Insurers

-

Kemper and Selective’s woes stem partly from own issues, but industry-level issues persist.

-

AIG made the shock announcement earlier today that John Neal is not joining the insurer.

-

Bryant has spent over 30 years with the specialty carrier.

-

The deal to reopen the government also extended the NFIP.

-

After outsized losses, the (re)insurer still sees opportunity in a softening market.

-

The mayor-elect has promised to build 200,000 new units in New York City.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The reinsurance loss ratio improved by over 20 points with no notable cat losses for the quarter.

-

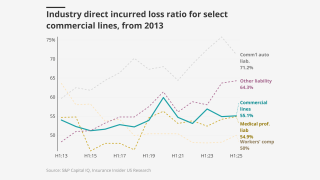

Workers’ compensation was the only line that saw a YoY decrease.

-

Many nuclear verdicts become much less radioactive on appeal.

-

The fashion brand says the insurer failed to defend it in multiple lawsuits.

-

The CEO thanked his friends and colleagues and said he was “going quiet”.

-

Veradace claims the deal benefits Tiptree management at shareholder expense.

-

The newly installed US vice chair explains why inefficiency drove her from legacy firms.

-

The charity said that improved ecosystems could help protect from disasters.

-

The defendant held a $1mn general liability policy with Kinsale.

-

Industry sources said they expect most larger firms will be able to meet the requirements.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

The loss would be one of the largest ever for mining underwriters.

-

The executive said inflation isn’t completely gone but is now “more understood”.

-

The credit can now be applied to mitigation against operational losses.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

State regulators have largely avoided enforceable AI regulations, but bad news could change that.

-

The reserve strengthening stemmed from bodily injury and defense costs for accident years 2023 and prior.

-

Slide does expect a “meaningful” amount of takeouts for this month and next.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company has now posted rate increases for 37 consecutive quarters.

-

The company is also prepared for potential M&A activity.

-

The executive said the firm has grown its casualty business by 80% from 2022.

-

Zaffino said AIG will continue to assess strategic opportunities after the Convex, Onex and Everest deals.

-

Underwriting income for North America quadrupled to $384mn, and the segment recorded a CoR of 82.6%.

-

The chief executive said he doesn’t expect to see a price drop anytime soon.

-

This publication exclusively reported the executive’s plans last month.

-

Casualty rates in Q3 rose 6.1% driven by increases in commercial auto, energy and excess liability.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The insurer reached highs of over 1.4 million policies in September 2023.

-

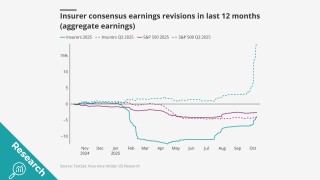

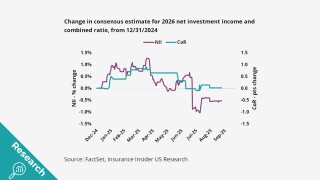

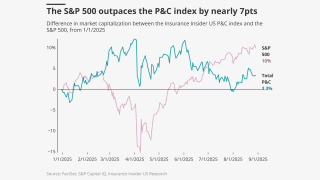

Fears of the oncoming soft market are causing a sector rotation away from P&C.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The global insurer is buying access to distribution and underwriting at a carrier with a 27% GWP CAGR.

-

Widespread underinsurance and low exposures will limit losses.

-

The acquisition will expand PHLY’s presence in the niche market.

-

The executive will fill the role previously held by Howden’s Figliozzi.

-

The search for a CFO had been underway since last July.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Gray specializes in contract bonds for mid-sized and emerging contractors.

-

The insurer paid tribute to the executive’s lasting contributions to the firm.

-

Dairy and livestock products within the agricultural unit were main growth drivers in Q3.

-

The FIO said it will work with regulators on coverage for digital assets.

-

The insurer continues to exit or reduce unprofitable lines and slowed growth as a result.

-

The CEO said the carrier is seeing sequential PIF growth in several states.

-

Sources said that the transaction valued the Californian auto F&I business at over $1bn.

-

Greenberg has strong links with IQUW management, and praised the firm’s leadership and cultural fit.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Exposure for California’s Fair plan has jumped, as insurers drop policyholders.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

The upgrade reflects consistent outperformance of “higher-rated peers”, S&P said.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

The regulations are designed to address long-term solvency concerns.

-

Despite the pricing pressure, margins for the line of business remain attractive, he added.

-

Erbig joins after more than 20 years in finance-related positions at Liberty Mutual.

-

Opportunities for growth remain in small and medium commercial accounts.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The global insurer will need to convince investors on the quality of the book.

-

Jason Keen joined Everest in 2022 as head of international.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

The executive joined the Dallas-based insurer as CUO in 2023.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

This publication revealed the move earlier this year.

-

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

Workers’ comp rates dropped again, but the decline slowed from last quarter.

-

The bill includes provisions to encourage retrofitting homes in high-risk areas.

-

The company sees itself in a “very strong position” in the state.

-

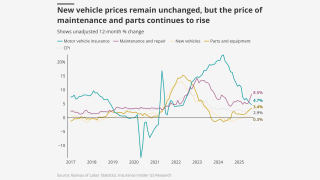

September’s medical care index increase follows a 0.2% drop in August.

