-

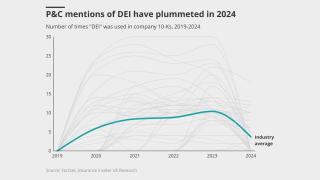

Top companies eliminated or heavily modified language related to DEI this year, analysis shows.

-

It is the second deliverable of the FIT Transition Plan Project.

-

A first-of-its-kind resolution adopted this week says subrogation can reduce insurance costs.

-

The decision comes after the agency refused to block a climate related vote at Travelers.

-

The decision is the first of its kind under the new Trump administration.

-

The suit accuses CEO Brian Cornell and other Target executives.

-

Anti-DEI shareholder activist groups are targeting directors and officers with increasing threats of litigation.

-

Frequency and severity of claims is starting to rise, and comes after sharp softening of rates.

-

The report aims to plug the gap in insurance-specific guidance.

-

The plaintiff is seeking damages in excess of $35,000 as well as a trial by jury.

-

The US regulator faces litigation from both sides of the climate issue.

-

The companies originally established the capacity agreement in January 2023.

-

A more business-friendly approach will be offset by increased uncertainty.

-

ECLiC discussed how climate litigation can impact the Lloyd’s market.

-

A new Geneva Association report says the early involvement of (re)insurers is key to supporting the growth of emerging technologies.

-

Directors and officers face an increased risk of litigation next year, according to a report.

-

With this approval, Aon brokers and clients can begin placing insurance through wholesaler and MGU Embrace.

-

The 30-strong segment will combine reinsurance and capital markets with data, analytics and technology.

-

A summary of commentary from the second day of Inside P&C New York, with insights on InsurTechs, MGAs and Vesttoo.

-

The report also highlighted general liability policies as an area of potential exposure to insurers.

-

The Net-Zero Insurance Alliance has said its Target-Setting Protocol will now serve as a “voluntary best-practice guide”.

-

A six-month deadline for carriers to publish emissions targets could be dropped.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

While insurance regulators are making headway in accounting for climate-related risks, these efforts are preliminary and fragmented across states.

-

The executive worked for WTW for more than two decades.

-

California Insurance Commissioner Ricardo Lara was speaking about climate change's impact on insurance pricing at the Bermuda Climate Summit.

-

The Canadian mutual only announced its membership to the NZIA less than two months ago, joining several high-profile carriers to have exited the alliance.

-

The investigation enquires into how the US insurance industry evaluates, invests in or underwrites fossil fuel expansion projects.

-

The structure envisages bringing in philanthropic capital to provide project funding to mitigate disaster risk as part of ILS deals.

-

Munich Re, Swiss Re, Hannover Re and Zurich have all abandoned the project in the past eight weeks.

-

A report from WTW and the Institute of International Finance has found little correlation between companies’ operation emissions intensity and their climate transition value-at-risk.

-

The Swiss reinsurer follows Munich Re, Hannover Re and Zurich in withdrawing from the alliance.

-

In the latest threat to the NZIA, 23 state AG have warned members that collaboration on decarbonization targets may not square with federal law.

-

Beneva has signed up to net-zero targets as a member of the NZIA, following a period of turbulence in which Munich Re, Zurich and Hannover Re have left the alliance.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Zurich’s decision comes less than a week after Munich Re decided to withdraw from the UN-backed initiative.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Industry climate alliances have received allegations from conservative politicians and regulators in the US that such commitments are illegal group activities that violate antitrust laws.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Maria Guercio, Melanie Markwick-Day and Jared Concannon join the unit as executives.

-

The decision is the carrier’s latest step in its ambition to transition to a low-carbon economy.

-

Human rights groups have issued a complaint to a US mediation body alleging that Marsh has violated OECD guidelines for corporate standards.

-

The insurance industry must use its extensive risk management expertise to mitigate the risks of climate change, the chair says.

-

The company has also employed Margaret Peloso as global climate officer.

-

Several structural factors, including the pricing cycle, make insurers more insulated from US activist states.

-

The correlation between a good ESG score and low loss ratio is strongest in property insurance, the report shows.

