Kinsale

-

The defendant held a $1mn general liability policy with Kinsale.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

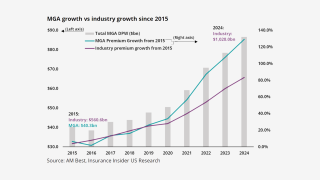

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

The specialty carrier’s share price fell nearly 7% on the day of the call.

-

Haney will remain on board as a senior adviser.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

On Q2 calls, carrier executives called out fierce competition in various lines of business, and a misalignment of interest.

-

Commercial property poses the most intense competition due to rates dropping, terms and conditions, and line size.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The latest E&S player planning to IPO remains a “show me” story.

-

Commercial property premium growth declined 18% in Q1, as rates fell 20%.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The latest cat event may not be enough to change the overall market, he added.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Hartford made the unusual move of calling out current AY development.

-

Kinsale’s cat losses for Q3 were “quite modest” including hurricanes Francine and Helene.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Hartford and Aon also posted notable, though more muted, stock bumps.

-

The CEO estimated that the loss trend is running in the high 5% range, slightly below the carrier’s rate increase.

-

A roundup of today’s need-to-know news, including Commissioner Lara’s FAIR plan reforms.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

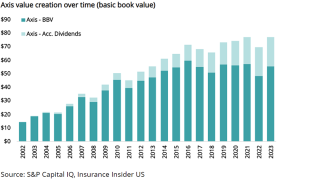

Industry trends show the Axis book value growth goal may be hard to hit.

-

The company reported 25.5% increase in GWP, down from the 40% growth in prior years.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

General liability represented the largest share of Kinsale’s reserves.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Michael Kehoe will relinquish the president’s role to COO Brian Haney and assume board chairmanship but will remain company CEO.

-

The carrier believes its existing reserves account for any liability relating to claims.

-

At least one carrier struck a note of caution during Q3 earnings about the ongoing rapid growth story in surplus lines.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The stock closed at $342.87 per share, down 19.56% from yesterday’s close of $426.22.

-

On a conference call with analysts, CEO Michael Kehoe described high growth rates from over the last five years as an “anomaly” and warned investors of possible "mean reversion” ahead.

-

AJ Gallagher posts 10.5% Q3 organic growth, lower sequentially but up year-on-year

-

Flows to the E&S market remain strong, executives have said, while dislocation in the property space continues to buoy overall pricing conditions.

-

“The broad E&S market is quite attractive today, and we’ve got a good level of confidence going forward,” CEO Michael Kehoe said.

-

The Inside P&C news team runs you through the earnings results for the day.

-

The company posted a 1.2-point increase in its loss ratio to 58.6%, as the firm saw less-favorable reserve releases and slightly higher cat losses during the quarter.

-

McMorrow joined Kinsale in 2010 and served in underwriting roles of increasing responsibility before being promoted to vice president in 2021.

-

During the quarter, real rates were up around 7% in the aggregate, compared to 8% in Q3 2022, according to management comments during the company’s conference call.

-

In its press release, CEO Mike Kehoe noted that the company capitalized “favorable E&S market conditions while maintaining underwriting and expense discipline”.

-

CEO Mike Kehoe said the company’s commercial property book outperformed expectations related to the storm.

-

CEO Mike Kehoe said his company’s results stem from a combination of higher insurance rates and rapid premium growth.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company posted a combined ratio of 79%, driven by lower relative expenses and premium growth.

-

Inside P&C’s news team runs you through the key developments from the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company founder warned that the “wily” and “entrepreneurial” plaintiffs’ bar would be back, however.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Winston joined the company in 2010 and was most recently promoted to vice president of underwriting in 2020.

-

Kinsale Capital Group posted a combined ratio of 75.5% and an expense ratio of 21.4% for Q4 2021.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

With no catastrophe losses, premium growth and favorable development lifted Kinsale operating income to $1.76 per share, well ahead of Street expectations.

-

Low-teens rate increases are expected to continue for the company as submissions improve.

-

Kinsale Capital Group reported a leap in Q3 net operating income, boosted by rate increases, lower catastrophe costs and favorable development.

-

COO Brian Haney pushed back on the notion that rate hikes had hit their peak and said he expected rising inflation to "prolong the hard market".

-

Kinsale posts a combined ratio of 79% in Q2 despite massive GWP growth.

-

A combination of profitable underwriting and improved investment returns helped the carrier perform strongly in Q1.