Greenlight Capital

-

The Caymans-based reinsurer’s Q3 CoR was 86.6%, down 9.3 points YoY.

-

The specialty reinsurer also saw several bad investments hit the books.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The firm expects to replace the volume with Innovations-channel business.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Aviation reserve strengthening added 10.1 points to the combined ratio.

-

The carrier reported total cat losses of $48.9mn during Q1-Q3 2024, versus $20.2mn in 2023.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The ratings agency cited a steady improvement in operating performance.

-

The firm’s exposure to US SCS was almost exclusively related to a non-renewed homeowners’ program.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The bridge disaster added 6.3pts points to the company’s overall CoR in Q1.

-

This is Burton’s last earnings call as the reinsurer’s CEO, as the firm recently appointed TransRe’s Greg Richardson to succeed him effective January 1.

-

The incoming chief exec was previously chief risk and strategy officer at TransRe from 2014 to 2023 and was CUO and held other strategic planning and underwriting roles at Harbor Point Re from 2006 to 2013.

-

Simon Burton has been CEO of the Cayman Islands-based total return (re)insurer since mid-2017.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

To seize the market opportunity, the company plans to raise non-convertible debt with closure expected in Q2 2023.

-

Property cat rates went up 50% while aviation, PVT and marine saw rises of around 25%+ during January renewals.

-

Hedge fund reinsurer Greenlight Re posted a 57.2% loss ratio for the fourth quarter, marking a 1.6-point improvement from the prior-year period.

-

Romer will succeed Neil Greenspan, who is leaving the reinsurer at the end of March.

-

Kagabo Ngiruwonsanga has also been elevated to head of underwriting of innovations.

-

The executive noted that the firm has low exposure to cyber and secondary cat perils but said these are areas of opportunity in the next six months.

-

The Cayman Islands-headquartered firm said its underwriting improvement in Q2 was driven by the shift in business mix to higher-margin lines of business.

-

The company had a combined ratio of 106.2%, compared to 101.5% for the first quarter of 2021.

-

Burton told analysts that the January 2022 renewals marked the end of the carrier’s portfolio turnaround that had begun in 2017.

-

Cayman Islands-based Greenlight Re's Q4 results were boosted by $11.5mn of favorable prior-year development and premium increases at its Lloyd’s and financial lines businesses.

-

Greenlight Re Innovations invests in platform that can provide on-demand, per-shipment cover.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Greenlight CEO Simon Burton described title insurance as the perfect example of an inefficient marketplace with high expense ratios.

-

The executive also noted that proactively reducing Greenlight’s exposure to the auto market was a “good decision."

-

David Einhorn, the hedge fund reinsurer’s chairman, said the results "do not reflect the significant progress" Greenlight has made in revamping its underwriting and operations.

-

Greenlight Capital Re names new leadership and associates for InsurTech venture unit

-

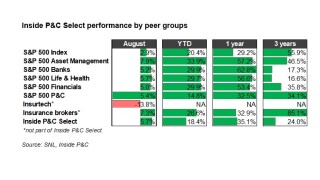

The Inside P&C Select Index outperformed the S&P 500 (5.7% to 2.9%) in August, despite Hurricane Ida making landfall.

-

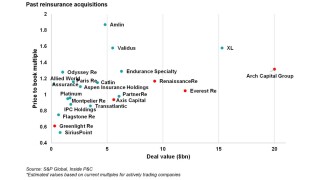

The drivers that led to the consolidation in the reinsurance industry might not replicate for a while.