Heritage

-

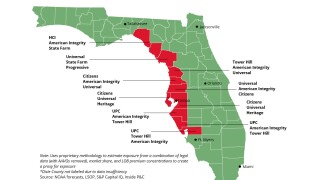

Floir has greenlit at least 14 new companies for operation in Florida in the last few years, contributing to the competition.

-

The carrier sees opportunities to grow in New York, the mid-Atlantic and Florida.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The total cost for the program increased 1.8% from last year’s.

-

California homeowners are also expected to move admitted business to E&S.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Floridian also expects to report its “best earnings quarter” for Q4 2024.

-

Heritage’s Q3 combined ratio improved 10.2 points to 100.6% driven by lower losses and expenses.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

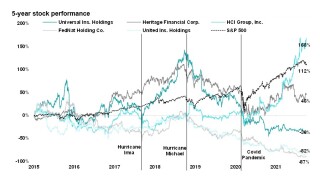

Shares gained after Hurricane Milton did less damage than anticipated.

-

Milton threatens to make landfall in Florida shortly after Helene.

-

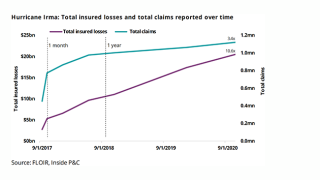

CFO Lusk said the company is about 99.2% closed on claims from the 2017 storm.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The decrease takes effect August 20, 2024, and impacts new and renewal business.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The first event tower exhausts at $1.1bn for the Northeast, $1.3bn for the Southeast and $750mn in Hawaii.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

CFO Kirk Lusk’s base compensation went down 16%, to $800,000 from $950,000, while his annual bonus increased to 65% of base salary.

-

CEO Ernie Garateix, company director Paul Whiting and existing investor Raymond Hyer all agreed to purchase stock.

-

“That’s one of the things we're monitoring ... but I think there are positive signs in the marketplace that litigation is down,” Garateix told analysts on the company’s third-quarter earnings call.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Losses from the Maui wildfire include a modest amount of reinsurance recoveries from the Per Risk reinsurance program, while losses from Hurricane Idalia were fully retained.

-

Executives were speaking after the company reported that its Q2 CoR decreased 4.3 points to 95.1% as Florida policies declined 15.8% from the prior year.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

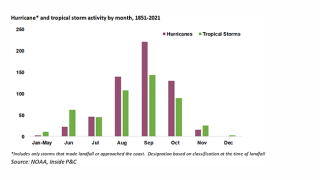

Forecasts for “near-normal” activity may mean the chance at a reprieve for the Florida market, but a history of underestimates warrants caution.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

First event reinsurance tower exhaustion points are $1.3bn for the Northeast, $1.1bn in the Southeast and $870mn in Hawaii.

-

The carrier reported a Q1 2023 combined ratio of 94.5%, which improved 35 points year on year, driven by lower weather losses.

-

The company’s net current accident year weather losses totaled $12.8mn, down from $63.8mn in Q1 2022.

-

The executive has been president of investment firm Seabreeze since 1997.

-

The carrier currently offers excess and surplus lines products in Carolina and Florida.

-

Heritage’s net current accident-year catastrophe losses in the quarter went down 8% to $27.5mn from $29.8mn in Q4 2021.

-

The company can repurchase shares up to $10mn for the period ending December 31, 2023.

-

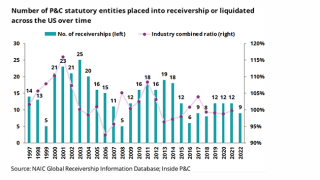

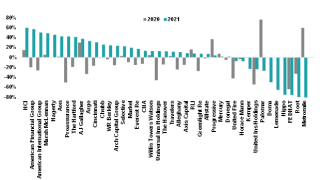

Receivership has been historically lower in the past 20 years, but trouble in Florida breaks away from the overall P&C industry trend.

-

Expanded state reinsurance support and legal reforms will be top priorities as Florida insurers face another retention loss.

-

Over $20mn, the company's reinsurance cover is roughly 40 cents on the dollar, depending on the severity of the storm.

-

The Floridian's net loss ratio jumped nearly 18 points to 97.6%, driven by a $40mn retention from Ian and slightly lower net earned premium than the prior-year quarter.

-

So far, the company has received nearly 12,000 claims associated with the storm.

-

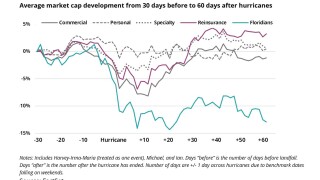

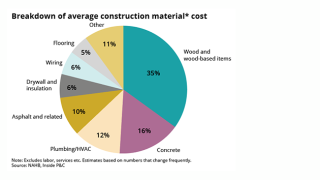

As the loss numbers for Hurricane Ian begin to come into focus, three topics to watch are impact from demand surge, litigation trends, and rate activity.

-

Hurricane Ian’s total effect is still unknown, but lessons from Hurricane Irma give insight into potential outcomes.

-

If current forecasts prove accurate, this will be a pivotal moment for the already off-balance Florida cohort and could result in a new market landscape.

-

With the most active hurricane month just a week away, the moment of truth has finally come for the already strained Floridians.

-

The carrier is continuing diversifying business outside of Florida with an 18.9% reduction in policies in force and a 14.9% reduction of total insured value for Florida.

-

Despite the looming uncertainty for other companies, Heritage's A rating was recently affirmed by Demotech on August 1.

-

The sector was hit by a rough first half of 2022, with more to come in the second half of the year.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The counties include Palm Beach, Polk, Orange, Broward, St Lucie, Escambia, Seminole, Osceola, Lake and Miami-Dade.

-

The company also proactively suspended writing new personal residential policies in various counties in Florida, effective June 3.

-

The Floridian said it had not needed to use the new Reinsurance to Assist Policyholders scheme that was created via new legislation.

-

CFO Kirk Lusk also disclosed that the 74% of the company's TIV is now outside of Florida, up from 69% as of Q1 2021.

-

The Floridian insurer said the write-down reflected prevailing valuation multiples.

-

The Inside P&C research team looks forward to the big issues of the new year.

-

As part of the deal, Heritage will transfer ownership of carrier Pawtucket and MGA First Access, as well as claims and underwriting data.

-

Storm losses were down 30% to $13mn, but the prior-year result had benefitted from a one-off gain.

-

Net cat losses were down, but other weather losses rose by 56% to $35.5mn.

-

Despite four major storms striking the US, Heritage sees Q3 cat losses decline by 35%.

-

Inside P&C's Research team looks at the prospects of Florida's wave of new arrivals.