Lemonade

-

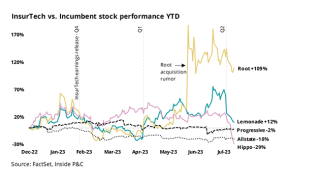

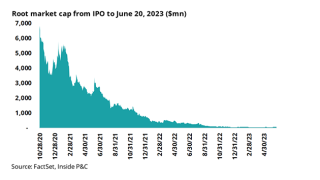

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

The gross loss ratio for the homeowners InsurTech fell by 12 points last quarter.

-

The company reduced its proportional quota share program from 55% to 20% cession.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company said the reduction was due to years of steady improvements.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The insurer has been focused on growing products with lower cat exposure such as pet and renter’s insurance.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier is looking to grow products with lower cat exposure such as renters and pet insurance.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The program is led by the same carriers as the expiring treaty.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Fourth-quarter results saw larger profits, but 2024 guidance was subdued.

-

The company reported 24% top line growth in Q4 2023.

-

The agreement has been extended an additional year through December 2025, and an incremental $140mn will be made available to Lemonade.

-

The decision is based on the belief that the clarity provided under the old structure outweighs the benefits of the co-CEO structure that was put in place two years ago.

-

Following its earnings report on Wednesday, Lemonade’s stock hit $14.80 per share on Thursday morning, nearly 35% higher than the previous close and the highest since mid-August.

-

The Inside P&C news team runs you through the earnings results for the day.

-

On the surface, InsurTech results were better than the noise from incumbents, but caution is needed to ascertain the quality of new business coming in during a time when even industry leaders stumble.

-

The InsurTech formed a new Cayman Island-domiciled risk bearing entity Lemonade Re, where it plans to hold some of the retained risk.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

“Tomorrow will be a better day.” “Next year will be a better year.” “The coming decade will be when this industry realizes its true potential.” We hear the same for most public enterprises.