Header

Your dedicated content hub

Fuel a smarter strategy with our actionable market intelligence

James River News

James River in the News

Competitor news

What Your Competitors are Reading

Competitor news

-

The move comes after Everest sold renewal rights for its global retail business to AIG.

-

The appointment follows Everest’s $2bn renewal rights sale of its commercial retail business to AIG.

-

The platform will debut in Germany before an accelerated global rollout in 2026-27.

-

The CEO thanked his friends and colleagues and said he was “going quiet”.

-

The executive most recently served as the company’s chief broking officer.

-

California may not be the only state to see non-economic damage caps in medmal get challenged.

-

Sources said the executive will report to Julian Pratt in South Florida.

-

Success in the soft market will be had when careful preparation meets opportunity.

-

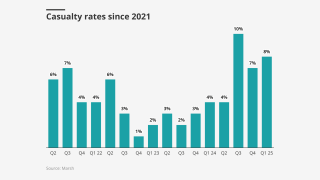

Rate decreases are often in double digits, but high loss trends and systemic risk persist.

-

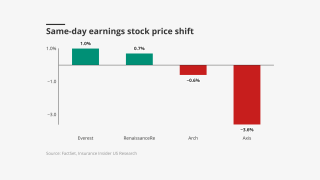

Both the primary and reinsurance segments benefitted from a light cat year.

-

The executive will fill the role previously held by Howden’s Figliozzi.

-

CEO Greg Case said data center demand could generate over $10bn in new premium volume in 2026.

-

The broker grew earnings per share by 12.1% during the quarter.

-

The broker will join Ron Borys’ financial lines team.

-

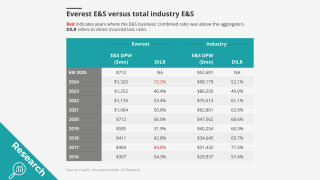

A re-focus on reinsurance nearly brings Everest back where it started.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

Sources said that the businesses in Canada and LatAm were part of Everest’s original plans to sell its retail book.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

Despite the pricing pressure, margins for the line of business remain attractive, he added.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The global insurer will need to convince investors on the quality of the book.

-

Jason Keen joined Everest in 2022 as head of international.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

Ben Hanback joins from Aon, where he spent almost a decade.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Rachel Turk was speaking on an Aon Reinsurance Renewal Season panel.

-

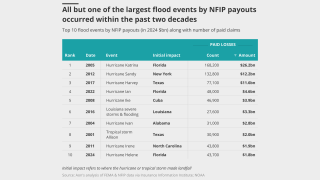

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

The state’s AG said the case threatens continued offshore oil and gas operations.

-

The executive was formerly EVP and central regional leader at Aon.

-

The executive has been at the broker for over 20 years.

-

The executive has worked for Aon for almost two decades.

-

The move is the latest in a series of casualty leadership shake-ups at the insurer.

-

Cyberattack/data breach remains in the top slot.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The $20bn+ TIV data center is seen as the leading edge of significant new demand.

-

The executive will join Howden’s new US retail broking operation.

-

He will spearhead the division’s launch slated for 2026, which will be the first product launch for ICW Group’s specialty unit.

-

The executive will initially focus on casualty fac business incoming as the result of the Markel renewal rights deal.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

The program, expected to start doing business next month, will be wholesale-only.

-

The Berkshire subsidiary is seeking coverage for a $22mn antitrust loss.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

The platform aims to “bend the loss curve”.

-

He joins the company after 22 years in casualty leadership roles at Chubb.

-

Sources said that the carrier has held preliminary talks with private debt investors.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

The executive most recently served as head of North American treaty reinsurance.

-

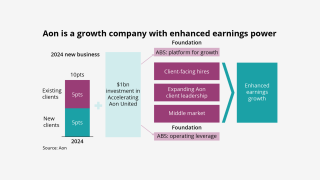

Aon acquired NFP from Madison Dearborn in April last year in a $13.4bn deal.

-

The broker has filed a motion to dismiss the lawsuit by Marsh.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.

-

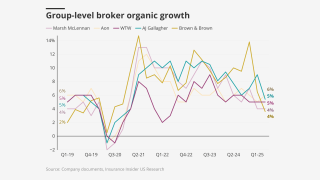

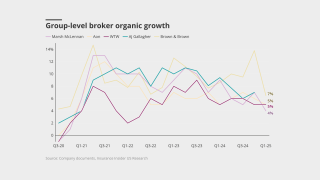

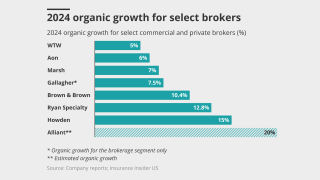

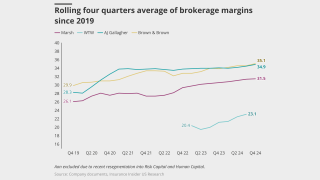

Not everyone will emerge unscathed as brokers navigate the slow-growth environment.

-

The company has also appointed David Tran as head of programs, Canada.