-

While limited to only some accounts, it’s a sign of the intense competition in the segment.

-

A canvassing of the cyber market suggests the impact will be negligible.

-

The carrier recently expanded its reinsurance product suite in Bermuda.

-

The range allows “for information that could emerge beyond what is known today”.

-

Haney will remain on board as a senior adviser.

-

Selective’s CEO earlier attributed Q3 adverse development to the NJ market.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Old Republic said the acquisition is expected to close in 2026.

-

The company saw growth accelerate in its property and casualty segments.

-

By line of business, $35mn of the charge relates to commercial auto and $5mn to personal auto.

-

Bill Ross has been CEO of the non-profit for 21 years.

-

Total pre-tax favorable prior period development in the quarter was $361mn, up nearly 48% YoY.

-

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

Pre-tax cat losses were down 63% from the prior year quarter to $285mn.

-

A quiet wind season is also expected to further soften the property market.

-

There’s nothing medical about SAM claims.

-

The CEO also said that the “bloom is off the rose” in the E&S property market.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Northeast Insurance said 55 claims were brought under the Child Victims Act.

-

Early Q3 earnings reports point to worsening market conditions.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

The new chief executive has served on PI’s board since 2018, including as chair.

-

MGAs that are good operators will stick out compared to the rest.

-

Critics claim the dispute system denies consumers' key legal rights.

-

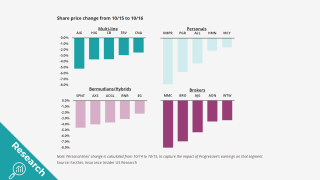

The selloff may hint at headwinds for equity investors.

-

An average of 81% of property accounts renewed flat or down.

-

The firm also expects to increase share repurchases in Q4 to roughly $1.3bn.

-

Private capital–backed buyers accounted for 73% of the 513 transactions this year.

-

The tech subsidiary applied to list its common stock on the New York Stock Exchange under the ticker symbol “XZO”.

-

The carrier reported favorable reserve development of $22mn compared to $126mn in Q3 last year.

-

As the Great Japanese M&A Contest develops, the executive said inorganic expansion is “a top priority”.

-

The insurer booked a $950mn policyholder credit expense in September.

-

State Farm is under investigation as its premiums have been rising “drastically".

-

Joseph Lacher will step down as president and CEO and resign from the board.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

A US district judge ruled a delay could put human life and property at risk.

-

The federal panel hasn’t finalized a timeline for formulating the new rules.

-

The reshuffle is likely laying the foundations for the eventual succession to CEO Mario Greco.

-

Mike Mulray joins from Everest, where he was EVP president of North America insurance.

-

Trade credit insurers are expected to respond with tighter buyer limits and stricter wordings.

-

The international division is seeking a new London market manager.

-

Growth concerns were top of mind at this year’s conference.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

The division mostly places higher up the tower, where many insurers have taken action to address SAM losses.

-

The governor has yet to sign a pending bill to create a public cat model.

-

Lighter cat losses a plus, while top-line, organic growth and reserving concerns persist.

-

Moretti has relocated to California from London.

-

The state’s AG said the case threatens continued offshore oil and gas operations.

-

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

Lupica moved to the role last year as part of a staggered handover of responsibilities to Juan Luis Ortega.

-

The executive was formerly EVP and central regional leader at Aon.

-

The executive said record operating income and returns don’t indicate Chubb is “beleaguered”.

-

The specialty insurer was recently acquired by Korean carrier DB Insurance.

-

When owners are not paying attention, discipline and governance are not top priorities.

-

The charges allege “egregious delays” and “unreasonable denials” in claims.

-

The two executives join from Markel and Arch, respectively.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

It is understood around $1bn of premiums could be ceded to the proposed vehicle.

-

The company will implement a new leadership structure after his departure.

-

The new unit will be led by former Emerald Bay exec George Dragonetti.

-

The request cites use of Verisk’s forward-looking wildfire model.

-

New home sales could be impacted by a prolonged stalemate.

-

Insurers continue to compete on price, especially in the SME sector.

-

Proceeds will be used to pay off debt maturing at the end of the year and to support new market growth.

-

The promotions are part of the carrier's strategy to increase property-liability market share.

-

The executive was most recently serving as CRO – insurance.

-

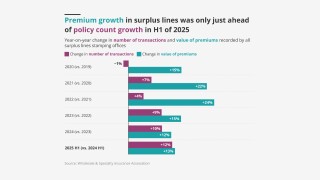

Trailing three month premiums were up 7.2% versus 13.1% in August.

-

The move is the latest in a series of casualty leadership shake-ups at the insurer.

-

Superintendent Harris is stepping down this month after four years of service.

-

Sexual abuse and molestation exclusions are starting to hold in higher layers of hospital towers this year.

-

The specialty insurer posted $800mn in GWP for the first six months of the year.

