Kemper

-

Kemper and Selective’s woes stem partly from own issues, but industry-level issues persist.

-

The reserve strengthening stemmed from bodily injury and defense costs for accident years 2023 and prior.

-

The executive’s exit follows CEO Joseph Lacher’s resignation last week.

-

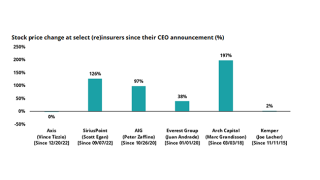

The selloff may hint at headwinds for equity investors.

-

Joseph Lacher will step down as president and CEO and resign from the board.

-

-

Insurance Insider US runs you through the earnings results for the day.

-

-

The firm does not expect reserve developments for its auto operations in Q4.

-

Kemper’s current results and historical trends suggest continued difficulty and remains a TBD story.

-

As the market hardens, Kemper plans to “open the filters and see what comes through” as another quarter of rate earns in, CEO Joseph Lacher told analysts on Monday.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company expects a net loss of between $140mn-$150mn for the quarter and a net operating loss in the range of $25mn-$35mn.

-

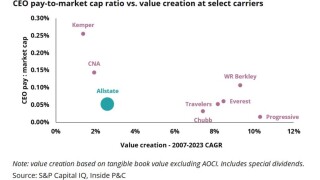

Allstate’s underperformance in results and value creation may be an opportunity for activist investor Trian, but history suggests it will have its work cut out.

-

In his stead, the company has named Bradley Camden as interim CFO and initiated a formal search process as part of the selection of a permanent CFO.

-

In tandem, the carrier initiated a formal search process as part of the selection of a permanent CFO.

-

The affirmations reflect Kemper’s recent rate increases in California and its exit of the preferred home and auto insurance market to redeploy capital to the carrier’s core segments.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The segment will now be a non-core part of the business and will no longer be reflected in future reporting, Lacher told analysts on the carrier’s Q2 earnings call on Monday.

-

The Inside P&C news team runs you through the earnings results for the day.

-

All policies will be non-renewed or canceled in accordance with state regulations, according to an announcement released ahead of the company’s Q2 earnings call on Monday.

-

The company also expects to record an after-tax goodwill impairment charge of approximately $45.5mn following a strategic review of its personal insurance business.

-

However, the carrier reiterated its prior guidance of a return to underwriting profitability In H2 2023 with a 2024 financial target of achieving 10%+ in full year RoE.

-

The auto insurer’s results were adversely impacted by prior-year claim reserve additions and catastrophes.

-

CEO Joe Lacher projected that the company will be profitable in the first half of the year and produce an underwriting profit in the second half.

-

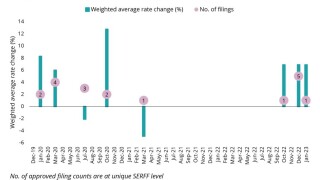

Five auto insurers receive approval to raise rates after 32-month halt by the California Department of Insurance.

-

The insurer estimated a 109% combined ratio for Kemper Auto in Q4, which included $7mn of adverse legal cost development for the first three quarters of last year.

-

The sell-off was one of the carrier’s “strategic initiatives” to focus on core capabilities as the company navigates a challenging environment for personal line businesses.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The CEO added that the company has also established an offshore captive and is in the process of creating a reciprocal exchange.

-

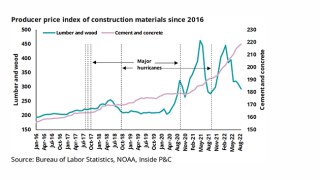

The company said longer term impacts of the pandemic, primarily significant prolonged inflation, have led to lower volumes of policies in force.

-

A challenging legal atmosphere and drift in loss cost components add difficulty to the task of tallying ultimate losses.

-

The ratings agency revised its outlook for the Chicago-based group to stable from negative.

-

Rate actions during the quarter was better than expected, said CEO Joseph Lacher.

-

The sector was hit by a rough first half of 2022, with more to come in the second half of the year.