-

The reinsurance CoR fell 2.3 points to 79.5% while the primary CoR rose 4.7 points to 98.7%.

-

Reinsurers are mostly aligned on cat reinsurance, but goals are otherwise diverse.

-

Specialty casualty now accounts for around 22.2% of its insurance business mix.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

The Bermudian said its pursuit of SMEs through M&A will provide sustainable improvements to its bottom line.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

As the US recovers from a major flood event, the vast majority of Americans remain uninsured.

-

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

The broker’s EPS beat consensus at $3.49 for the quarter.

-

Jill Beggs was most recently COO for reinsurance.

-

The former Corvus president will report to Ajit Jain.

-

The former Lloyd’s CEO is also eligible for a target $5mn annual equity award.

-

The executive briefly exited the firm last month for a role at Marsh.

-

The company also encouraged insurers and brokers to support the initiative.

-

Underhill spent nine years at BHSI as global head of transactional liability.

-

John Neal was due to start at Aon as global reinsurance CEO in September.

-

The former Lloyd’s CEO will not make his planned move to Aon.

-

US events accounted for more than 90% of global insured losses.

-

The appointments will be effective as of August 1.

-

The unit will include both ocean and inland marine coverage.

-

The broker has expanded the number of global industry verticals to seven from four.

-

He was most recently Marsh’s US manufacturing and automotive practice head.

-

The executive brings more than 25 years of insurance experience.

-

The broker noted a “significant variation” in renewal outcomes.

-

The executive will report to US construction practice leader Jim Dunn.

-

In North America, the median W&I claim payment in 2024 was $5.5mn, the highest on record.

-

The platform will capture and standardise data from all submissions, the broker said.

-

Jim Williamson said litigation funding had evolved into an investment class.

-

Coverage has broadened while limits have increased, the broker said.

-

The executive was formerly head of cyber solutions, North America.

-

The carrier has scaled up its international insurance offering in recent years.

-

The ongoing demonstrations could have law enforcement liability implications.

-

Above-market organic growth, mid-market M&A and talent infusions were all heralded.

-

The documents figure in a potential criminal case against a CCB employee.

-

Case added that recently acquired broker NFP has “exceeded” expectations.

-

The executive has 15 years of experience in meteorology and cat analytics.

-

Ed Short was previously VP, digital partners, at Arch.

-

The executive will be responsible for leading E&S primary and excess casualty.

-

Muñoz was also Aon Re chairman for the Latin American region.

-

The executive will remain CEO of reinsurance until September 1.

-

Most of the losses are attributable to a supercell storm in Texas.

-

The executive will also continue as MD overseeing Caribbean fac.

-

Two large storms hit the Midwest and Ohio Valley regions on May 14-17 and May 18-20.

-

Unpacking how much excess capital there really is and dissecting the source of its returns.

-

Michael Brooks, SVP, head of transactional liability, will be taking over temporarily.

-

Sources said MarshBerry was retained earlier this year to run the sale.

-

The exec will lead key initiatives including Aon United, and work closely with NFP.

-

Hussey will take over the role left vacant when Luis Sonville moved to AJ Gallagher late last year.

-

Growth in construction projects is increasing the need for coverage.

-

The take-up rate will depend on the price discount and market segment.

-

The industry is seen as “resilient” amid a volatile risk environment.

-

He was appointed executive chairman for international in 2021.

-

New broker vehicles are setting up amid accelerated softening in D&F.

-

During first quarter earnings calls, insurers argued that they can mitigate volatility.

-

The executive was previously a top US casualty broker.

-

The conglomerate’s insurance subsidiaries will have to make do without some of their prior strategic advantages.

-

In an economic downturn, the kneejerk reaction is to treat insurance and risk management as a cost.

-

The executive had previously been at Aon for over 15 years.

-

The facility is a nudge towards a structural change, not a full-out assault.

-

Both Chubb and Zurich will underwrite the risks, with Nico as the sleeping partner.

-

At his last annual meeting as CEO, Buffett highlighted the importance of Berkshire’s insurance operations.

-

The primary and reinsurance unit CoRs were 103.1% and 98.7%, respectively.

-

He takes over from Amanda Lyons, who was promoted to global product leader last year.

-

The facility provides up to $100mn in claims-made excess casualty coverage.

-

The remediation process is on track for completion in the fourth quarter.

-

It will be tough to pull off prior goals despite management assurances.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The days of 30%+ growth are probably behind the firm, he said.

-

Overall, the company’s underwriting income fell 43% to $417mn in the first quarter.

-

The broker's share price dipped 11% in morning trading after its Q1 earnings missed expectations.

-

The commercial risk and reinsurance units delivered mid-single-digit growth.

-

Everest’s US wholesale business is seeking to expand its market presence.

-

Marsh alleges Aon also went after its clients as well as its employees.

-

Insurance Insider US explores the economics of the lift-out growth strategy.

-

Insured losses were the second highest on record for the first quarter.

-

He will replace Scott Lee, who is retiring after 40 years in claims.

-

The two internal hires have been with BHSI for around five years.