-

The project, funded by Agence Française de Développement, was revealed during the G20 Leaders’ Summit in Bali.

-

Marsh McLennan is mobilising the insurance industry to support the UN’s Race to Resilience initiative, starting by featuring 17 climate adaptation projects.

-

The broker warned that more insurers will restrict or drop oil and gas business in the coming years.

-

The Federal Insurance Office seeks to collect underwriting data on homeowners’ insurance from carriers writing above $100mn in premium.

-

The transport sector has the largest investment gap, needing an estimated $114tn to build greener infrastructure.

-

The tool scores (re)insurers’ books on a scale of one to five on how well they serve communities.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

While regulations and shareholder proposals draw concerns, the insurance industry also sees ESG efforts as tool for drawing new blood to the business.

-

Sources noted that competition has expanded from excess layers into the primary market – and that has been a major development since the beginning of the year.

-

The hydrogen industry is a key pillar of the energy transition, but securing insurance coverage is challenging.

-

Greenberg said Chubb will not set a net-zero timeframe until the carrier finds out how to monitor the reduction of carbon footprint in its underwriting portfolio.

-

As the federal government tightens rules on PFAS and lawsuits swell, calculating the exposure for the insurance industry is a daunting task.

-

Shareholders also narrowly voted against a proposal relating to a third-party racial equity audit.

-

Clients face under-insurance for BI if their coverage is not adjusted to reflect energy price rises.

-

The carrier has also disclosed carbon emission breakdowns across its underwriting portfolios, as well as D&I figures for its workforce, in an ESG report.

-

Shareholders approved a second proposal asking for a report detailing how Chubb is addressing greenhouse gas emissions.

-

Capgemini’s report said insurers needed to embed climate strategies into operating models and fundamentally change data strategy.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The expectation that we would be talking about the slowing of the brokerage supercycle proved to be misplaced.

-

The new Coaction has also converted to a public benefit corporation (PBC), making it the first commercial P&C insurer to do so.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Through the collaboration, the two companies will work together to help clients with their investment strategy decisions by providing data sets, analytics and insights into ESG portfolio-level exposures.

-

Chubb has also received demands from shareholders for more information on its climate-related policies.

-

Chubb and Travelers are targeted as “climate laggards” by a shareholder group that wants the insurers to step up monitoring the impact of underwriting and investment activities.

-

The council comprises Cindy Bruyère, Henk Dijkstra, Kenneth E Kunkel and Park Williams.

-

Carriers are planning to increase their allocation most significantly to private equity (44%) and green or impact bonds (42%).

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The carrier has introduced a number of ESG-focused roles, which sees Cathal Carr, SVP, underwriting, appointed as global head of climate and sustainability strategy.

-

To help achieve its goal, Marsh McLennan has selected seven carbon-offset projects across the world.

-

The SEC intends to make information around climate-related risks more transparent.

-

Liberty Mutual will provide US and Canadian clients that sign up for Marsh’s tool with ESG risk advisory services.

-

The global insurer has added a "net-zero emissions" goal of 2050 for investments and underwriting.

-

The UN’s Principles for Sustainable Insurance is helping to ensure ESG practices are embedded across all aspects of the insurance industry.

-

The recommended range for absolute emissions reductions by 2025 should be 49%-65% or more of members’ portfolios.

-

The broker said terms and pricing were not significantly impacted by new capacity from oil and gas players.

-

The broker said the last three years of hardening had led to a “substantial technical correction”.

-

Project Leaf will see environmental, social and governance (ESG) information issues woven into Aspen’s decision making for its credit and political risk portfolio.

-

A panel of Aon experts discussed cyber, ESG, cat risk and consumer behavior in 2022.

-

Carriers are planning for inflationary threats and have been responding to major catastrophes, while the InsurTech and broking markets have driven M&A drama.

-

Constance Hunter previously served as KPMG’s chief economist and has nearly three decades of experience in the financial sector.

-

A new report sets out how to scale insurance and capital for environmental protection projects, for a sector estimated to reach $50bn in size by 2030.

-

In his new role, Francis Bouchard will work closely with executives and climate leaders across the company’s four businesses.