ILS

-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

MultiStrat, the founder of casualty ILS, is focusing on committed capital to grow, said Bob Forness, CEO, MultiStrat.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The Bermuda SPI will write a quota share of SageSure’s captive Anchor Re.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

The bond will provide named storm and quake coverage in the US.

-

Erik Manning is joining the business from BMS as head of ceded reinsurance.

-

The vehicle will take a quota share of all of the risks underwritten by Ryan Specialty’s MGA arm.

-

Industry sources estimate the market to be around $3bn.

-

The loss aggregator has classified the fires as two separate events for reinsurance purposes.

-

The state insurer is budgeting for an extra 43% of overall coverage in 2025-26.

-

The 2025 target would be ~25% larger than the $3.56bn it placed for 2024.

-

The loss tally is considerably lower than estimates issued by model vendors.

-

The company increased its full year 2024 adjusted net income guidance.

-

The proposals include increasing either statutory or CRTF funds.

-

Citizens also secured $1.1bn of limit for its Everglades Re cat bond.

-

A more consistent trading rhythm returned to the property market, with capacity deployment outside of frequency-exposed layers and more heavily loss-impacted segments bouncing back.

-

The lawsuit, filed Thursday on behalf of Clear Blue and its subsidiaries, alleges that Aon conducted insufficient due diligence on the ILS InsurTech.

-

The Bermudian firm said it expects the acquisition could drive more growth than the prior forecast of $2.7bn incremental premium.

-

In 2021, SiriusPoint acquired a “significant ownership stake” in the firm, which meant the specialty insurer and reinsurer providing multi-year capacity and paper to the ILS house.

-

A summary of commentary from the second day of Inside P&C New York, with insights on InsurTechs, MGAs and Vesttoo.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The company’s targeted Vescor cat bond would have provided collateral to meet auto and other obligations, but there were multiple structural points of risk for investors.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The firm’s statement followed allegations in Israeli tech media of missing collateral linked to deals it was concerned in.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

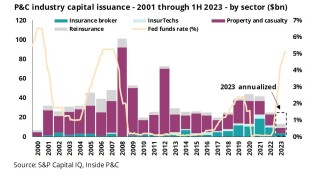

With the macro environment drying up capital streams M&A has slowed, but IPOs are reflective of pricing opportunities.

-

Normalized cat returns of 25%-30% do not seem to be persuading reinsurers to dial up risk.

-

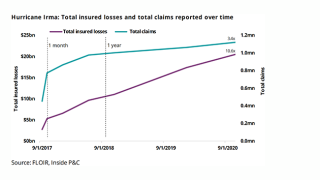

Hurricane Ian’s total effect is still unknown, but lessons from Hurricane Irma give insight into potential outcomes.

-

US investments in the ILS and cat bond market are highly concentrated with five companies accounting for 70% of industry investments.

-

Reinsurers are more bullish about their prospects than they have been in years, but start-up and ILS fundraising is a desert.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The broker put ILS capital at $96bn by year end, $1bn lower than mid-2021 but ahead of its $94bn year-end 2020 estimate.

-

The call came after Markel reported Q1 results that included 21% growth and a 5 point reduction in the combined ratio.

-

Courts in Bermuda and the US approved the move, which had earlier been subject to investor litigation.

-

Sources fear that the issue will be buried after the coming legislative elections in November.

-

Negotiations were dragged out by decisions being referred for sign-off at senior levels.

-

Markel will provide approximately $150mn to facilitate the buyout of the retrocessional segregated accounts of the funds, as well as tail-risk cover to release $100mn of trapped collateral.

-

The business acts as a transformer, allowing traditional asset managers the chance to participate on collateralised (re)insurance transactions.

-

CEO Juan Andrade laid out the new targets in an investor day presentation in which he said the carrier will become a “digital first” (re)insurer.

-

The executive had previously been the head of third-party capital at Axis.

-

Reinsurance recoveries and subrogation payouts helped to minimize retained cat losses to $466mn, post-tax.

-

The executive says the carrier made strides last year in its underwriting and is well positioned for growth.

-

Palomar expanded its underwriting footprint in 2020 as it entered the specialty lines market.

-

The insurer will take a pre-tax net hit of $567mn from the winter loss, implying roughly $700mn of reinsurance recoveries before the impact of reinstatement premiums.

-

The hedge fund reinsurer reports an underwriting loss of $1.1mn for the quarter, a fraction of the typhoon-driven deficit of a year earlier.

-

The broker says the ILS alliance will "meaningfully increase" its capacity in three segments.