HCI Group

-

The company anticipates a considerable bump in book value after IPO of subsidiary Exzeo.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The $21/share pricing falls in the middle of the expected range.

-

The tech subsidiary applied to list its common stock on the New York Stock Exchange under the ticker symbol “XZO”.

-

Sources said they expect the carrier’s listing to raise about $100mn.

-

Sources said that the carrier’s listing is expected to raise around ~$100mn.

-

Floir has greenlit at least 14 new companies for operation in Florida in the last few years, contributing to the competition.

-

Despite being hailed as an asset, executives said the current situation is not ideal for either valuation or competitive purposes.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

HCI secured three towers with $3.5bn in XoL coverage.

-

With plenty of reinsurance capacity, CEO Patel said it’s been a “boring year” for treaty negotiations.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

HCI will now consist of two operating units – the other being its four underwriting entities.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The policies represent approximately $35mn of in-force premium.

-

Executives have said that the carrier’s conservative reinsurance program made losses sustainable.

-

The CEO said his company is in good shape despite the landfall of three storms this year.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The policies assumed represent $200mn of in-force premium.

-

HCI is estimated to incur a net expense of $125mn for Milton in Q4 2024.

-

Shares gained after Hurricane Milton did less damage than anticipated.

-

Milton threatens to make landfall in Florida shortly after Helene.

-

Subsidiaries Core and Typtap have applied to participate in the November Citizens policies assumption.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Floridian secured $2.7bn in aggregate limit across two towers.

-

The loss ratio in the business that HCI assumed was also better than anticipated.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

-

Estimates were revised from $845mn to $740mn.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company announced it is undertaking several strategic steps designed to increase operational and capital flexibility and to better position it for future growth opportunities.

-

The assumption brings TypTap’s total in-force premium to $1bn.

-

HCI sold a total of 1.15 million shares of its common stock at a public offering price of $78 per share, before underwriting discounts and commissions.

-

HCI is offering one million common stock shares priced at $78 per share.

-

CORE plans to commence operations in February 2024 by assuming policies representing approximately $75mn of in-force premium from state-backed insurer Citizens.

-

The Floridian was approved for 75,000 policies, made 72,958 offers and assumed 53,750 policies – a 74% acceptance rate.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Awaiting Floir approval, the move will mark the Floridian’s entry into the commercial residential insurance space, CEO Paresh Patel told analysts Tuesday.

-

HCI subsidiary TypTap Insurance Company has received approval from Floir to assume up to 25,000 policies from Florida’s state-owned insurance company.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company had assumed 200,000 policies by the end of Q2 and will now “resume growth to a higher number in the future”, Patel told analysts.

-

The Inside P&C news team runs you through the earnings results for the day.

-

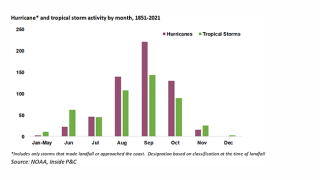

Forecasts for “near-normal” activity may mean the chance at a reprieve for the Florida market, but a history of underestimates warrants caution.

-

The carrier is obligated to use the RAP program and upped its ceded premiums.

-

The stock price went as high as $60.60 per share at midday Wednesday, compared to yesterday’s close at $50.48 per share.

-

HCI was modelling a decrease in claim frequency of about 15% to 20% and in litigation frequency of about 3%.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

HCI will own all its stock, launching it with 2.5 million shares valued at $1 per share.

-

The carrier reported a Q4 consolidated loss ratio of 39.4%, down one point on the year as claims frequency declined while severity stabilized towards the end of the year.

-

The company is confident it has sufficient additional reinsurance capacity should claims begin to develop outside of initial expectations.

-

The Florida carrier suggested that Ian will not exhaust the state’s reinsurance Cat Fund.

-

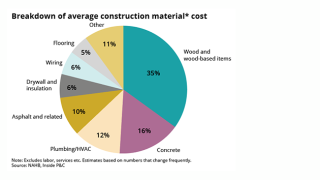

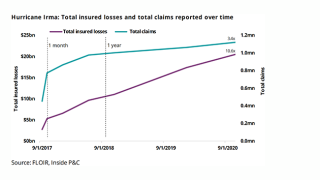

As the loss numbers for Hurricane Ian begin to come into focus, three topics to watch are impact from demand surge, litigation trends, and rate activity.

-

Hurricane Ian’s total effect is still unknown, but lessons from Hurricane Irma give insight into potential outcomes.

-

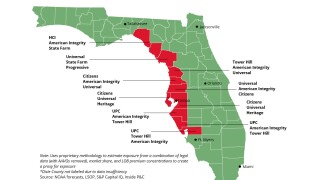

If current forecasts prove accurate, this will be a pivotal moment for the already off-balance Florida cohort and could result in a new market landscape.

-

With the most active hurricane month just a week away, the moment of truth has finally come for the already strained Floridians.

-

The company sees and opportunity to grow market share in the state.

-

The sector was hit by a rough first half of 2022, with more to come in the second half of the year.

-

The US P&C carrier is putting more premium through its captive.