-

The appointments cover US casualty, the US Central region and construction.

-

London-based US excess casualty writers are increasingly looking to attach lower in the tower.

-

Total reinsurer capital grew by $45bn in 2024 to $715bn.

-

The executive was named group CEO in January.

-

Joe Fobert will report to William Hazelton, EVP of Everest.

-

Jeanmarie Giordano joined the company last September.

-

Keogh worked at Aon for nearly 30 years before retiring in 2022.

-

A new report warns that underwriters must consider political uncertainty and macroeconomic trends.

-

The executive will continue as head of BHSI’s E&P lines business.

-

The executive was Everest CEO from 1994 to 2013 and has served as board chair since 1994.

-

The broker has promoted Oriol Gaspa Rebull to global head of analytics strategy.

-

Cue a feeding frenzy from suitors and a frenzy of speculation from the market.

-

The executive will join the firm effective May 1.

-

Earlier today, Aon confirmed president Eric Andersen had stepped down from his role.

-

BHSI is dividing its retail general property unit into four regions.

-

The executive will remain with the firm as a senior adviser to the CEO until mid-2026.

-

-

The carrier was seeking to expand its March 1-renewing program.

-

Perlman has been at MMA for over six years, most recently as president of national business insurance.

-

The executives will join the company in the coming weeks.

-

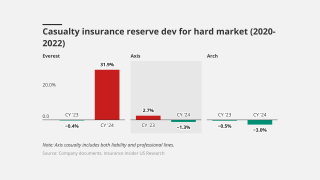

GAAP reserve triangles reveal the struggles of some hybrid franchises.

-

John Howard was appointed as an independent, non-executive member.

-

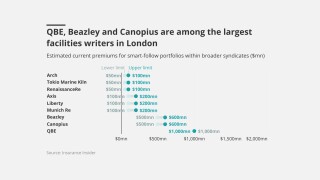

The big brokers are lining up London capacity to write follow lines on US risks.

-

At the PLUS D&O symposium, executives raised concerns over tariffs and the role of reinsurance.

-

The broker has over 30 years’ experience and will be based in Dallas.

-

Berkshire Hathaway’s "float" rose to $171bn in 2024 from $169bn in 2023 as Buffett praised Geico’s Todd Combs.

-

The conglomerate reported after-tax cat losses of $1.2bn related to Hurricanes Helene and Milton in 2024.

-

The company, meanwhile, is bullish on E&S US casualty.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The agency said it does not expect a “material impact” from the charge.

-

The event now includes a casualty portion and has officially been re-branded as the Property and Casualty Symposium.

-

At January 1 renewals, prices dropped 5%-15% for loss-free programs.

-

Company-specific strategies will play a vital role in sustaining growth in the current market.

Insider On Air: Our Webinars & Podcast Channel

Behind the Headlines Podcast

-

AI and precise data can enable insurers to innovate policy durations, from annual to transaction-specific, offering more tailored coverage options, said Christina Lucas, Global Market Leader, Insurance, Google Cloud, during an interview at the PwC Insurance Summit.

-

Pushing 1 January renewals late in the season can undermine outcomes, said Maamoun Rajeh, President, Arch Capital Group. During an interview at the PwC Insurance Summit, Rajeh called for a bifurcated market approach combining strategic partnerships and a collaborative price discovery process months before renewals.

-

During an interview at the PwC Insurance Summit, SiriusPoint CEO Scott Egan highlighted the danger of pricing cycles. As pressure mounts after a quiet cat quarter, he urged reinsurers not to create pricing cycles by chasing volume at the expense of long-term industry attractiveness and risk adequacy.

From our other titles

From our other titles

From our other titles

From Insurance Insider

Insider Outlook: Year in Review

From cat losses from wildfires and hurricanes to litigation battles to the shifting commercial insurance landscape — these are the stories that defined our industry in the last 12 months.

In celebration of Insurance Insider US Honors Awards, please enjoy our Year in Review video.

From Insurance Insider US

Commercial lines rate increases slow to 3.8%: WTW

The figure is down from 5.9% in Q2 2024.

From Insurance Insider

LIVE from Monte: Mereo CEO Croom-Johnson

While investors recently have favored the “instant gratification” of supporting brokers and MGAs, start-up reinsurer Mereo CEO David Croom-Johnson said he thinks capital will “fall back in love” with balance-sheet companies who deliver consistent profitable results.

From Insurance Insider ILS

Hannover Re outlines ILS plans as Ludolphs to retire at end of 2026

Hannover Re Capital Partners is in talks with two investors for 1 January launch.

From Insurance Insider

LIVE from Monte: Paul Campbell, Global Growth Officer for Aon’s strategy & technology group

Paul Campbell details how the most profitable insurers act during a soft versus hard market.

From Insurance Insider US

Brown & Brown appoints Hearn to lead global operations

The executive has been serving as COO since February.

Insurance Insider provides robust insights, sharp analysis and exclusive news on the global insurance-linked securities market.

Insurance Insider ILS provides robust insights, sharp analysis and exclusive news on the global insurance-linked securities market.