-

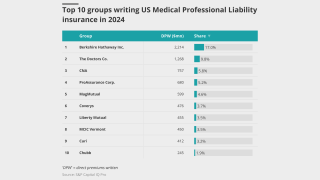

The change reflects the insurers’ recent deal with ProAssurance.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

AIG’s filing alleges copyright and trademark breaches, as well as violations of unfair business practice laws.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

The jump in the latest estimate could be due to damage to seasonal properties only being recently discovered.

-

Verisk's recent deals and its interest in cyber-analytics firm CyberCube show M&A in the segment has ticked up.

-

The company will continue its capacity partnership with the MGA until 2030.

-

The subsidiary will offer primary and excess liability.

-

The executive previously spent more than 16 years at The Hartford.

-

The NHC also warned that a hurricane watch could be required in Bermuda as early as Monday afternoon.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

The $20bn+ TIV data center is seen as the leading edge of significant new demand.

-

The New York City gala paid tribute to the industry’s top talent.

-

Lower rates mean lower investment incomes and higher book values for insurers.

-

The transaction marks the largest US market entry by a Korean non-life insurer.

-

Juries don’t significantly differentiate in cases involving severe injury.

-

He will drive the growth of Chubb's claims-made excess casualty facility.

-

Getting that message across is key to bettering the industry.

-

With the deal, sources expect backers Tiptree and Warburg Pincus to exit the Floridian insurer.

-

Sources said they expect the carrier’s listing to raise about $100mn.

-

The executive has been with ASG since it was formed in 2016.

-

The insurance industry’s lower reliance on foreign skilled workers softens the blow.

-

Rates continue to be favorable for buyers across major lines of coverage.

-

He will spearhead the division’s launch slated for 2026, which will be the first product launch for ICW Group’s specialty unit.

-

Economic volatility, including from tariffs and rising interest rates, is reshaping risk profiles for specialty insurers.

-

Despite the formation of Gabrielle, there is "a very high probability" of a below-average season.

-

Sources said that the carrier’s listing is expected to raise around ~$100mn.

-

The risk also ranked as a top three concern for companies of all sizes.

-

The WCB has denied the allegations, claiming its decisions were based on “reasonable investigations”.

-

The proposed changes aim to establish clear guidelines for intervenors.

-

Cat losses in August were below historical trends, but we are not in the clear just yet.

-

The Inigo CEO said the lack of portfolio crossover was highly attractive to Inigo.

-

The US mortgage insurer announced its $1.7bn acquisition of Inigo earlier today.

-

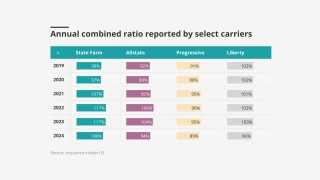

Despite tort reform, physicians’ insurers are struggling with the same loss inflation challenges as other liability peers.

-

Average incident costs for SMEs were up nearly 30%.

-

The Chicago-based executive was previously Everest’s CUO of excess casualty.

-

The executive’s skepticism is informed by the industry’s typical approach to cyclicality.

-

As data privacy litigation increases, insurers increasingly lean on exclusions.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

There will also be a renewed focus on organic growth, both in P&C and across US and international operations.

-

While the Fed is more concerned with jobs, other macroeconomic concerns trouble the industry.

-

Vantage Group Holdings received a BBB- long-term issuer credit rating.

-

This follows the news that AmTrust will spin off some of its MGA businesses.

-

The executive joins from MSIG USA.

-

Following the Golden Age of Specialty, franchise quality will play a bigger role in determining success.

-

The Berkshire subsidiary is seeking coverage for a $22mn antitrust loss.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

Winners and losers will emerge more clearly, with less opportunity to ride the market wave.

-

A report by the ratings agency challenges current industry wisdom.

-

He was appointed CUO of casualty, Americas, in July last year.

-

The executive previously held roles at The Hanover, CNA and AIG.

-

Tricia Loney brings 20 years of industry experience to the role.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

Florida led deregulation by eliminating the diligent effort rule in June.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

-

The platform aims to “bend the loss curve”.

-

Ransomware claims have made up the majority of recent large losses.

-

He joins the company after 22 years in casualty leadership roles at Chubb.

-

The company saw a 53% decrease in cyber claims after a surge in 2024.

-

Persistent social inflation challenges evident across key long-tail lines at half-year mark.

-

All rates were up on a year-over-year basis, except for workers’ compensation.

-

The fundraising round brought in $50mn for the insurer.

-

The ratings outlook has also been revised to stable from negative.

-

One of the options being explored is setting up a dedicated company for the wholesale vertical.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

Clients in the segments that AIG trades in may not be as receptive to the idea as the insurer would like.

-

The bi-partisan legislation would make FEMA a cabinet-level agency.

-

Growth in the SME sector could help stabilize the market, however.

-

P&C stocks recovered faster than the S&P 500 following a late July dip, but a gap remains.

-

The US specialty carrier announced Tuesday that it was buying the Lloyd's business for $555mn.

-

The executive said claims can be a differentiator in a softening market.

-

The rest of 2025 appears poised to remain favorable for insureds, however.

-

California, Florida and Texas all saw decreases in monthly premium growth.

-

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

The data modeling firm said losses previously averaged $132bn annually.